Probate Code 13100 Form With Decimals

Description

How to fill out Petition To Probate Lost Will?

Whether for commercial objectives or personal affairs, everyone must confront legal situations eventually in their lifetime.

Completing legal documents requires meticulous focus, starting with selecting the correct form template.

Once downloaded, you can either fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms library at your disposal, you will not waste time searching for the right template online. Utilize the library’s user-friendly navigation to locate the correct template for any event.

- For instance, if you select an incorrect version of the Probate Code 13100 Form With Decimals, it will be rejected upon submission.

- Thus, it is essential to have a reliable source of legal documents like US Legal Forms.

- If you require a Probate Code 13100 Form With Decimals template, follow these simple steps.

- Acquire the template you need by utilizing the search feature or browsing the catalog.

- Review the form’s details to ensure it fits your case, jurisdiction, and area.

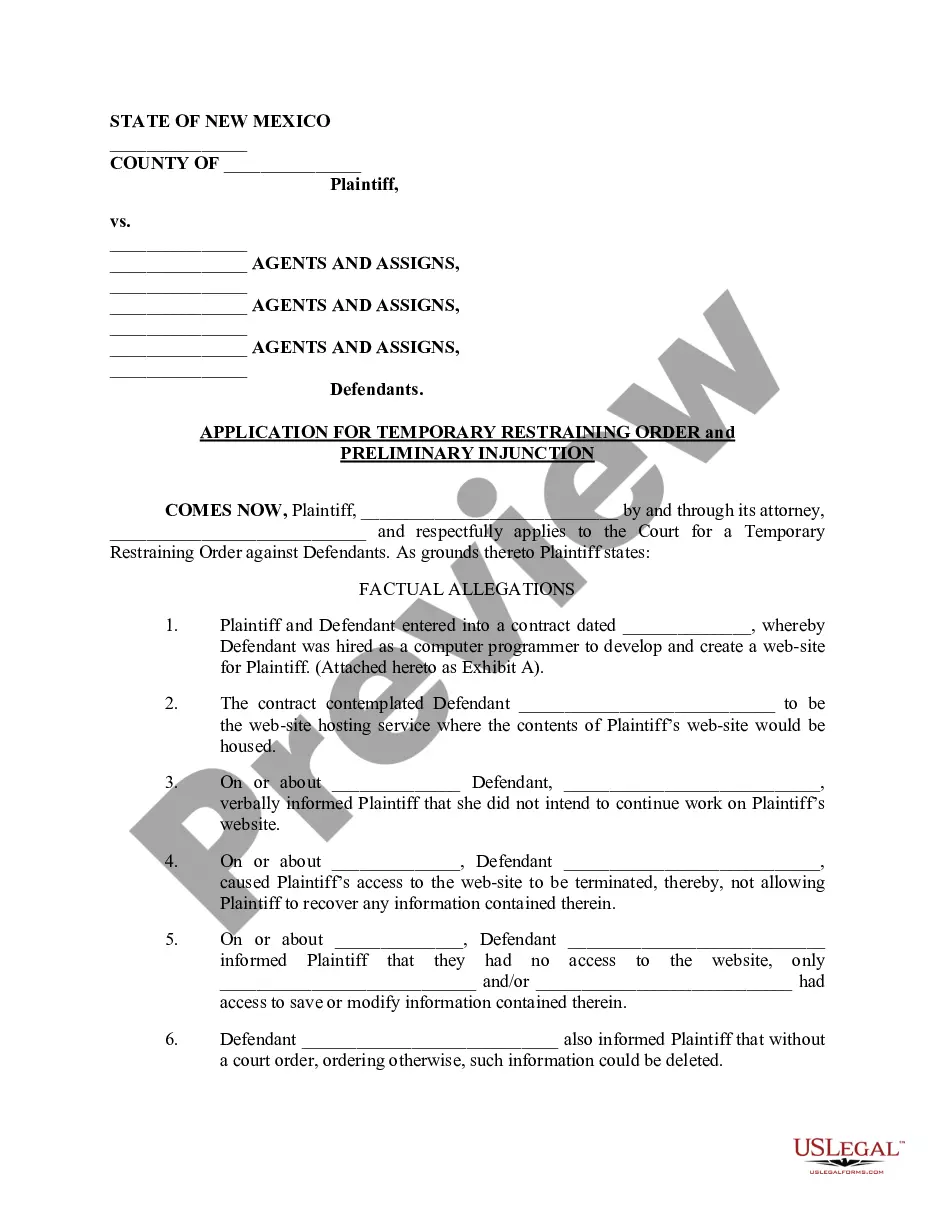

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search option to find the Probate Code 13100 Form With Decimals sample you require.

- Download the file when it meets your specifications.

- If you own a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing choice.

- Fill out the account registration form.

- Choose your payment option: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Probate Code 13100 Form With Decimals.

Form popularity

FAQ

Legally, you are not required to have the Affidavit notarized. But many institutions will ask you to do so, so it may be a good idea to notarize it before you try to use it to transfer the property. If there are other people entitled to inherit the property, they must also sign the Affidavit.

If the Decedent's ?probate property? has an aggregate fair market value of less than $184,500 (in 2023), or the Decedent's property is to pass to the Decedent's surviving spouse, or where the Decedent intended to transfer his/her property to his/her revocable living trust but failed to accomplish such transfer, a ? ...

Ing to California Probate Code Sections 13100-13116, if the decedent passes away with their estate valued at less than $166,250, which includes real and personal property (but excludes certain property), a formal probate proceeding may not need to be opened.

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500. It typically occurs when the deceased person died without a will, but it can occur even if the deceased person did have a will if they owned real property that is subject to probate.

Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.