Revocable Form Trust Within A Revocable Trust

Description

How to fill out Revocable Trust Agreement Regarding Coin Collection?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more cost-effective way of preparing Revocable Form Trust Within A Revocable Trust or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms diligently put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Revocable Form Trust Within A Revocable Trust. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the library. But before jumping directly to downloading Revocable Form Trust Within A Revocable Trust, follow these recommendations:

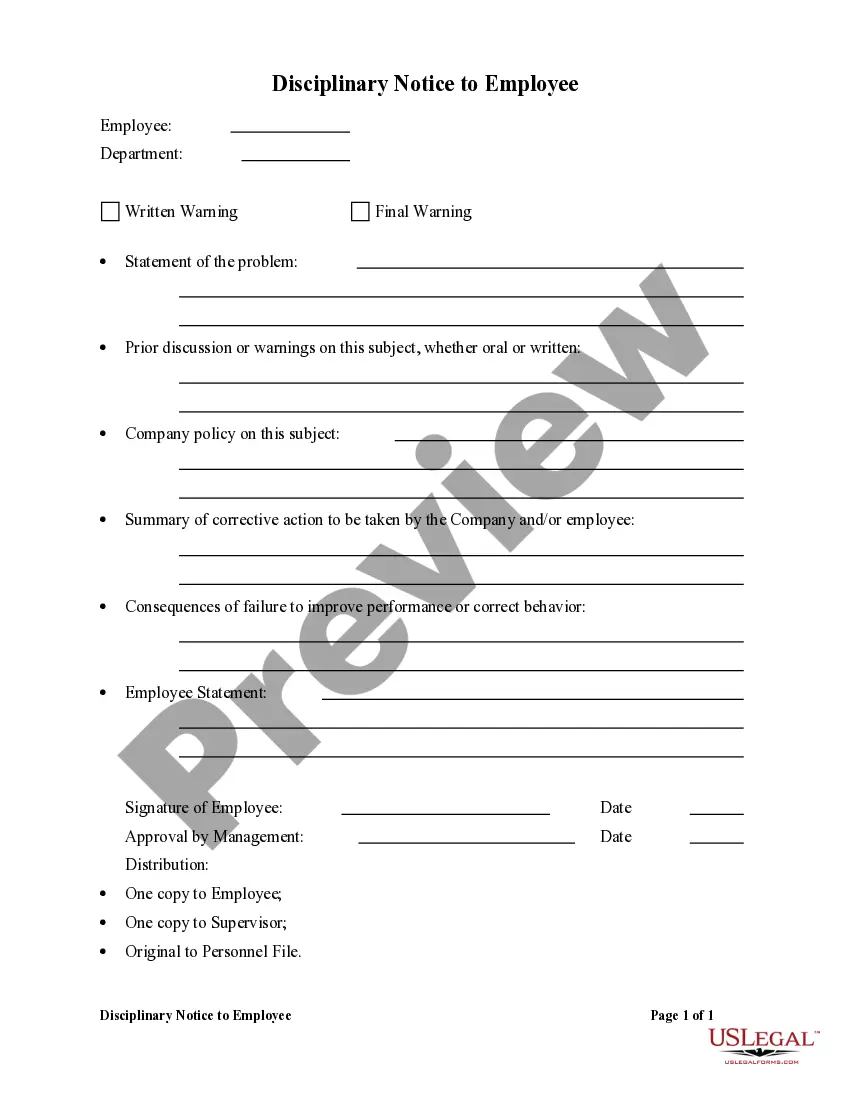

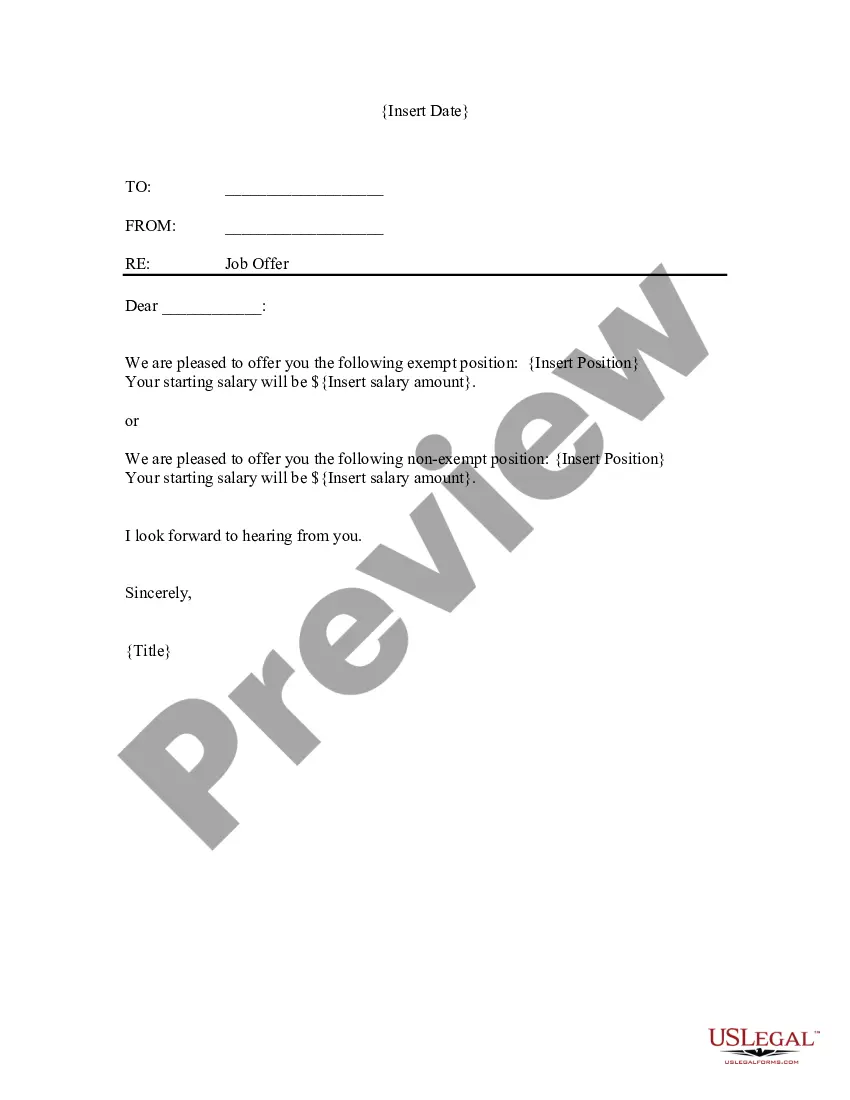

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Check if form you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Revocable Form Trust Within A Revocable Trust.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and turn document completion into something easy and streamlined!

Form popularity

FAQ

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income rather than the trust paying the tax. However, beneficiaries aren't subject to taxes on distributions from the trust's principal, the original sum of money put into the trust.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

Franke, Jr. Yes, once the trust grantor becomes incapacitated or dies, his revocable trust is now irrevocable, meaning that generally the terms of the trust cannot be changed or revoked going forward. This is also true of trusts established by the grantor with the intention that they be irrevocable from the start.

The main disadvantage of a revocable living trust is that it does not protect you from creditors or lawsuits. Because you have control of everything in your trust and have access to the assets, you can still be sued for liability.