Independent Contractor Test With Cargo Van

Description

How to fill out Agreement With Independent Contractor To Develop Exam Questions And Cases For Website Which Provides Test Preparation Services For Medical Licensing Exams?

Individuals generally link legal documentation with complexity that only experts can manage.

In a sense, this is accurate, as creating an Independent Contractor Test With Cargo Van requires extensive understanding of the relevant criteria, including state and local statutes.

However, with US Legal Forms, the process has become simpler: pre-prepared legal documents for any life or business situation aligned with state laws are gathered in a single online repository and are now accessible to all.

You can print your document or transfer it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they are stored in your account. You can access them anytime through the My documents section. Experience the many benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms offers over 85,000 current documents organized by state and area of usage, allowing for quick searches for Independent Contractor Test With Cargo Van or any other specific template.

- Existing users with an active membership must Log In to their account and click Download to receive the document.

- New users will need to register for an account and subscribe before they can access any documents.

- Here are the detailed steps to acquire the Independent Contractor Test With Cargo Van.

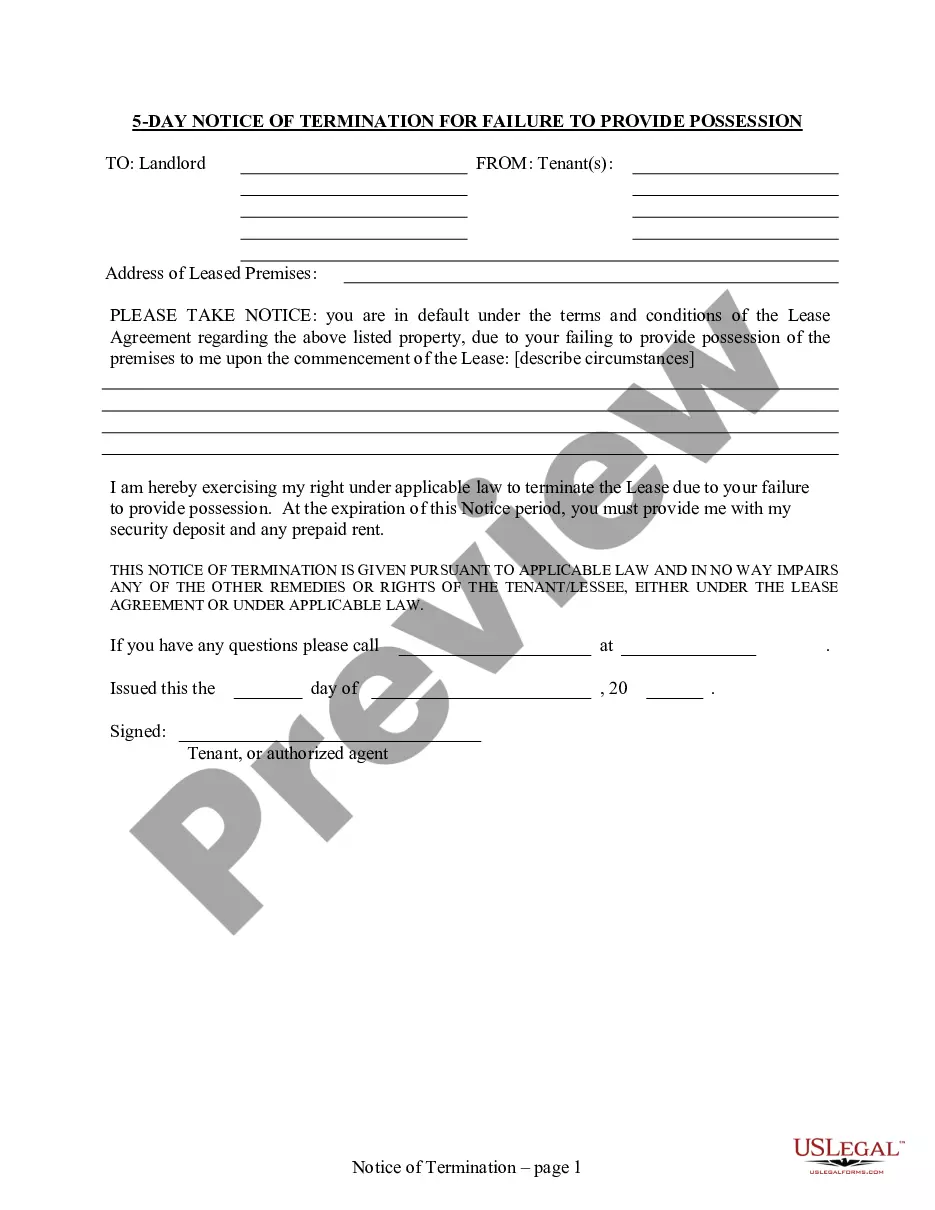

- Carefully review the page content to confirm it meets your requirements.

- Examine the form description or view it through the Preview option.

- If the previous option does not meet your needs, find another example using the Search field at the header.

- Once you locate the appropriate Independent Contractor Test With Cargo Van, click on Buy Now.

- Select the pricing plan that fits your requirements and budget.

- Create an account or Log In to move to the payment section.

- Complete your subscription payment using PayPal or a credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status.

The primary qualifications for getting a cargo van job as an independent contractor are a valid driver's license, a clean driving record, and a cargo van suitable for the types of products you plan to carry.

What Is an Independent Contractor Truck Driver? An independent contractor truck driver works for his own business and provides his services to carrier companies. An independent contractor can also be an owner-operator if they have their own truck and equipment, but these can also be leased.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

Generally speaking, companies can only classify truck drivers as independent contractors if the truckers have control over how and when they perform their duties.