Promissory Note For Car Pdf

Description

How to fill out Simple Promissory Note For Car Loan?

There's no longer a necessity to spend countless hours searching for legal documents to adhere to your local state regulations.

US Legal Forms has consolidated all of them in one location and made them easily accessible.

Our platform offers over 85k templates for various business and individual legal situations organized by state and type of use.

Preparing legal documents in compliance with federal and state laws is swift and straightforward with our collection. Experience US Legal Forms today to keep your paperwork organized!

- All forms are expertly prepared and certified for accuracy, giving you confidence in acquiring an up-to-date Promissory Note For Car Pdf.

- If you are acquainted with our service and already possess an account, ensure that your subscription is valid before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents anytime by navigating to the My documents tab in your profile.

- If you're unfamiliar with our service, the procedure will require a few additional steps.

- Here's how new users can access the Promissory Note For Car Pdf from our catalog.

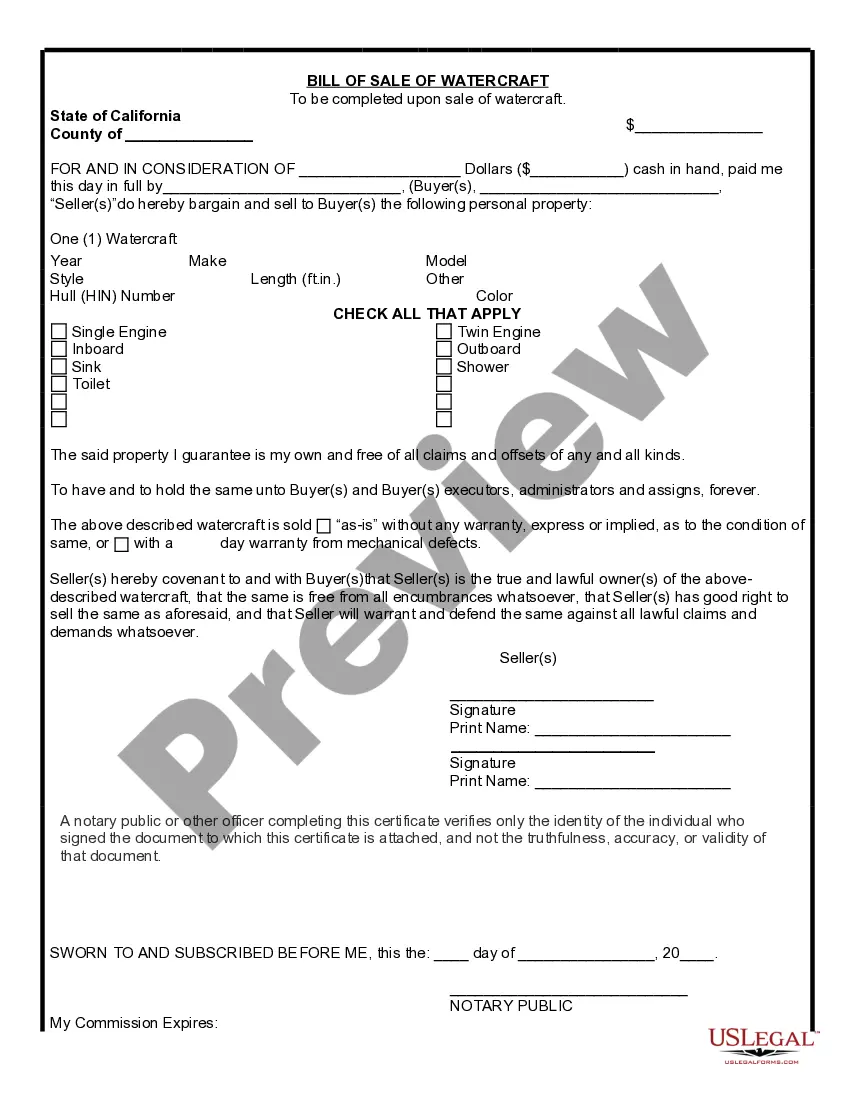

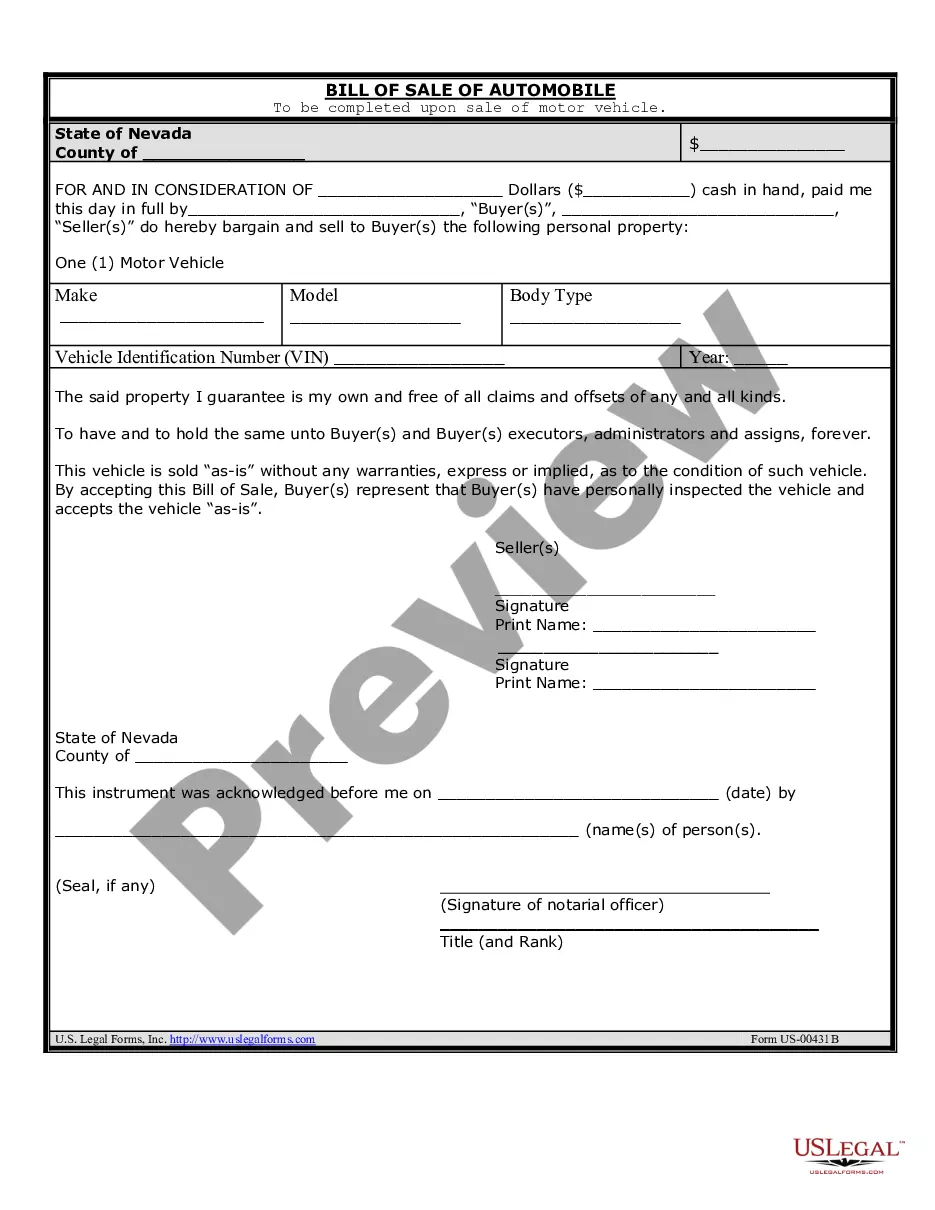

- Carefully review the page content to verify it contains the sample you require.

- To assist with this, utilize the form description and preview options if available.

Form popularity

FAQ

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

A Promissory Note is a document that is signed by an individual that details the amount of money borrowed from another individual or organization (Lender). A promissory note is also referred to as a Promise to Pay note or a Note payable.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.