California Probate 13100 Form With Payment

Description

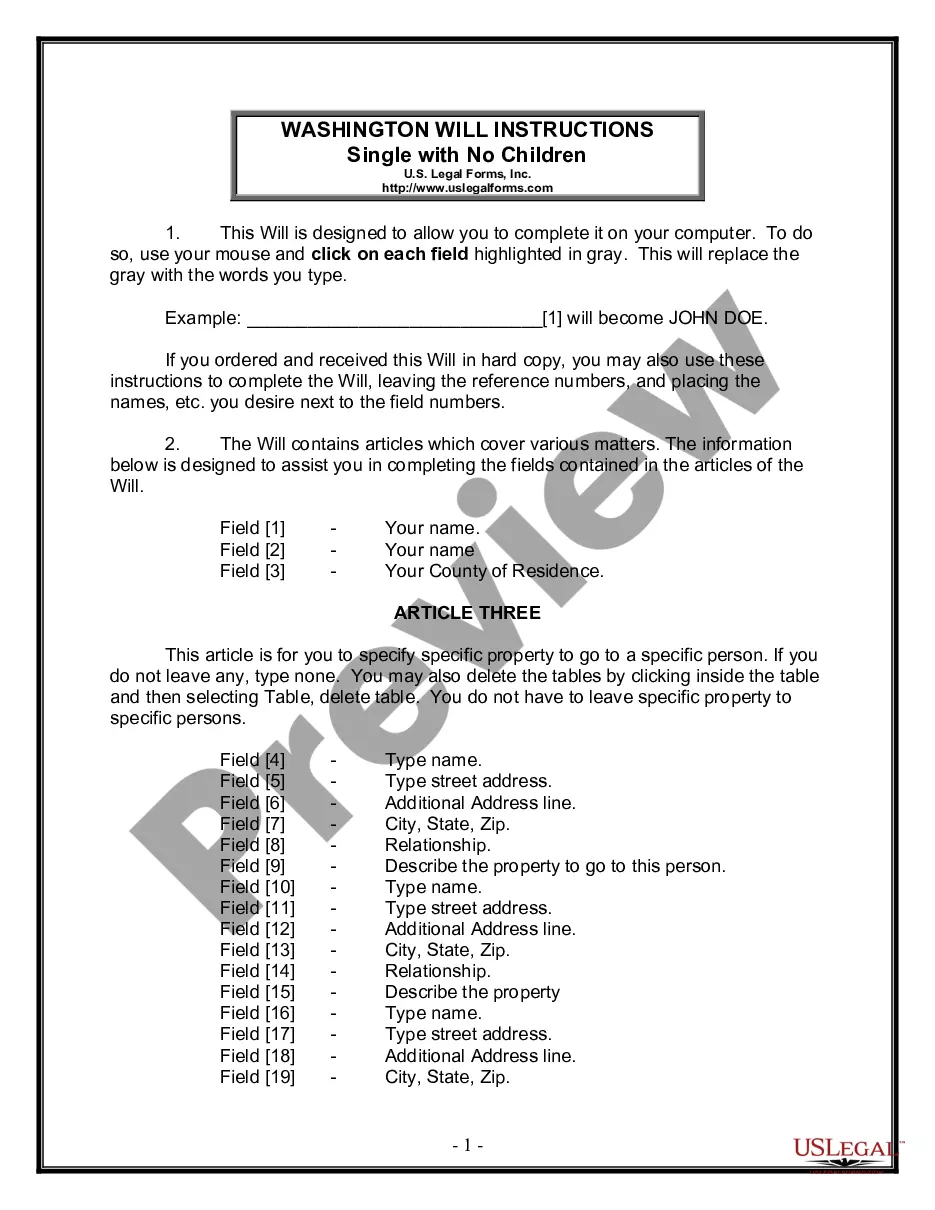

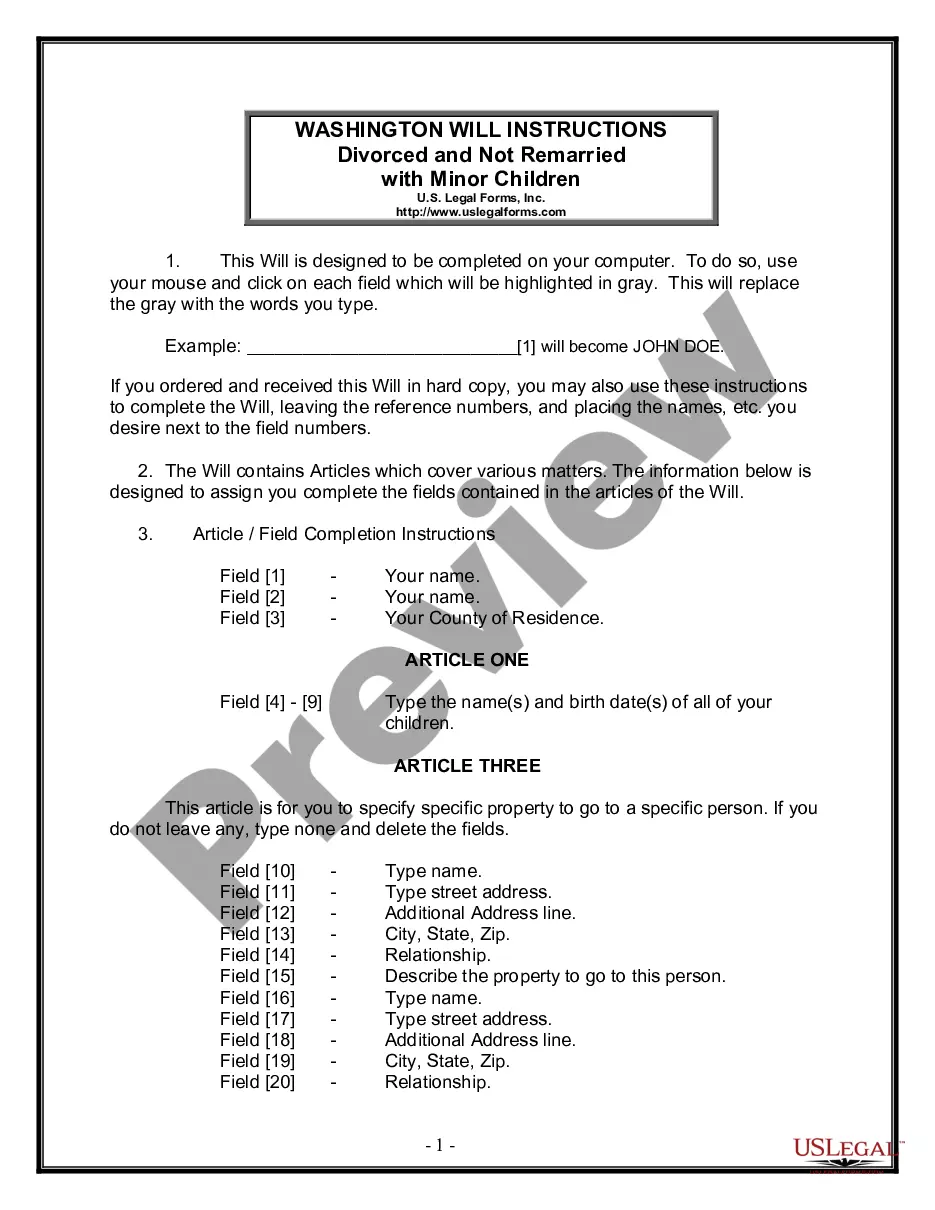

How to fill out Petition To Probate Lost Will?

Legal management can be daunting, even for the most informed professionals.

If you are seeking a California Probate 13100 Form With Payment and lack the time to search for the suitable and current version, the process can be stressful.

Access a library of articles, guides, and resources pertinent to your situation and requirements.

Save time and effort locating the necessary forms, and utilize US Legal Forms’ sophisticated search and Preview feature to find the California Probate 13100 Form With Payment and obtain it.

Select Buy Now when you’re prepared, choose a subscription plan, select the desired file format, and Download, complete, eSign, print, and send your document. Experience the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your document management routine into a seamless and user-friendly experience today.

- If you have a monthly membership, Log Into your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and manage your files as desired.

- If you’re a new user of US Legal Forms, create a free account for unlimited access to all the advantages of the library.

- After accessing the required form, confirm that it is the correct one by previewing it and reviewing its description.

- Ensure that the template is authorized in your state or county.

- Utilize a comprehensive online form directory that can significantly benefit anyone looking to handle these matters efficiently.

- US Legal Forms is a leading provider of online legal documents, boasting over 85,000 state-specific forms available to you at any time.

- Leverage advanced tools to complete and manage your California Probate 13100 Form With Payment.

Form popularity

FAQ

Maximum Value of Small Estate: $166,250?$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500.

(Revised: 01/2021) Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.

Ing to the California probate code §§890, 13000 - to be considered a small estate and avoid probate, the total value of all real property and personal property cannot exceed $184,500.