Bank Draft Authorization Form With Chase Bank

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Filling out legal documents needs careful attention, starting with choosing the right form sample. For example, when you choose a wrong version of the Bank Draft Authorization Form With Chase Bank, it will be declined when you submit it. It is therefore crucial to get a dependable source of legal documents like US Legal Forms.

If you have to get a Bank Draft Authorization Form With Chase Bank sample, stick to these simple steps:

- Get the template you need using the search field or catalog navigation.

- Check out the form’s information to make sure it suits your situation, state, and county.

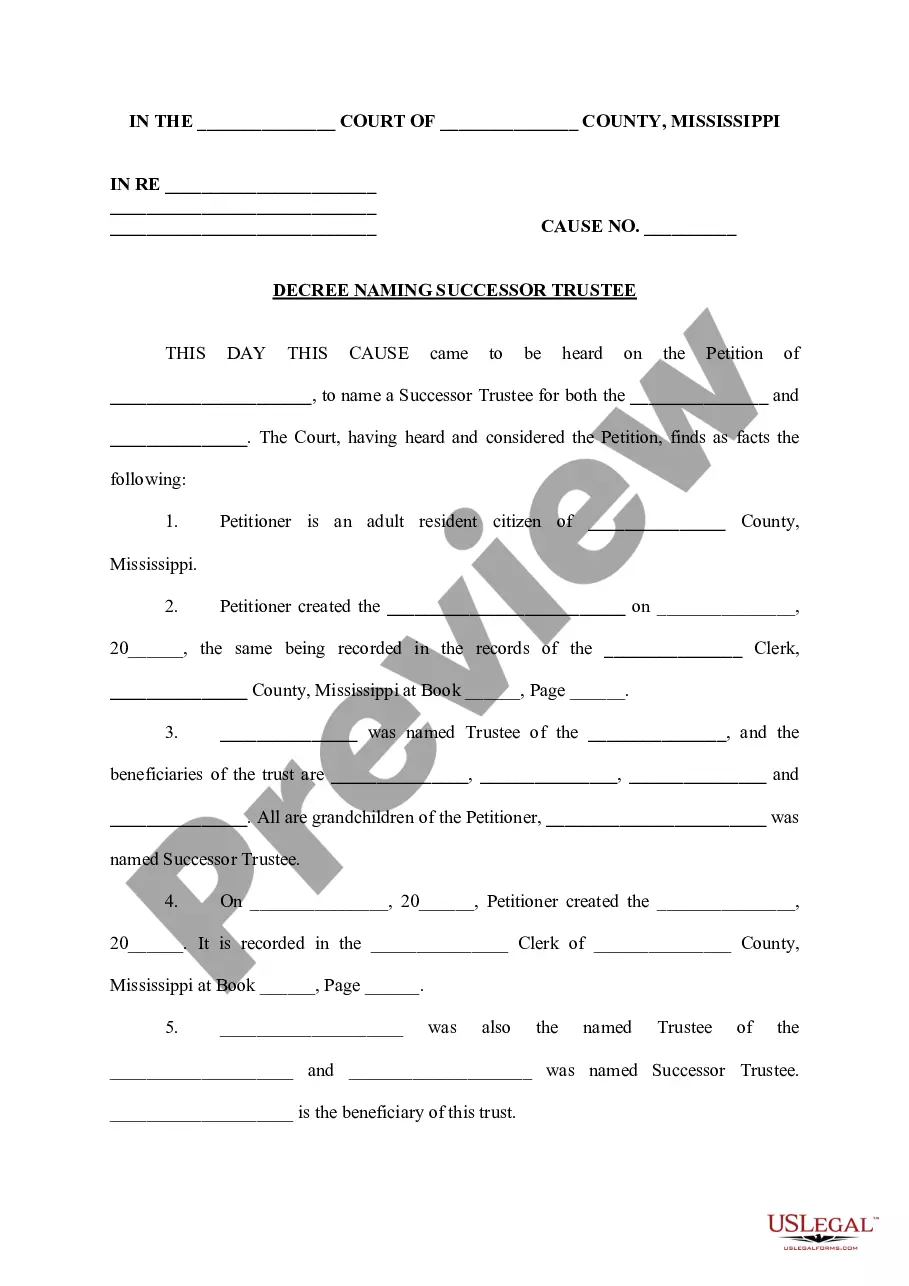

- Click on the form’s preview to see it.

- If it is the wrong form, return to the search function to find the Bank Draft Authorization Form With Chase Bank sample you require.

- Download the template when it meets your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the profile registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Bank Draft Authorization Form With Chase Bank.

- When it is downloaded, you are able to complete the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time seeking for the right template across the web. Use the library’s easy navigation to find the appropriate template for any occasion.

Form popularity

FAQ

How to Write a Check Step 1: Date the check. Write the date on the line at the top right-hand corner. ... Step 2: Who is this check for? ... Step 3: Write the payment amount in numbers. ... Step 4: Write the payment amount in words. ... Step 5: Write a memo. ... Step 6: Sign the check.

You'd fill out the: Date. Write the date you're mailing the check in the upper right-hand corner of the check. ... Payee. Write the payee's name on the line that says ?Pay to the Order of,? unless your statement lists another name to use. ... Check amount (numerical). ... Check amount (written out). ... Memo. ... Signature.

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

A credit card authorization, also known as a hold, lasts anywhere between a minute and 31 days. Holds last until the merchant charges your card for the purchase and clears them, or they naturally "fall off" your account.

Get your personalized pre-filled direct deposit form Sign in to chase.com or the Chase Mobile® app. Choose the checking account you want to receive your direct deposit. Navigate to 'Account services' by scrolling up in the mobile app or in the drop down menu on chase.com. Click or tap on 'Set up direct deposit form'