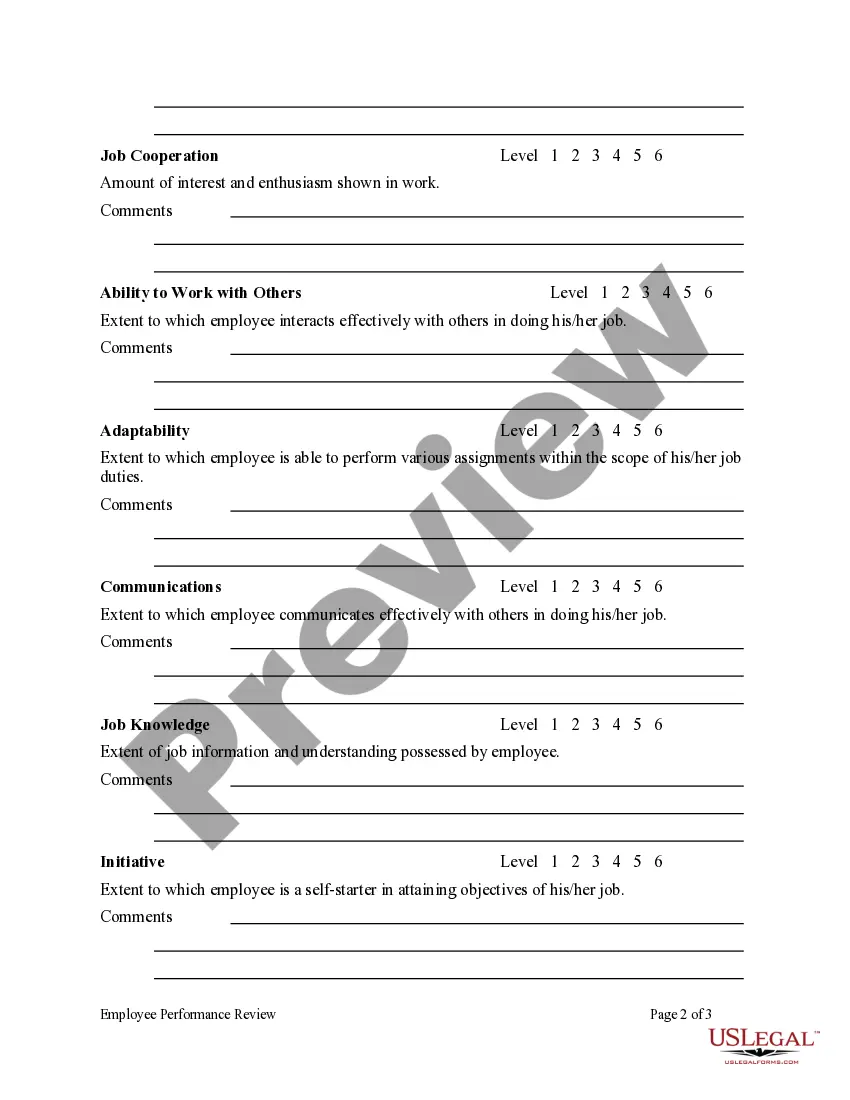

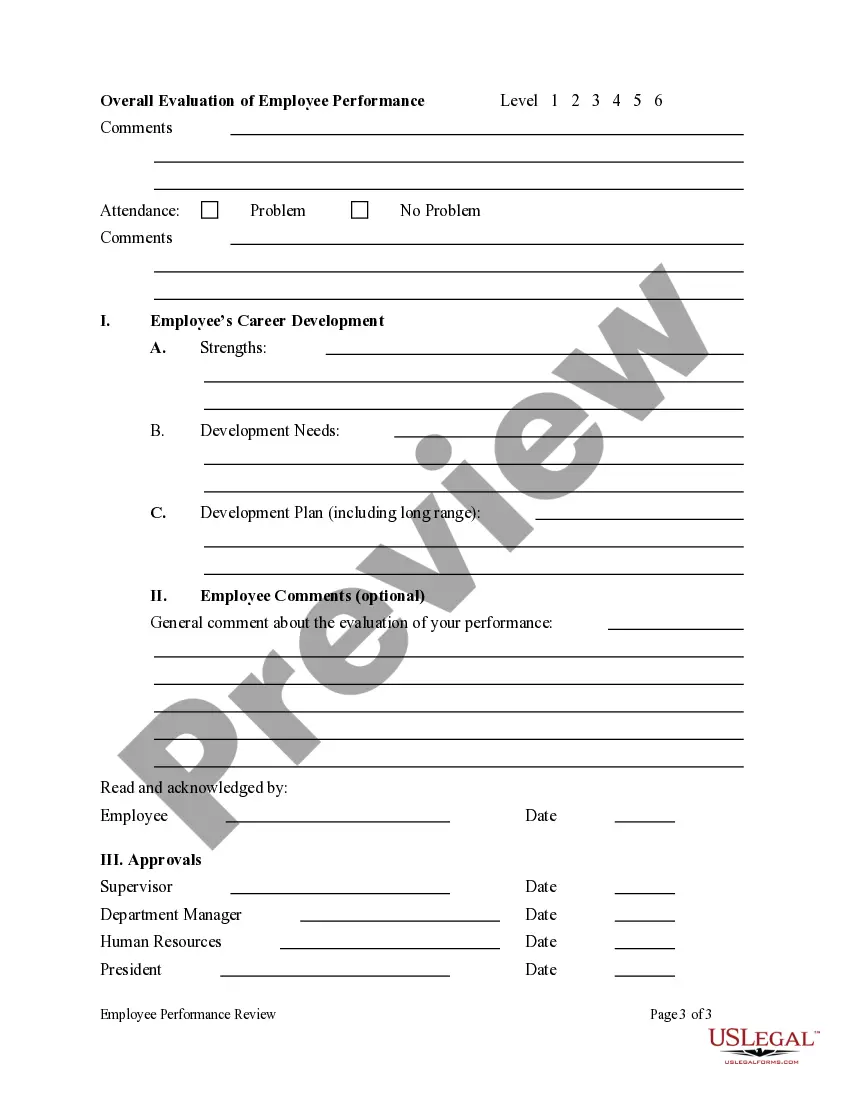

Staff Review Form With Answer

Description

How to fill out Employee Performance Review?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their life.

Filling out legal documents requires meticulous focus, starting with selecting the right template.

With a vast collection of US Legal Forms available, you don’t need to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the appropriate template for any situation.

- Locate the sample you require using the search bar or directory navigation.

- Review the form’s details to make sure it fits your specific circumstance, state, and locality.

- Click on the form’s preview to examine it.

- If it is not the right form, go back to the search option to find the Staff Review Form With Answer template you need.

- Download the template if it fulfills your requirements.

- If you have an account with US Legal Forms, simply click Log in to access previously saved documents in My documents.

- If you don’t yet have an account, you can download the form by clicking Buy now.

- Choose the suitable pricing option.

- Fill out the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Staff Review Form With Answer.

- Once downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

