Agreement Pay Tax With Check

Description

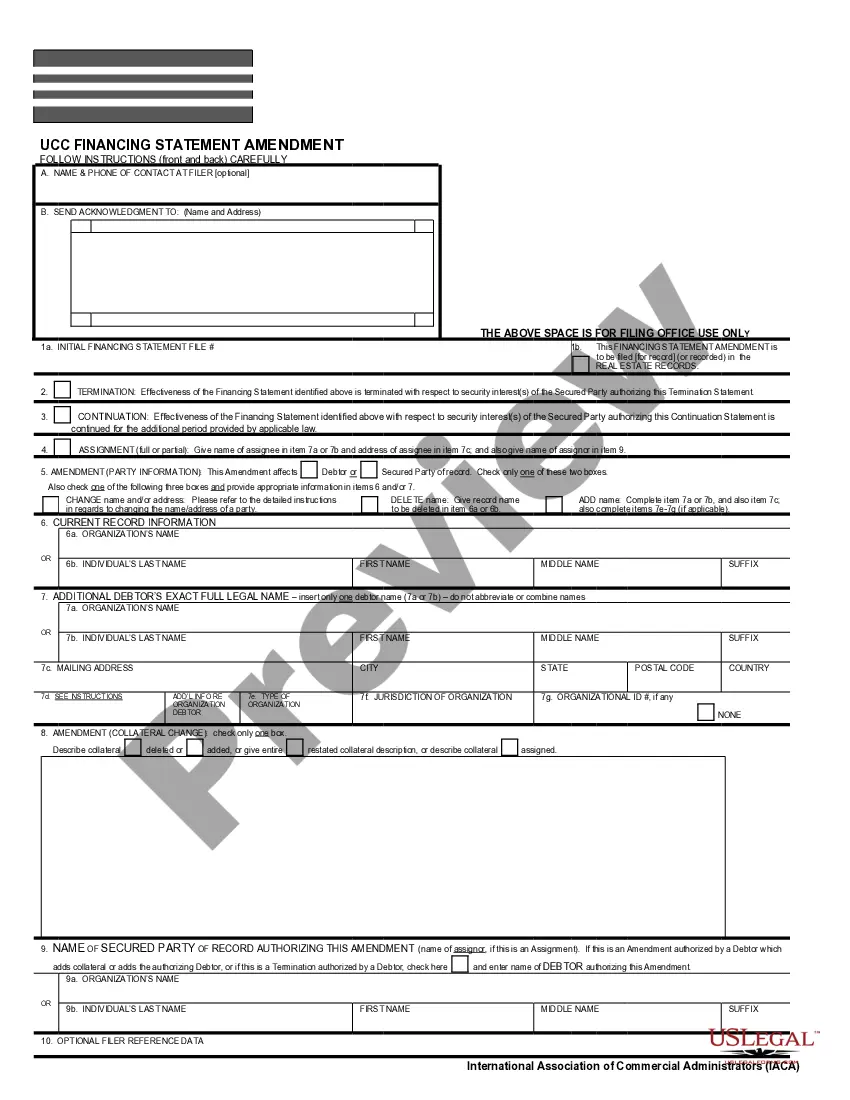

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

The Agreement Pay Tax With Check visible on this page is a reusable official template created by qualified lawyers in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and lawyers more than 85,000 validated, state-specific documents for any personal and business circumstance. It’s the quickest, easiest, and most reliable method to obtain the files you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you prefer for your Agreement Pay Tax With Check (PDF, DOCX, RTF) and download the sample to your device.

- Search for the document you need and examine it.

- Browse through the file you searched and preview it or check the form description to ensure it meets your needs. If it doesn't, use the search bar to locate the appropriate one. Click Buy Now after finding the template you require.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you have an existing account, Log In and review your subscription to continue.

- Obtain the fillable template.

Form popularity

FAQ

A Notice of Federal Tax Lien (NFTL) may be filed to protect the government's interests until you pay in full. However, an NFTL is generally not filed with a Guaranteed Installment Agreement. Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet.

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. To qualify for a lower user fee, you can request an installment agreement using the IRS Online Payment Agreement tool.

If the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file Form 9465; you can request an installment agreement online. For more information, see Applying online for an installment agreement and other payment plans, earlier.

You can send Form 9465 with the e-return, but the IRS must still approve the installment agreement form. The IRS may also require you to mail a check to them for processing the initial payment before the agreement is in effect.

A payment can be made in the form of cash, check, wire transfer, credit card, or debit card.