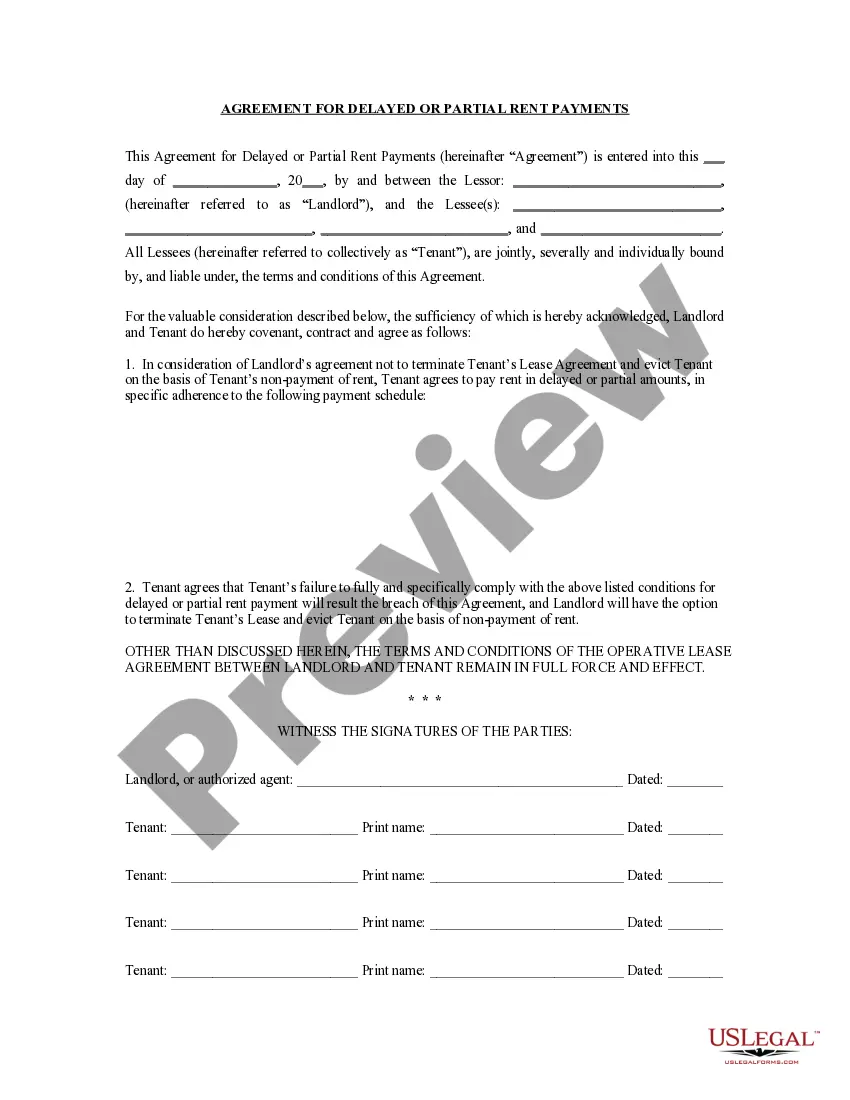

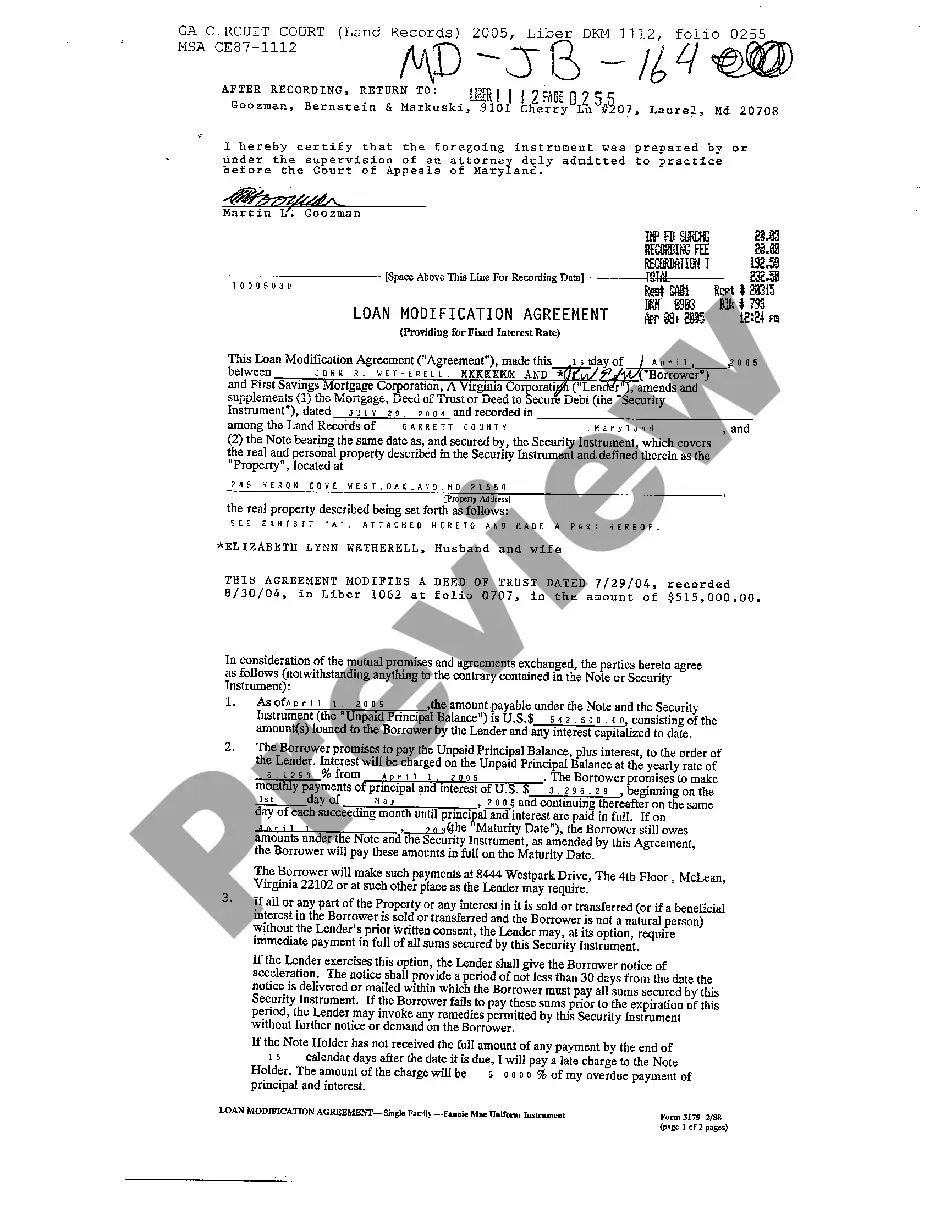

Payment Agreement Contract For Car

Description

How to fill out Pay Per Click Services Agreement?

Steering through the red tape of official documents and templates can be challenging, particularly when one isn’t engaged in that field professionally.

Even locating the correct template for a Payment Agreement Contract For Car will require considerable time, as it should be valid and precise to the last detail.

However, you will need to spend much less time selecting an appropriate template from a reliable source.

Acquire the correct form in a few straightforward steps: Enter the document name in the search bar, select the appropriate Payment Agreement Contract For Car from the results, review the description of the sample or preview it, and if the template meets your requirements, click Buy Now. Then choose your subscription plan, use your email to create a password for registering at US Legal Forms, opt for a credit card or PayPal payment method, and finally save the template document on your device in your preferred format. US Legal Forms can save you time and effort in investigating whether the form you found online meets your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a resource that streamlines the task of locating the appropriate forms online.

- US Legal Forms serves as a centralized point for obtaining the most current document samples, confirming their usage, and downloading these samples for completion.

- It functions as a repository containing over 85K forms applicable across various professional fields.

- When searching for a Payment Agreement Contract For Car, you need not question its authenticity as all forms are authenticated.

- Having an account at US Legal Forms guarantees that all necessary samples are readily available to you.

- You can save them in your history or add them to the My documents catalog.

- Access your saved forms from any device by simply clicking Log In at the library site.

- If you haven’t created an account yet, you can always look for the template you need.

Form popularity

FAQ

How to Write a Simple Payment Contract LetterThe date that the agreement was signed and thus going into effect.The date of the first payment.The date when each payment after will be made.A grace period, if any.When a payment is considered late.

A payment plan agreement, also known as an installment agreement, is a written legal document that allows one party to make smaller payments over time to payoff a larger debt.

Here are the steps to write a letter of agreement:Title the document. Add the title at the top of the document.List your personal information.Include the date.Add the recipient's personal information.Address the recipient.Write an introduction paragraph.Write your body.Conclude the letter.More items...?27-May-2021

Follow these six easy steps to set up a debt repayment plan.Make a List of All Your Debts.Rank Your Debts.Find Extra Money To Pay Your Debts.Focus on One Debt at a Time.Move On to the Next Debt on Your List.Build Up Your Savings.Other Tips.