Claims Against Creditor With Debt

Description

How to fill out Release Of Claims Against Estate By Creditor?

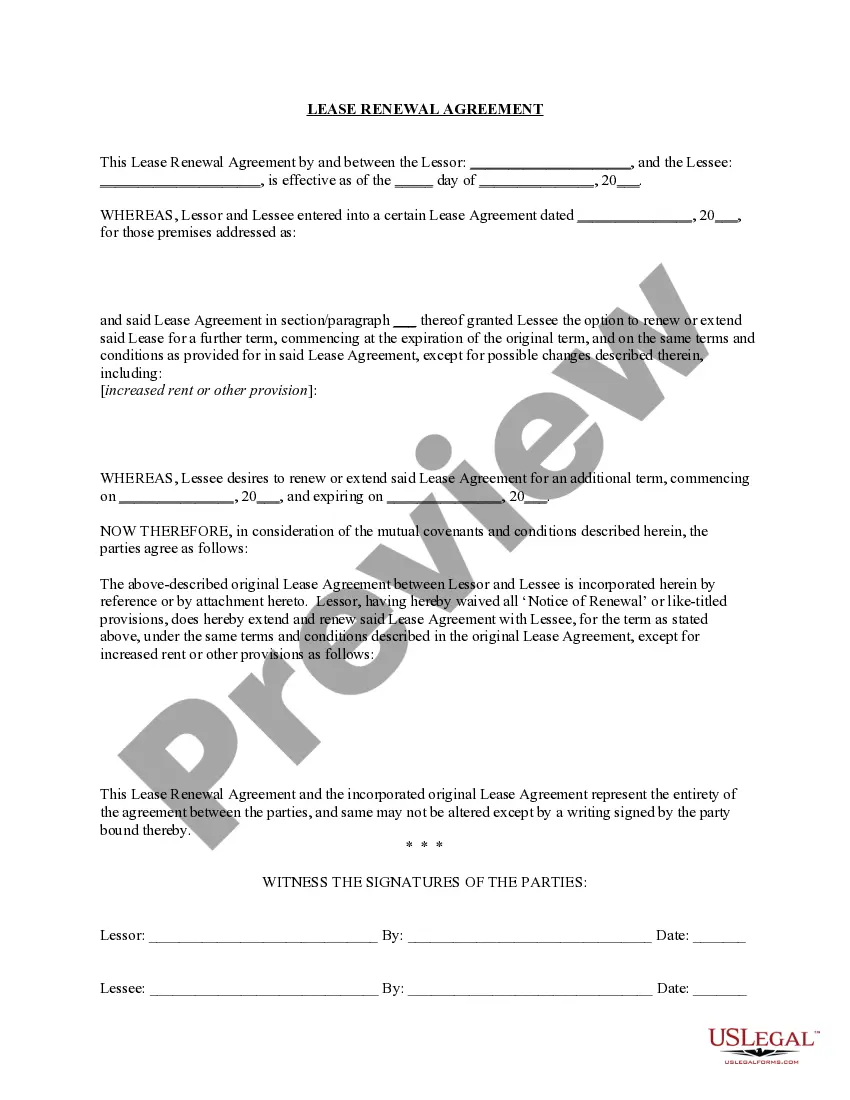

The Claims Against Creditor With Debt you see on this page is a reusable formal template crafted by professional attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has delivered individuals, businesses, and lawyers over 85,000 verified, state-specific documents for every business and personal situation.

Subscribe to US Legal Forms to have validated legal templates for all of life's situations readily available.

- Browse for the document you need and examine it.

- Select the template you require and preview it or check the form details to ensure it meets your needs. If it does not, utilize the search feature to locate the correct one. Click Buy Now once you have identified the template you seek.

- Sign up and Log In.

- Choose the pricing package that fits you and set up an account. Use PayPal or a credit card for immediate payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

In North Dakota, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

A North Dakota small estate affidavit is a form allows an heir, successor or beneficiary to petition for assets from a deceased individual's estate. Using this form bypasses the North Dakota probate court and only applies to estates that involve no real property.

In North Dakota, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed. This deed permits a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

In North Dakota, you must file probate within three years of the individual's passing. Filing within three years allows you to qualify for informal probate or affidavit. If you wait longer than three years to file, the estate has to go through normal probate.

Some assets may not need to be included in probate if they have a named beneficiary. However, North Dakota does allow for an informal probate process which is a simplified version. If the value of the estate is less than $50,000, probate may be avoided.

The total value of the probated property (minus any debts or other encumbrances on the property) is less than $50,000.00; No real property (real estate) is part of the probated estate; No probate case is started or completed in a North Dakota state district court, a court of any other state, or a tribal court; and.