Indiana has a special rule allowing debtors to request a reduced wage garnishment of between 10% and 25% of their weekly disposable earnings. However, to qualify for the reduced garnishment, they must show good cause to the court. It's up to the judge's discretion to grant a smaller wage garnishment percentage.

Indiana Wage Garnishment Process To get a wage garnishment in the state of Indiana, a creditor first needs to sue you in court for the debt you owe. If you don't show up to the court to challenge the creditor's lawsuit, then the court will issue a default judgment against you.

If you wish to stop wage garnishment in Indiana there are several options available to you. Pay the Debt and Avoid the Suit. Appeal to the Court in Indiana. Bankruptcy in Indiana. Seek Legal Assistance.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

If you have questions about wage garnishment or a Notice of Wage Garnishment, or any debt that you owe to DWD, you may contact the DWD Benefit Collections Unit at 1-800-262-6949.

In Indiana, the laws are designed to mainly track federal wage garnishment limits. If more than one creditor is garnishing your wages at the same time, then the maximum amount that can be garnished by all of your creditors combined is 25 percent.

Stop Wage Garnishment Immediately by Filing for Bankruptcy Depending on why you're paying, it may only be temporary. It won't impact child support, alimony, tax, or student loan payments since these are non-dischargeable (can't be cleared) priority debts under the bankruptcy code.