Claims Against Estate Probate Without A Will

Description

How to fill out Release Of Claims Against Estate By Creditor?

Finding a reliable source to acquire the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the correct legal documents requires accuracy and careful consideration, which is why it's essential to obtain samples of Claims Against Estate Probate Without A Will exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the hassle associated with your legal documentation. Explore the vast US Legal Forms archive where you can locate legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to locate your template.

- Review the form’s details to ensure it meets your state and regional requirements.

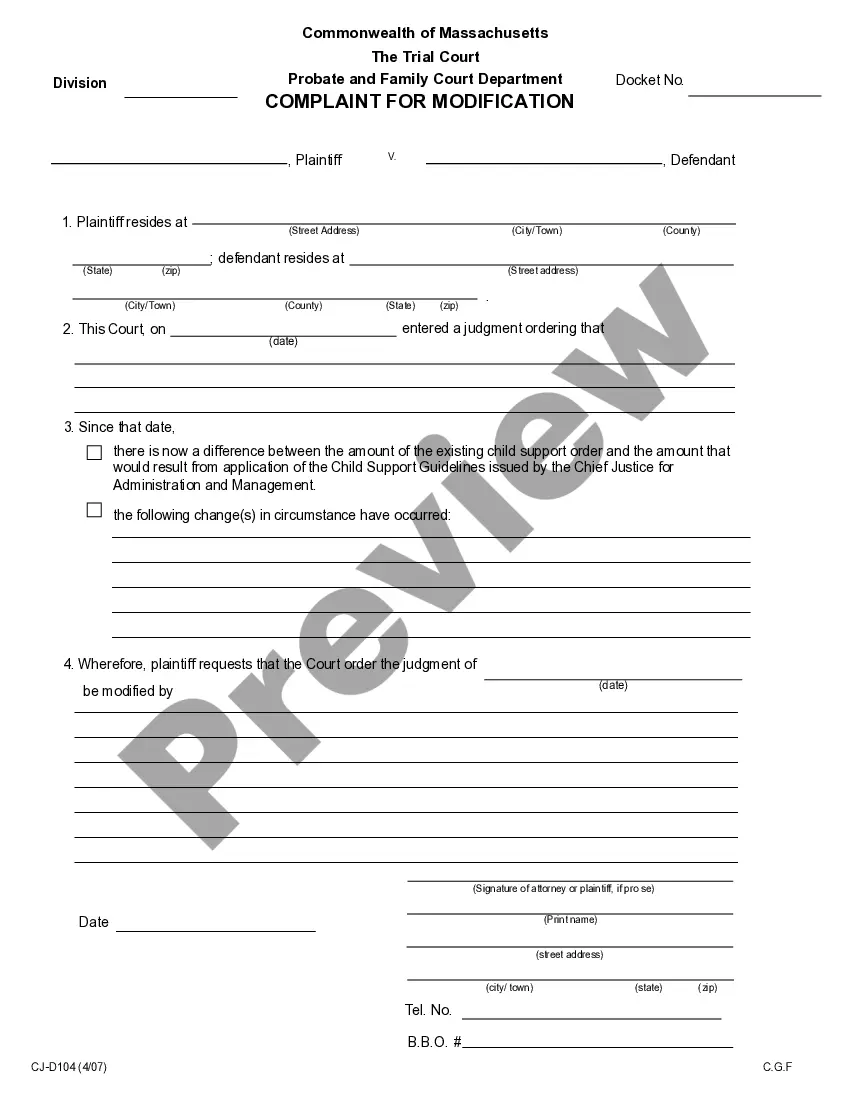

- Access the form preview, if available, to confirm that the template aligns with your needs.

- Return to the search to find the correct document if the Claims Against Estate Probate Without A Will does not fulfill your requirements.

- Once you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you don't have an account yet, click Buy now to purchase the form.

- Choose the pricing option that suits your needs.

- Proceed with the registration to complete your acquisition.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Pick the document format for downloading Claims Against Estate Probate Without A Will.

- After obtaining the form on your device, you can edit it using the editor or print it for manual completion.

Form popularity

FAQ

The good news is that if you're a beneficiary of an estate, you do not inherit that estate's debts. Beneficiaries are typically not responsible for any outstanding debts that may be discovered after the probate period has passed or that can't be paid during the probate period.

The later of: 4 months from date of first publication of Probate Notice to Creditors, or. 30 days from date of mailing of actual notice.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

A creditor has 4 months from the date of publication or 1 month from the date they receive actual notice, whichever is later, to present their written claim or it will be barred. The written statement must indicate the basis of the claim, the claimant's name and address and the amount of the claim.

Unlike some states, Michigan does not have a required filing deadline for a probate case. However, several factors can affect the timing of the process. Understanding these variables will help you feel better prepared to fulfill your fiduciary duties.