Capital Contribution Template Without Issuance Of Shares

Description

How to fill out Notice Of Capital Call Request To Member, Unpaid Contribution Of Member, And Possibility Of Dilution Of Membership Interest For Failure To Make Such Contribution?

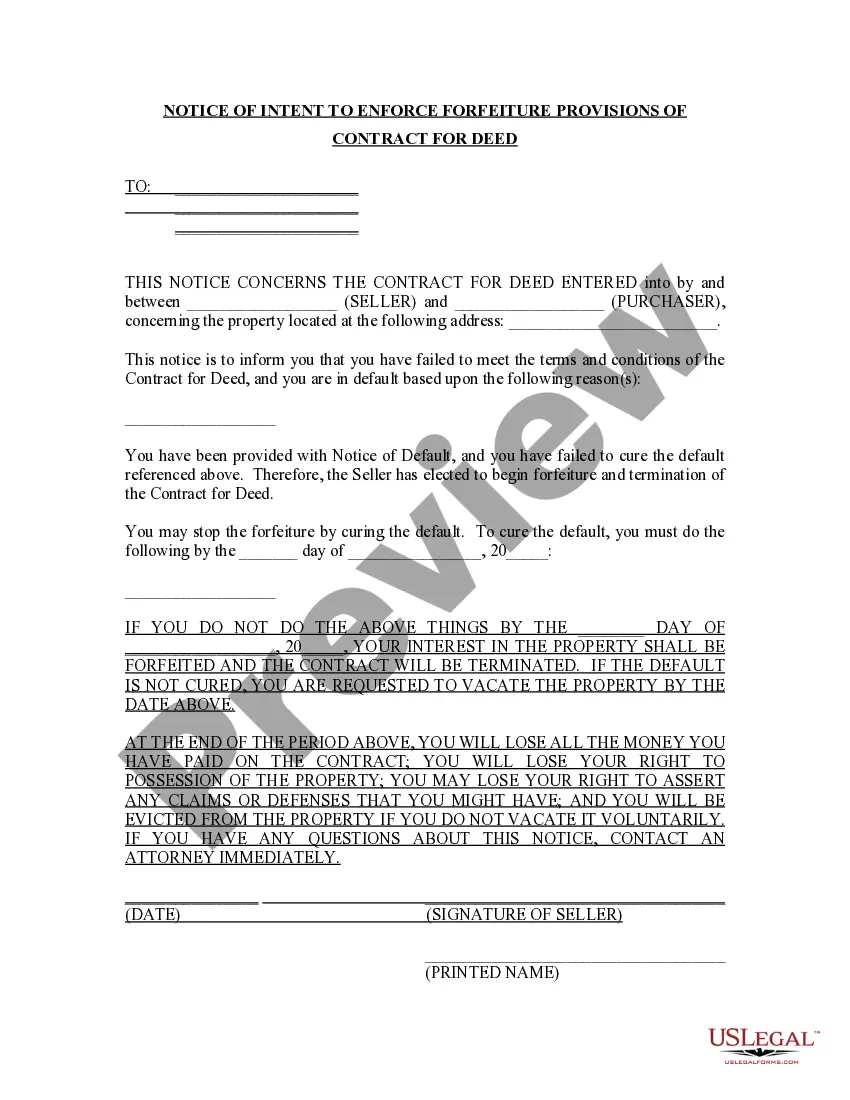

The Capital Contribution Template Without Issuance Of Shares you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Capital Contribution Template Without Issuance Of Shares will take you just a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or review the form description to verify it fits your requirements. If it does not, use the search bar to get the appropriate one. Click Buy Now when you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Select the format you want for your Capital Contribution Template Without Issuance Of Shares (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

The accounting entry for the contributed capital are to debit cash or asset and credit Shareholders' Equity, reflecting the increase in assets and balance owed to shareholders.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

A capital contribution is a contribution to the equity capital of a company, but is not made in exchange for shares issued to the contributor and it does not constitute a separate asset in its own right.

This is the price that shareholders paid for their stake in the company. Contributed capital is reported in the shareholder's equity section of the balance sheet and usually split into two different accounts: common stock and additional paid-in capital account.

Any contributions to capital should be documented. You'll want to be sure to include previous and new valuations and ownership percentages, signatures and more. Our LLC capital contribution agreement documents the following essential information: Name of each member making a contribution.