Petition For Expungement

Description

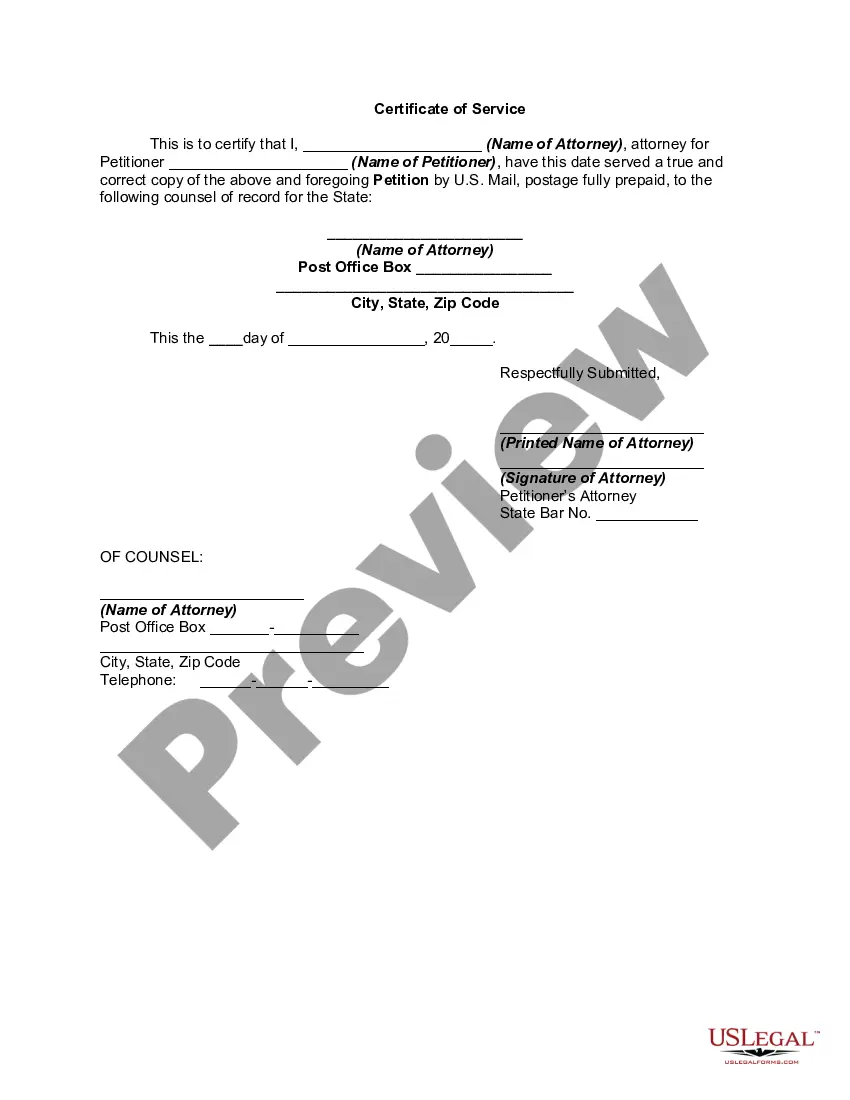

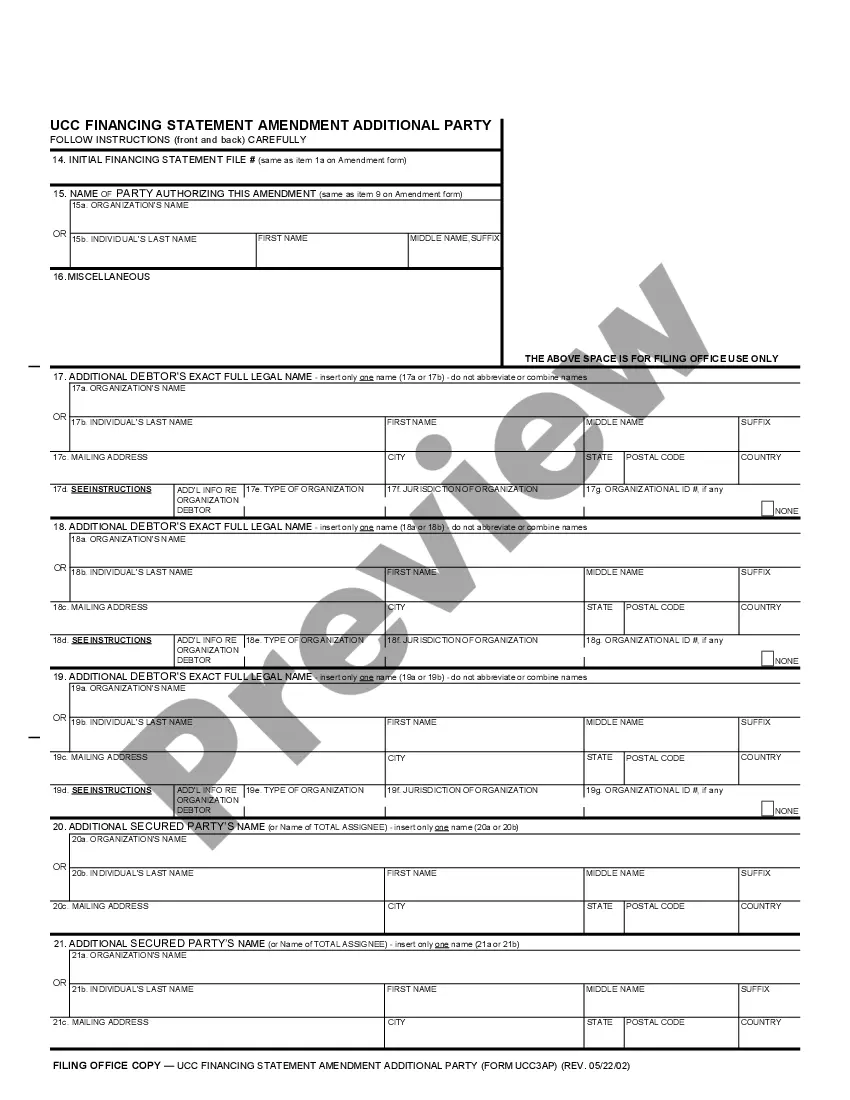

How to fill out Petition For Expungement Of Record In Case Of Acquittal And Release Without Conviction?

Managing legal documents can be daunting, even for seasoned professionals.

When you seek a Petition For Expungement and lack the time to find the correct and current version, the process can become frustrating.

US Legal Forms accommodates every requirement you may have, whether for personal or business documentation, all consolidated in one location.

Leverage advanced tools to complete and manage your Petition For Expungement.

Here are the subsequent steps to follow after acquiring the form you need: Validate that it is the correct form by previewing it and reviewing its description.

- Utilize a repository of articles, guides, and resources related to your situation and needs.

- Conserve time and effort in locating the necessary documents, utilizing US Legal Forms’ innovative search and Review feature to obtain your Petition For Expungement.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to review the documents you've previously stored and manage your files as needed.

- If you're a first-time user of US Legal Forms, create an account to gain unlimited access to all the benefits the library offers.

- Utilize a comprehensive online form directory to revolutionize your approach to these matters.

- US Legal Forms stands as a frontrunner in online legal documents, boasting over 85,000 state-specific forms accessible whenever you need them.

- Access legal and business forms tailored to your state or county.

Form popularity

FAQ

