Independent Contractor Form

Description

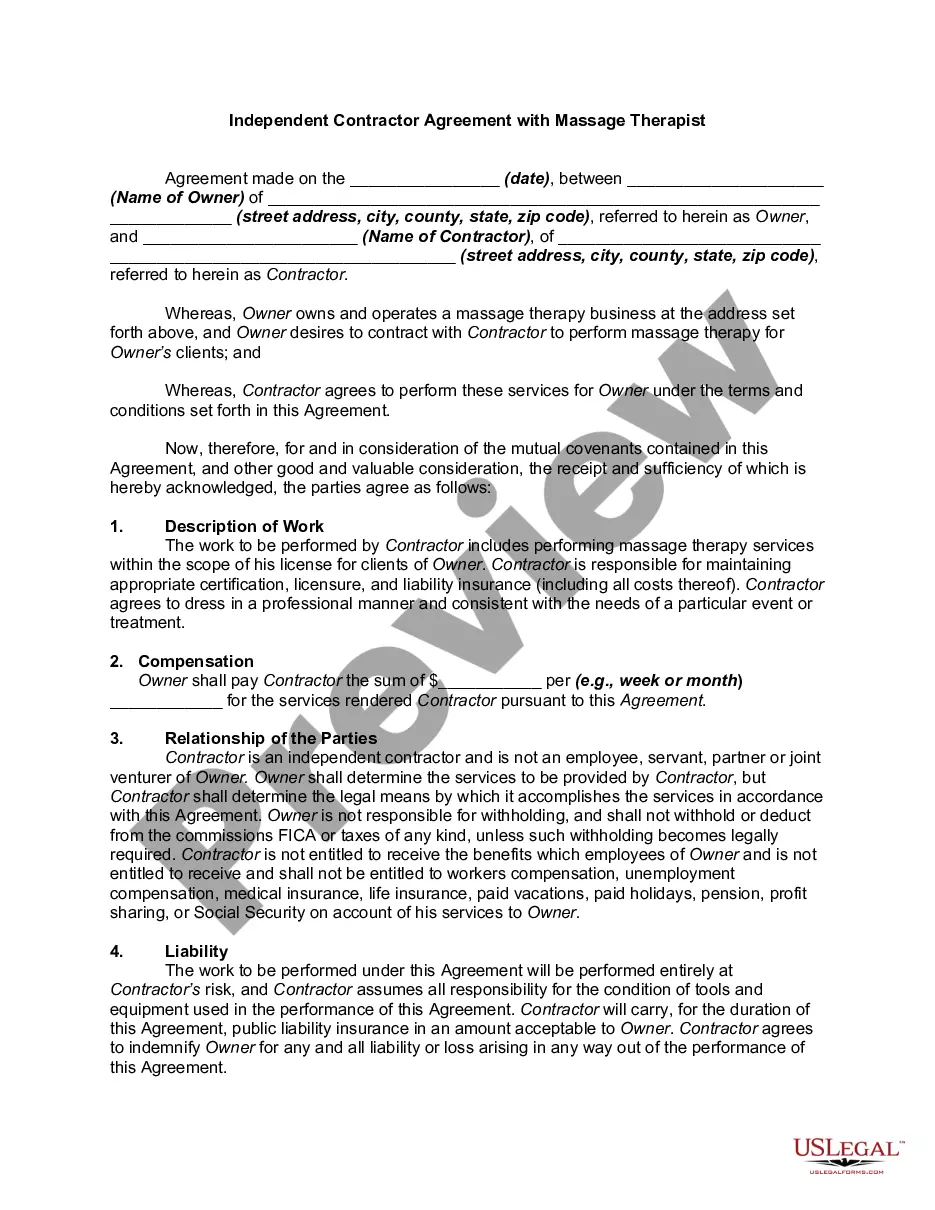

How to fill out Independent Contractor Agreement Between Licensed Counselor And Therapist And Licensed Counselor And Therapist Practicing As A Solo Practitioner?

Bureaucracy necessitates exactness and correctness.

If you do not manage completing forms like Independent Contractor Form on a daily basis, it may lead to some misunderstanding.

Selecting the appropriate sample from the beginning will guarantee that your document submission proceeds smoothly and avert any hassles of resending a document or redoing the work entirely from the ground up.

If you are not a subscribed user, finding the needed sample will require a couple of additional steps: Locate the template using the search bar. Ensure the Independent Contractor Form you’ve found is applicable for your state or region. View the preview or examine the description containing usage details of the sample. When the outcome matches your search, click the Buy Now button. Select the suitable option from the offered subscription plans. Log In to your account or sign up for a new one. Complete the purchase using a credit card or PayPal account. Acquire the form in your preferred format. Locating the proper and current samples for your documentation can be done in a few minutes with an account at US Legal Forms. Evade bureaucratic uncertainties and enhance your efficiency in handling forms.

- You can consistently find the accurate sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online catalog of forms that provides over 85 thousand templates for multiple sectors.

- You can retrieve the latest and most relevant version of the Independent Contractor Form by simply searching it on the platform.

- Identify, save, and download templates in your profile or review the description to confirm you possess the correct one at hand.

- With an account at US Legal Forms, it is straightforward to procure, keep in one place, and navigate the templates you preserve for access in just a few clicks.

- When on the site, click the Log In button to authenticate.

- Then, go to the My documents section, where your document list is stored.

- Examine the description of the forms and download those you need at any time.

Form popularity

FAQ

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

IRS Tax Form 1099-NEC. As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Form 1099-NEC is used by payers to report payments made in the course of a trade or business to others for services.

9s and 1099s are tax forms that businesses need when working with independent contractors. Form 9 is what an independent contractor fills out and provides to the employer. Form 1099 has details on the wages an employer pays to an independent contractor. This form is filed with the IRS and state tax authorities.

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that is contracting 1099 employees, determine what type of work this individual will do for your business.