Agreement Payment Taxes For Business

Description

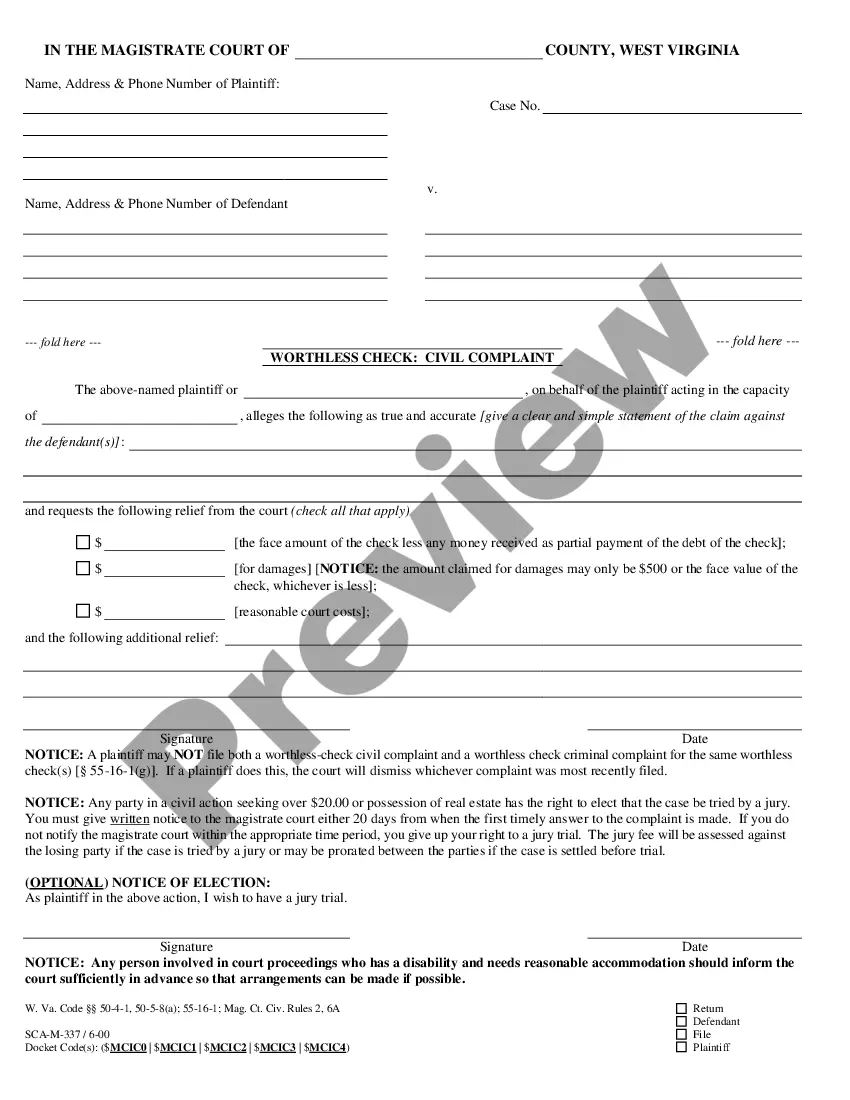

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

Managing legal documents can be daunting, even for the most experienced professionals.

If you are looking for an Agreement Payment Taxes For Business and lack the time to search for the right and updated version, the process can be stressful.

US Legal Forms meets all your requirements, from personal to business documentation, in one convenient location.

Utilize advanced features to fill out and manage your Agreement Payment Taxes For Business.

Here are the steps to follow after acquiring the form you need: Verify that it is the correct form by previewing it and reviewing its details, ensure that the template is recognized in your state or county, click Buy Now when you are ready, select a subscription plan, choose the desired file format, and Download, fill out, eSign, print, and submit your document. Benefit from the US Legal Forms online collection, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- Access a valuable resource library of articles, guides, and materials pertinent to your circumstances and requirements.

- Save time and effort searching for the necessary documents, and utilize US Legal Forms’ sophisticated search and Review feature to find Agreement Payment Taxes For Business and obtain it.

- If you possess a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check the My documents tab to review the documents you have previously downloaded and to organize your folders as desired.

- If this is your first time using US Legal Forms, create an account and gain unrestricted access to all the benefits of the library.

- A comprehensive online form repository can be a significant advantage for anyone seeking to handle these matters effectively.

- US Legal Forms is a frontrunner in digital legal forms, offering over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can access tailored legal and business forms specific to your state or county.

Form popularity

FAQ

Make your check or money order payable to ?United States Treasury.? Don't send cash. If you want to pay in cash, in person, see Pay by cash, later. Make sure your name and address appear on your check or money order. Enter your daytime phone number and your SSN on your check or money order.

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.

Schedule C is a simple way for filing business taxes since it is only two pages long. When complete, you just subtract your expenses from your business earnings to arrive at you net profit or loss. You then transfer this amount to your personal income tax form and include it with all other personal income tax items.

To file your tax return as an independent contractor (self-employed), use the records you gathered (see Keep Records above) and fill out these forms: Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Schedule SE (Form 1040), Self-Employment Tax.

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.