Generic Affidavit Of Domestic Partnership With Irs

Description

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

When you need to file a Generic Affidavit Of Domestic Partnership With Irs that adheres to your local state's laws, there may be numerous options available. There's no need to review every form to confirm it meets all the legal requirements if you are a US Legal Forms subscriber. It is a dependable service that can assist you in acquiring a reusable and current template on any topic.

US Legal Forms is the largest online database with an archive of over 85k ready-to-use documents for business and personal legal matters. All templates are validated to conform to each state's regulations. Thus, when downloading a Generic Affidavit Of Domestic Partnership With Irs from our site, you can rest assured that you have a valid and current document.

Retrieving the necessary sample from our platform is incredibly straightforward. If you already possess an account, simply Log In to the system, verify that your subscription is active, and save the chosen file. In the future, you can access the My documents section in your profile and maintain access to the Generic Affidavit Of Domestic Partnership With Irs whenever needed. If this is your first time using our website, please follow the instructions below.

Acquiring accurately drafted official documents becomes effortless with US Legal Forms. Furthermore, Premium users can also take advantage of the powerful integrated tools for online PDF editing and signing. Give it a try today!

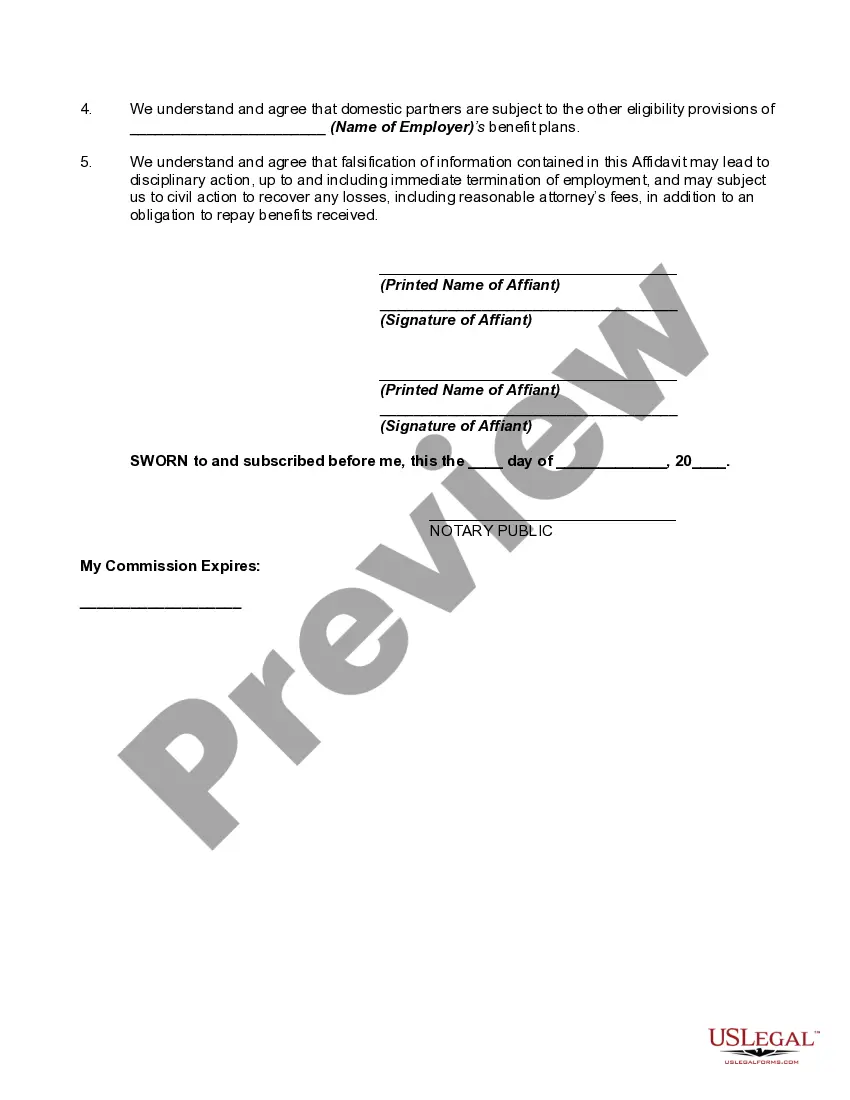

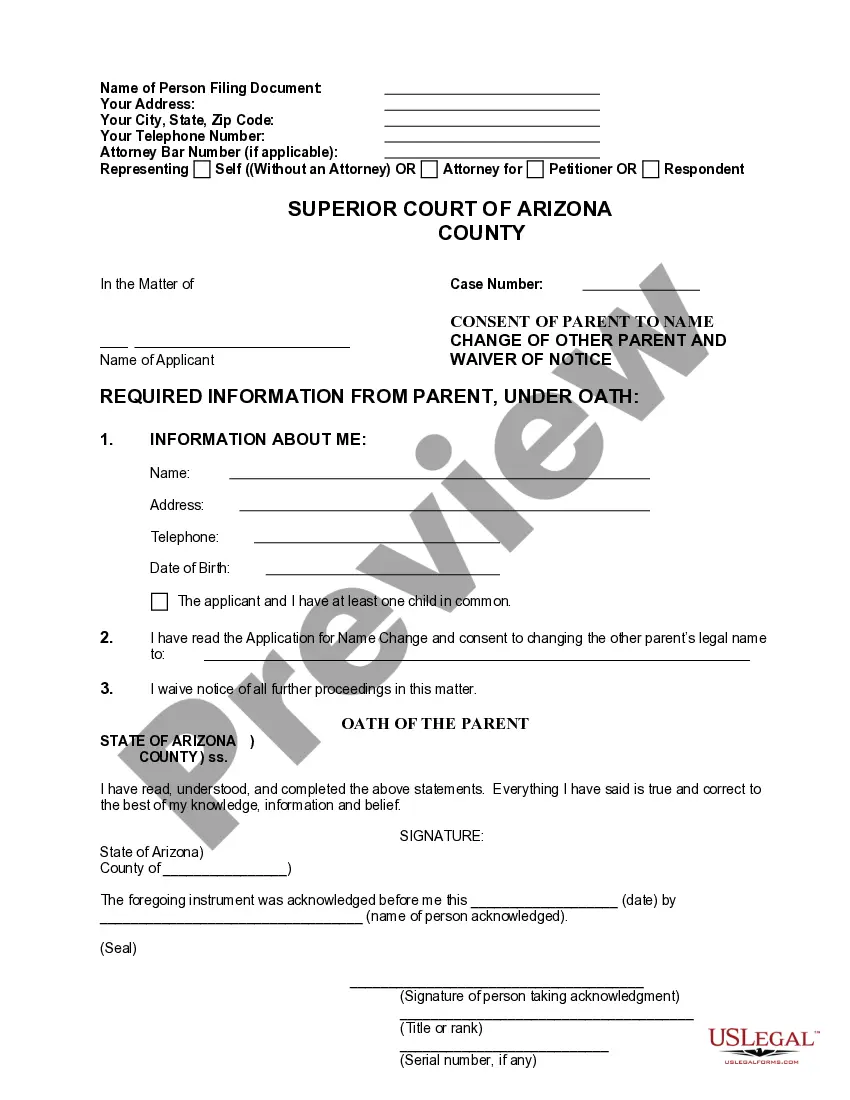

- Navigate through the suggested page and ensure it aligns with your criteria.

- Use the Preview mode and review the form description if available.

- Find another sample via the Search bar in the header if necessary.

- Click Buy Now once you discover the appropriate Generic Affidavit Of Domestic Partnership With Irs.

- Select the most fitting subscription plan, Log In to your account, or create one.

- Pay for a subscription (PayPal and credit card options are available).

- Download the template in your desired file format (PDF or DOCX).

- Print the document or complete it electronically in an online editor.

Form popularity

FAQ

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

Imputed income is defined as the value of the domestic partner coverage minus the after-tax amount contributed toward the coverage.

No. Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes.

The IRS doesn't recognize domestic partners or civil unions as a marriage. This means that on your federal return, you should file as single, head of household, or qualifying widow(er).

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.