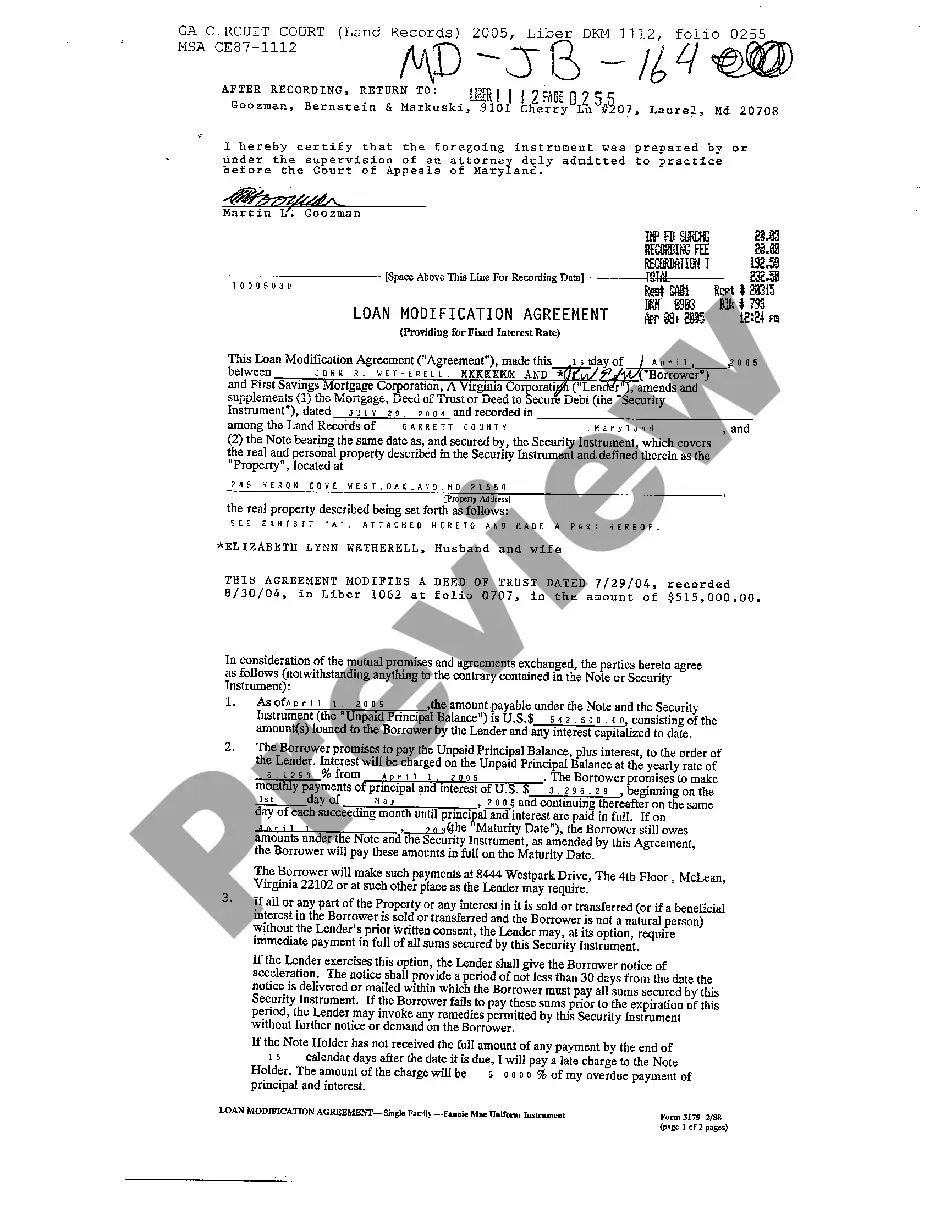

Maryland Loan Modification Agreement Providing for Fixed Interest Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Loan Modification Agreement Providing For Fixed Interest Rate?

Greetings to the largest legal document collection, US Legal Forms. Here, you can access various examples such as the Maryland Loan Modification Agreement Establishing Fixed Interest Rate templates and retain as many as you need. Prepare official papers in just a few hours, instead of days or weeks, without incurring a hefty fee with an attorney. Obtain the state-specific document in just a few clicks, feeling confident that it was created by our licensed lawyers.

If you’re already a registered user, simply Log In to your profile and click Download next to the Maryland Loan Modification Agreement Establishing Fixed Interest Rate you need. Because US Legal Forms is an online platform, you’ll always have access to your saved documents, irrespective of the device you’re using. Locate them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve finished the Maryland Loan Modification Agreement Establishing Fixed Interest Rate, send it to your attorney for confirmation. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a wealth of reusable templates.

- If this is a state-specific document, verify its relevance in the state where you reside.

- Review the description (if available) to determine if it’s the correct template.

- Explore additional content using the Preview feature.

- If the document satisfies all of your requirements, simply click Buy Now.

- To create an account, select a pricing option.

- Utilize a card or PayPal account to sign up.

- Store the template in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

A mortgage rate modification occurs when a lender changes the terms of your existing mortgage loan to provide a more favorable interest rate. For instance, if you have a home loan with a variable interest rate, a Maryland Loan Modification Agreement Providing for Fixed Interest Rate can convert it to a fixed rate. This change helps provide predictability in your monthly payments, which can enhance financial stability. Utilizing services like US Legal Forms makes it simple to navigate the modification process and secure a rate that works for you.

