Create Irrevocable Trust Online With Irs

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

Accessing legal forms that adhere to the federal and local laws is essential, and the internet provides a multitude of choices to select from.

However, what is the purpose of squandering time scouring the web for the accurately prepared Create Irrevocable Trust Online With Irs example when the US Legal Forms online library already houses such forms consolidated in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates crafted by attorneys for any business and personal situation.

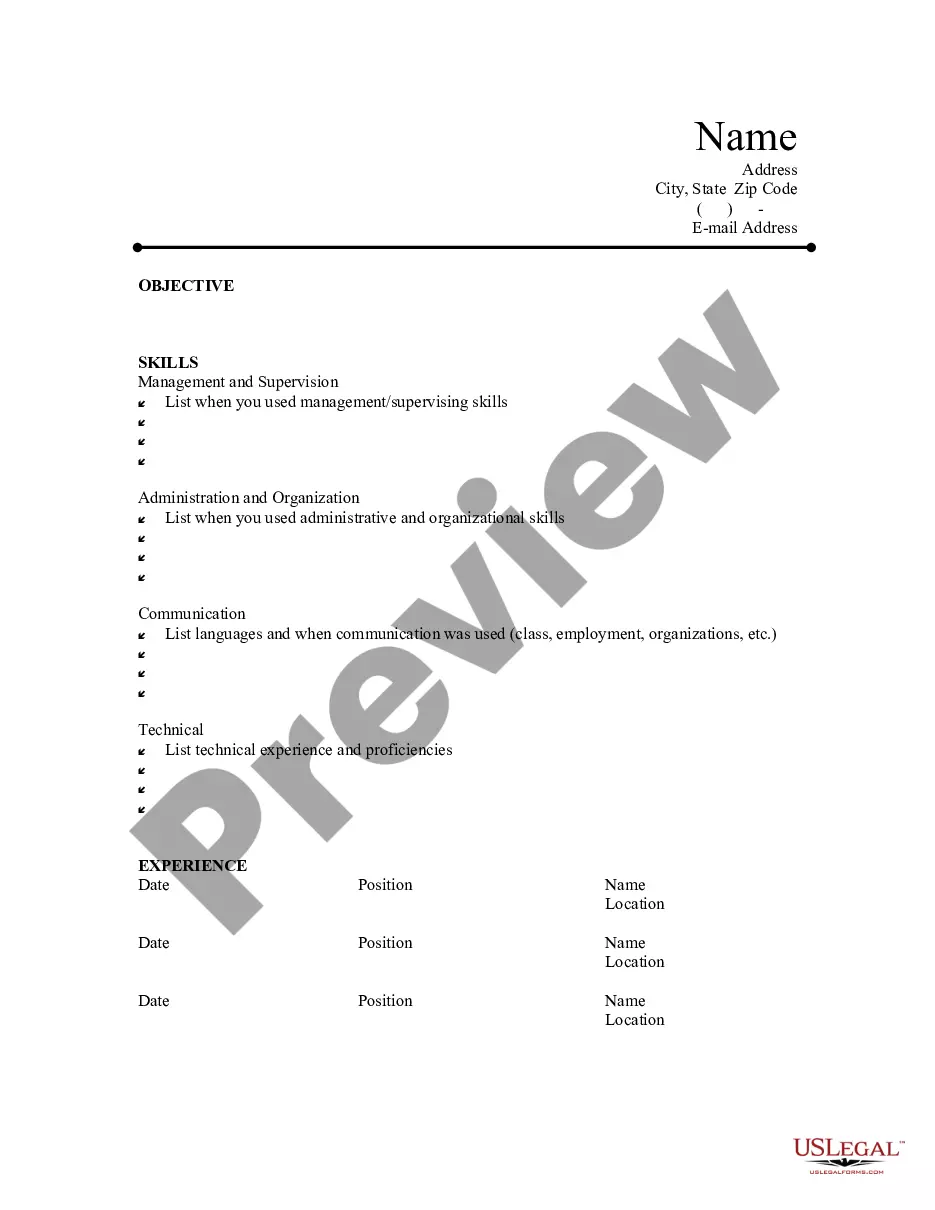

Review the template using the Preview option or through the text description to ensure it meets your needs.

- They are easy to navigate with all documents organized by state and intended use.

- Our experts keep current with legislative modifications, ensuring your paperwork is consistently up to date and compliant when acquiring a Create Irrevocable Trust Online With Irs from our site.

- Securing a Create Irrevocable Trust Online With Irs is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you are a newcomer to our site, follow the outlined steps below.

Form popularity

FAQ

Yes, you can file IRS Form 56 electronically. This form notifies the IRS of the creation of a trust and is essential when you create an irrevocable trust online with IRS. Ensure that you provide accurate information to avoid delays. Using our platform, US Legal Forms, can simplify this process, making it easier for you to manage your trust's documentation.

The three common types of irrevocable trusts are charitable trusts, special needs trusts, and life insurance trusts. Each type serves distinct purposes, such as supporting charitable causes, protecting inheritances for individuals with disabilities, or managing life insurance policies. Understanding these options can help you create irrevocable trust online with IRS standards effectively. US Legal Forms provides valuable resources to guide you through the specifics of each type, helping you make informed decisions.

Yes, you can create an irrevocable trust for yourself. However, once you establish this type of trust, you cannot change its terms or reclaim the assets you've placed within it. This means that choosing to create irrevocable trust online with IRS guidelines is a significant commitment to your estate plan. Platforms like US Legal Forms make it easier for you to navigate this process, ensuring compliance with legal requirements.

Irrevocable trust income is reported on Form 1041, where you'll detail any earnings from the trust and note distributions to beneficiaries. It’s important to accurately track and report this income to comply with IRS regulations. Consider using online tools that help you create irrevocable trust online with IRS, making income reporting straightforward and compliant.

You can file your own irrevocable trust if you understand the legal requirements and tax obligations involved. Utilizing a reputable online service simplifies this process, guiding you in creating an irrevocable trust online with IRS. This empowerment allows you to manage your estate planning effectively and without a lawyer's help.

Filing an irrevocable trust with the IRS involves filling out Form 1041 and potentially additional schedules. You must report any income generated by the trust and indicate distributions to beneficiaries. Trust services online, including US Legal Forms, can assist you in effectively creating and filing your trust with the IRS.

Yes, you can create an irrevocable trust online using user-friendly platforms that guide you through the process. Services like US Legal Forms offer templates and instructions to help you ensure your trust is legally binding. This makes it convenient for you to create irrevocable trust online with IRS without the need for extensive legal knowledge.

The IRS has recently implemented new regulations concerning the reporting and taxation of irrevocable trusts. These rules can affect how income is taxed and how distributions are reported. For the latest updates and guidance, consider using online services that allow you to create irrevocable trust online with IRS and stay compliant.

To file an irrevocable trust with the IRS, you need to complete Form 1041, the U.S. Income Tax Return for Estates and Trusts. Be sure to provide accurate information about the trust, its income, and its beneficiaries. Using a reliable service like US Legal Forms can simplify this process, allowing you to create irrevocable trust online with IRS easily and efficiently.

Filling out a W9 for an irrevocable trust requires specific information about the trust. Start by entering the trust's name as the legal entity and its taxpayer identification number. If you're unsure about the process, using a platform like USLegalForms can help you create irrevocable trust online with IRS-compliant forms, making the W9 completion much simpler.