Gift Property Form For Texas

Description

How to fill out Gift Of Entire Interest In Literary Property?

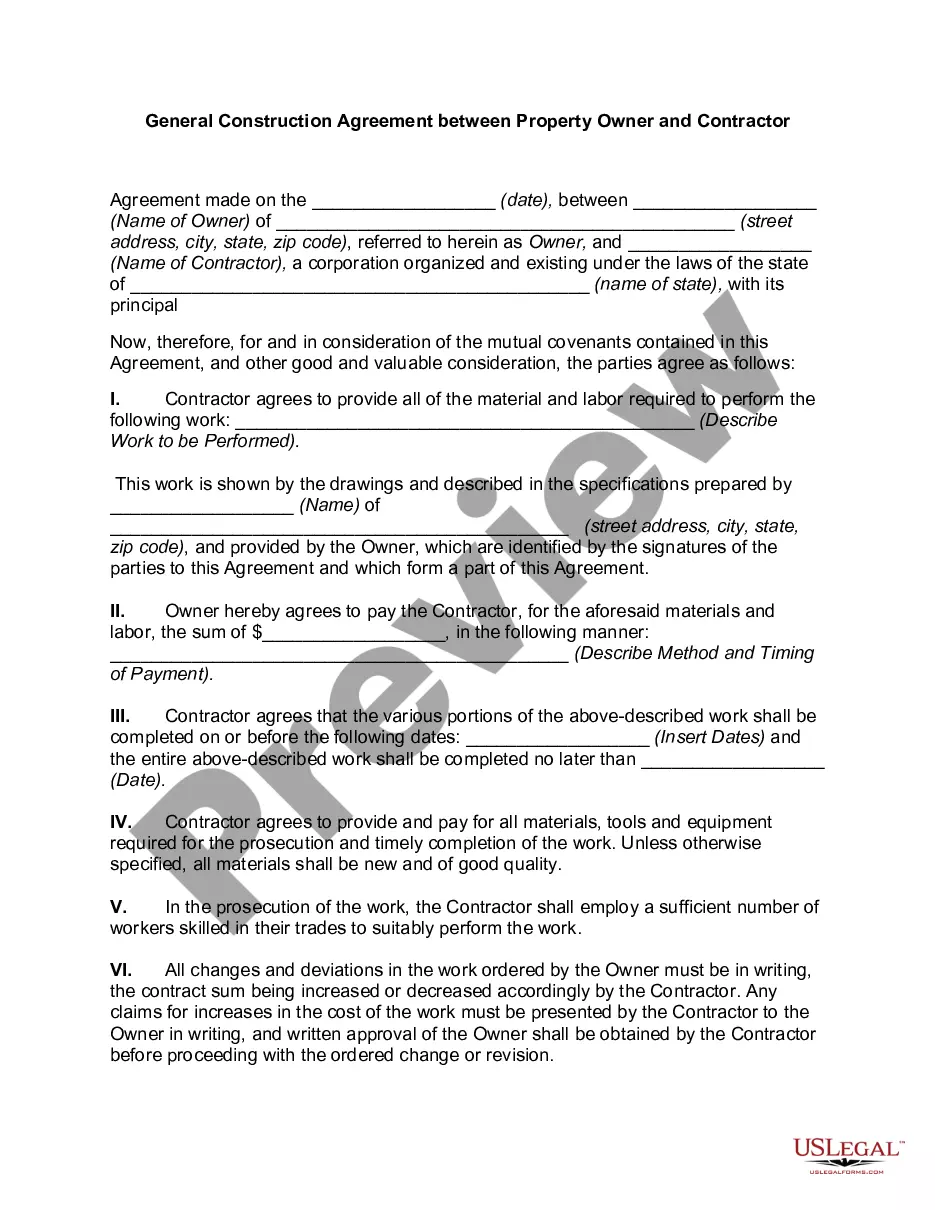

The Donated Property Document For Texas displayed on this site is a reusable legal prototype crafted by expert attorneys in accordance with national and local legislation.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with more than 85,000 authenticated, state-specific documents suitable for any business and personal circumstances. It’s the fastest, simplest, and most reliable means to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-virus safeguards.

Download your document one more time. Access the same document whenever needed. Go to the My documents tab in your account to redownload any previously purchased documents.

- Search for the document you require and review it.

- Browse through the file you looked for and preview it or check the form description to ensure it meets your specifications. If it doesn’t, utilize the search function to locate the correct one. Click Buy Now once you have identified the template you need.

- Register and sign in.

- Choose the pricing plan that works for you and set up an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Get the fillable document.

- Choose the format you desire for your Donated Property Document For Texas (PDF, Word, RTF) and download the template to your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill and sign your form electronically.

Form popularity

FAQ

Filling out a gift deed in Texas involves completing key sections of the gift property form for Texas. Start by entering the names of the donor and recipient along with the property's legal description. You must also state clearly that the property is a gift. It’s advisable to review the document for accuracy and completeness, and you can find helpful resources and templates on US Legal Forms to guide you through.

To transfer a property deed to a family member in Texas, start by completing a gift property form for Texas. The form must detail the property and identify both parties. You will need to notarize the deed, then file it with the county clerk to officially complete the transfer. Utilizing platforms like US Legal Forms can simplify this process, providing you with the necessary templates and resources.

A gift deed in Texas must meet specific requirements to be valid. First, it needs to be in writing and signed by the donor. Additionally, you must provide a clear description of the property and state that it is a gift. Lastly, ensure that both the donor and recipient are identified, making the gift property form for Texas crucial for a smooth transfer process.

To gift a property deed in Texas, you need to complete a gift property form for Texas. This form should include the names of the donor and recipient and a description of the property being gifted. After filling out the form, have it signed in front of a notary public. Finally, file the deed with your local county clerk's office to make the transfer official.

Common mistakes in gift deeds can lead to complications that may affect the legitimacy of the transfer. One frequent error is failing to properly fill out the gift property form for texas, which can invalidate the document. Additionally, parties might overlook the necessity of having the deed signed in front of a notary, which is crucial for legal acceptance. Always ensure that you have complete, accurate information and consider consulting a professional to avoid these pitfalls.

To gift property to a family member in Texas, start by completing the appropriate gift property form for Texas. This form needs details about both the donor and recipient. After signing the form with a notary, you should file it with the local county office. This process formally transfers ownership and makes the gift official.

While hiring a lawyer is not mandatory to transfer a deed in Texas, it can be beneficial, especially if you encounter complications. Many people opt for the straightforward method provided by a gift property form for Texas. This form simplifies the process and reduces legal confusion. However, consulting a legal expert ensures that all specifics of your situation are addressed.

To gift deed property in Texas, first, you need to complete a gift property form for Texas. This form transfers ownership without expecting payment. After filling out the required information, sign the document in front of a notary. Finally, file the gift deed with the county clerk’s office for it to be valid.