No, a fixed interest rate is designed to remain constant for the life of the loan agreed upon in the original contract. This means that once you enter into a Maryland Loan Modification Agreement Providing for Fixed Interest Rate, you can count on stable monthly payments. If you find your financial situation has changed, consider reaching out to professionals to explore your options for potentially altering your loan terms. US Legal Forms can assist you with the necessary documentation and guidance.

With an adjustable rate mortgage, the interest rate typically changes at predetermined intervals, such as annually or biannually. This change is based on market conditions and the specific terms of the loan agreement. If you are looking for stability in your payments, a Maryland Loan Modification Agreement Providing for Fixed Interest Rate may be a suitable option. This agreement allows you to maintain a consistent payment amount throughout the life of the loan, protecting you from sudden rate increases.

Yes, a lender can change your interest rate under certain conditions. If you have a Maryland Loan Modification Agreement Providing for Fixed Interest Rate, your interest rate should remain stable throughout the term of the loan. However, if you do not have a fixed rate, the lender may increase or decrease the interest rate based on market conditions or your financial situation. To protect your interests, consider consulting with a legal expert to ensure that you understand the terms of your agreement.

The legal interest rate in Maryland is generally set at 6% per year unless otherwise specified in a contract. This rate can impact any Maryland Loan Modification Agreement Providing for Fixed Interest Rate, as borrowers may want to negotiate terms based on current market rates. It is crucial to consult with a legal expert when modifying a loan agreement to ensure you understand how the interest rate affects your payment obligations. Our platform, USLegalForms, offers resources to help you navigate these legal considerations and create a compliant loan modification agreement.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

If you are having trouble keeping up with your monthly mortgage payments, you can apply for a loan modification to reduce your interest rate and hence, lower your monthly payments. A lender will review your current mortgage and financial circumstances before deciding to approve or deny you for a modification.

Technically, a loan modification should not have any negative impact on your credit score.If that's the case, those the Consumer Data Industry Association missed or partial payments will damage your credit, but the loan modification itself will not.

In essence, the adjustment period is the period between interest rate changes. Take, for instance, an adjustable-rate mortgage that has an adjustment period of one year.If the adjustment period is three years, it is called a 3-year ARM, and the rate would change every three years.

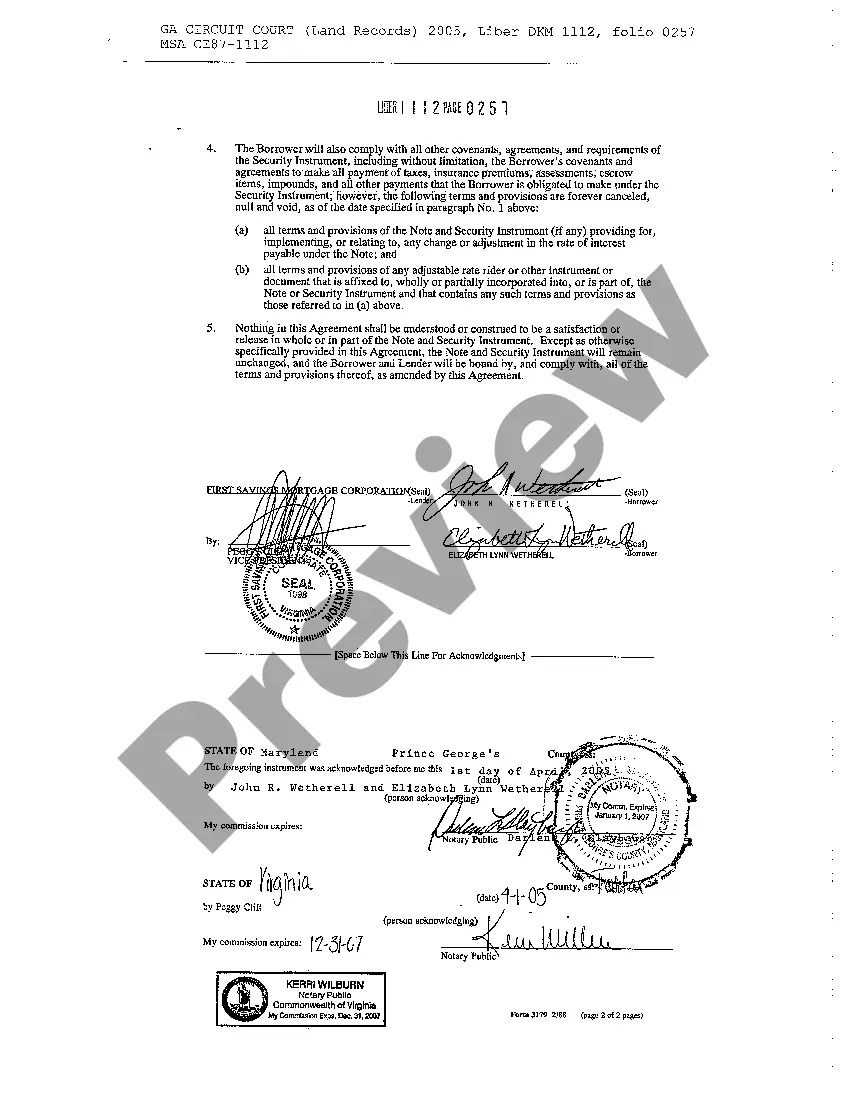

A loan modification can change the principal of the loan, the interest rate, and other terms to make the loan more affordable.However, a lender must agree to the loan modification, which means borrowers must negotiate with them.