LLC Taxation For Non-Residents Foreigners with a Wyoming LLC are only taxed in the US on income from US sources, which means that income from other countries won't be taxed by the US. But non-US owners of Wyoming LLCs are taxed initially on any US-sourced income at a rate of 30%. This 30% is paid to the IRS.

Starting an LLC in Wyoming. ... Decide on a name for your business. ... Assign a registered agent for service of process. ... Get an Employer Identification Number (EIN) from the IRS. ... Create an operating agreement. ... Pay the license tax. ... Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

To form a Wyoming S corp, you'll need to ensure your company has a Wyoming formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

Do I need a physical address for my business in Wyoming? Technically, no. But when you file your business formation documents with the Wyoming Secretary of State, you'll be required to list an address for your registered agent and a business address (known as the ?principal office address? in Wyoming).

Wyoming charges a $102 filing fee for your Articles of Organization, but there may be add-ons and other costs that bump this amount up (such as fees for licenses or permits in your industry). You can opt for the online filing option or file your documents by postal mail.

To register your foreign LLC in Wyoming, you need to complete the state's Certificate of Authority application and file it with the Wyoming Secretary of State. Here's the content you'll need to provide: LLC name as registered in home jurisdiction.

It costs $199 to incorporate your business in Wyoming for the first year. Subsequent years will require a $52 annual report and our $59 Wyoming registered agent service. Every $199 corporation includes: State Filing Fee.