Disclosure Requires Truth Lending Act For The Following

Description

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

Managing legal documents can be formidable, even for experienced professionals.

When seeking a Disclosure Requires Truth Lending Act For The Following and lack the time to dedicate to finding the suitable and current version, the process can be challenging.

With US Legal Forms, you can access legal and business forms tailored to specific states or counties.

US Legal Forms accommodates any needs you may have, ranging from personal to business documentation, all centralized in one location.

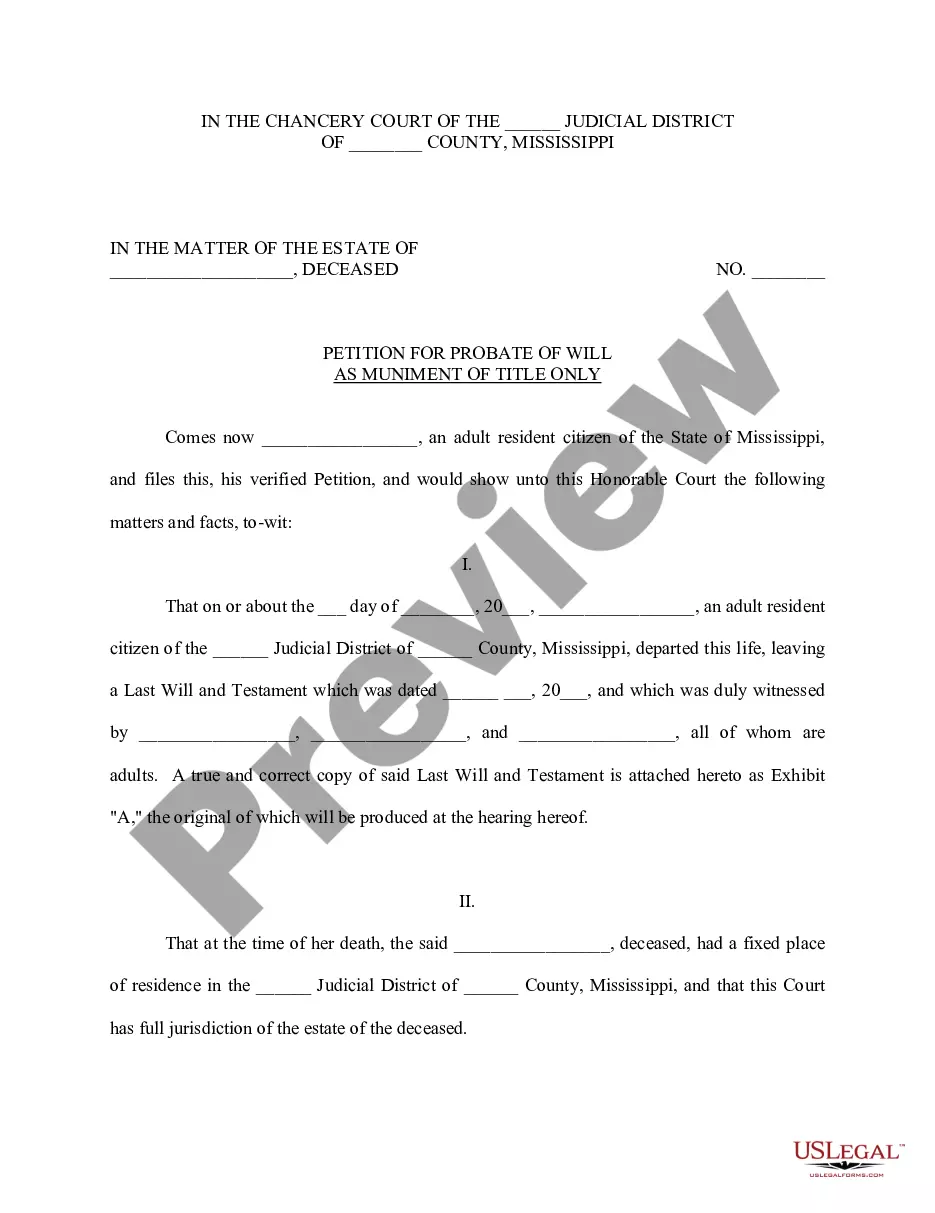

Upon downloading the form you require, follow these steps: Verify it is the correct document by previewing it and reviewing its details.

- Access a valuable resource library filled with articles, guides, and materials pertinent to your circumstances and requirements.

- Save time and energy searching for the documents you need, employing US Legal Forms’ advanced search and Preview feature to locate and obtain Disclosure Requires Truth Lending Act For The Following.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Consult the My documents section to review the documents you've previously saved and manage your files as needed.

- If it’s your first experience with US Legal Forms, register for an account and gain unlimited access to all platform benefits.

- A robust online form library could be a revolutionary solution for anyone aiming to manage these matters effectively.

- US Legal Forms stands as a frontrunner in the realm of online legal forms, offering more than 85,000 state-specific legal forms available to you at all times.

- Utilize high-tech tools to fulfill and handle your Disclosure Requires Truth Lending Act For The Following.

Form popularity

FAQ

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms. TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested.

Summary. The Truth in Lending Act (TILA) is intended to ensure that credit terms are disclosed in a meaningful way so consumers can compare credit terms more readily and knowledgeably.

The disclosures must follow the required order and include the number of months and the total dollar amount to be paid at consummation for homeowner's insurance and mortgage insurance premiums, the prepaid interest to be paid at consummation, based on daily interest, number of days, interest rate and the total to be ...

The lender must disclose all finance charges (loan fees, finder's fees paid to the person bringing the borrower to the lender, service charges, points, mortgage insurance premiums and interest).

Sample disclosures required under TILA include: Annual percentage rate. Finance charges. Payment schedule. Total amount to be financed. Total amount made in payments over the life of the loan.