In the answer to a civil lawsuit, the respondent/defendant tells his side of the story. He is supposed to admit facts that are true and deny allegations that are not true. This answer must be filed within 30 days in some state courts. Failure to file an answer can result in a default judgment against the respondent/defendant. A default judgment is a judgment for failure to defend that is entered against the respondent/defendant just like there had been a trial.

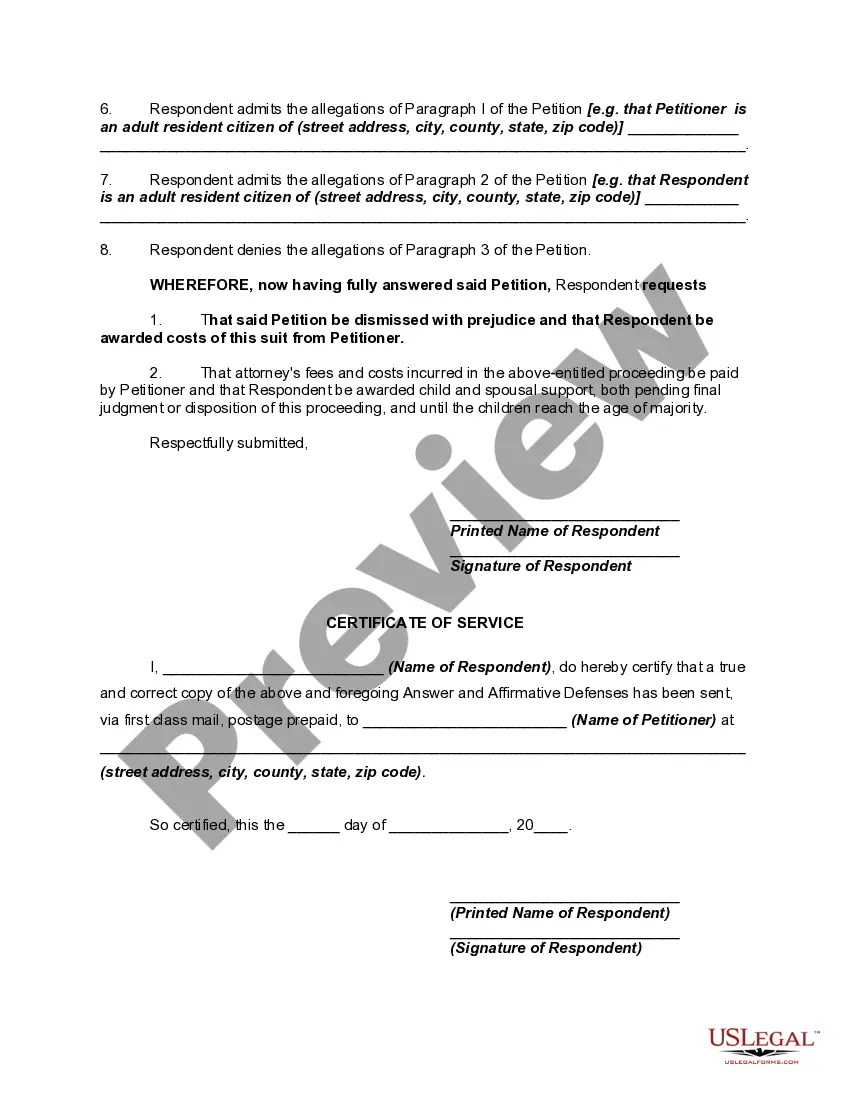

This form is a generic example of an answer that may be referred to when preparing such a pleading for your particular state.