Notice Of Intent To Foreclose Form

Description

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Red tape requires meticulousness and exactness.

If you do not engage in completing forms such as the Notice Of Intent To Foreclose Form regularly, it may lead to some misunderstanding.

Selecting the right example from the outset will guarantee that your document submission will proceed smoothly and avert any hassles of resubmitting a document or repeating the same task from the beginning.

Obtaining the correct and up-to-date templates for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your form handling.

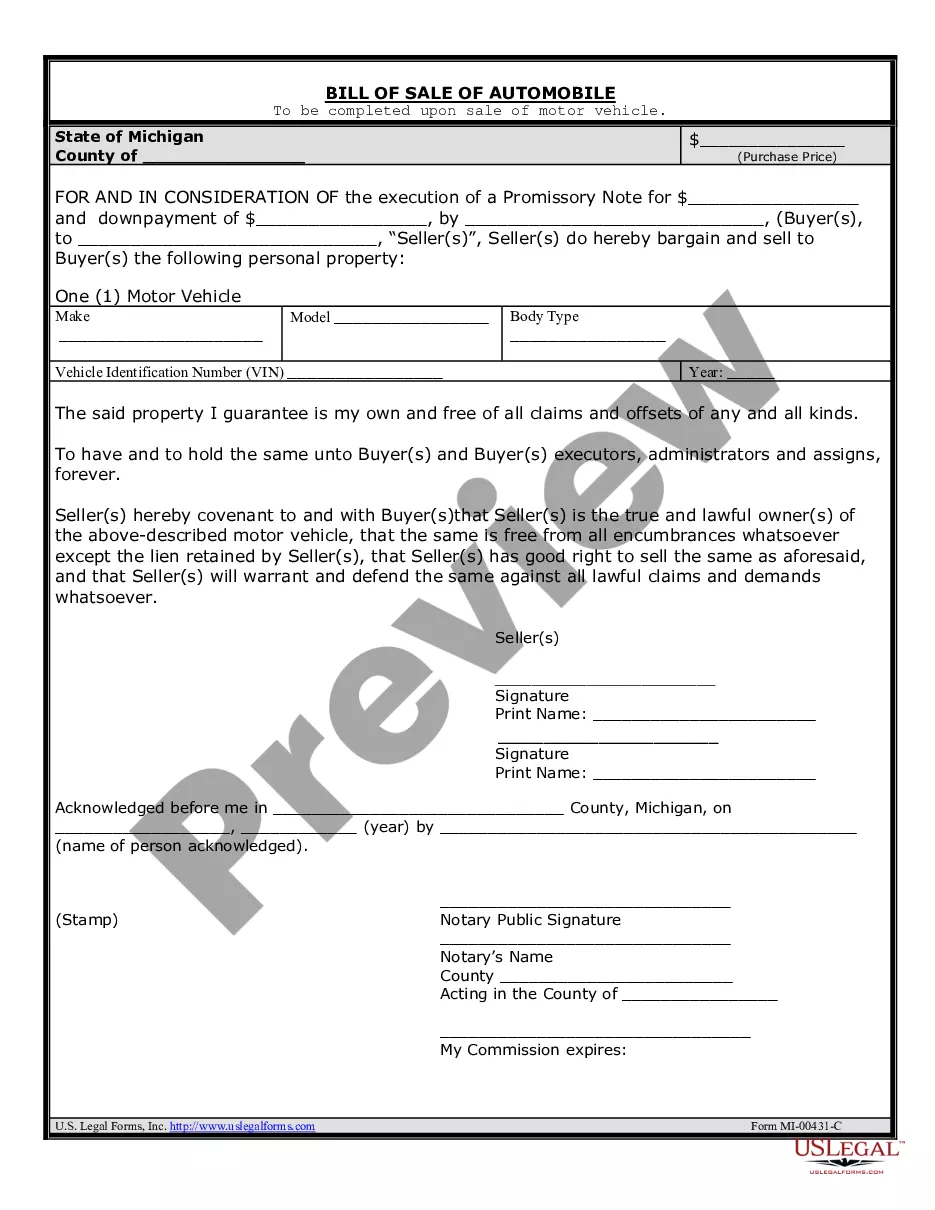

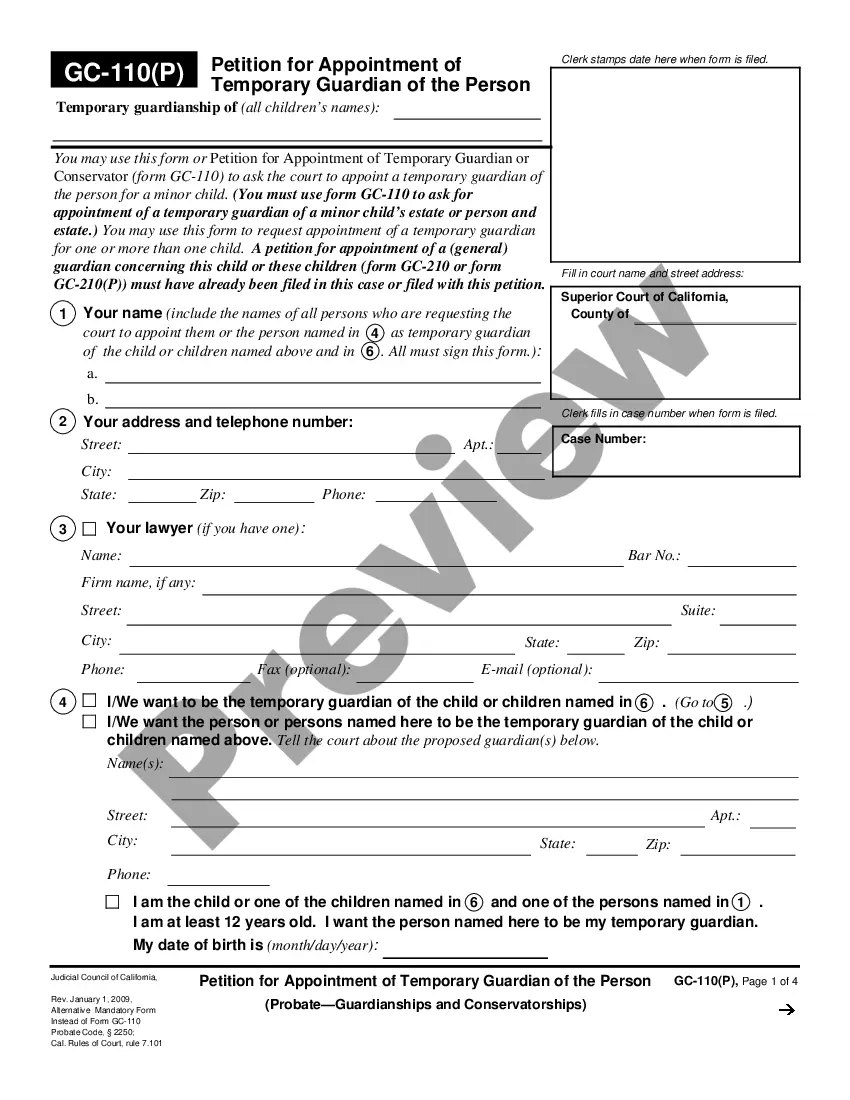

- Find the template using the search function.

- Verify that the Notice Of Intent To Foreclose Form you’ve found is suitable for your state or locality.

- Examine the preview or review the description that includes details on the use of the sample.

- If the outcome aligns with your query, click the Buy Now button.

- Choose the appropriate option among the available subscription plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Download the document in your preferred file format.

Form popularity

FAQ

A notice of intent to lien in Pennsylvania is a formal declaration that a creditor plans to impose a lien against a property due to unpaid debts. This notice serves as a warning to the property owner, providing an opportunity to settle debts before the lien is officially placed. Homeowners should understand the implications of such notices and, if needed, utilize resources like a Notice of Intent to Foreclose form to seek assistance.

The 120-day rule for foreclosure is a regulation that requires lenders to wait 120 days after a missed mortgage payment before initiating foreclosure proceedings. This period is critical for homeowners, as it allows time to explore options, such as negotiating with the lender or seeking assistance. Completing a Notice of Intent to Foreclose form during this time can help clarify the homeowner's intentions.

A notice of intent to foreclose signifies that a lender intends to take possession of a property due to the homeowner's failure to meet mortgage obligations. Receiving this notice can be stressful but serves as a critical alert for homeowners to take action. Responding effectively, including completing a Notice of Intent to Foreclose form, can help homeowners understand their next steps.

A letter of intent to foreclose is a written communication from the lender, indicating their plan to pursue foreclosure due to delinquent payments. This letter serves as a warning to the homeowner about the potential loss of property. It is essential to respond appropriately to this letter and consider consulting legal advice or completing a Notice of Intent to Foreclose form for guidance.

A notice of intent to foreclose in Pennsylvania is a formal document sent to the homeowner by the lender. This document outlines the lender's intention to initiate foreclosure proceedings due to missed payments. It is recommended to address this notice promptly and consider seeking assistance, such as utilizing a Notice of Intent to Foreclose form, to explore your options.

In Pennsylvania, a tenant can remain in a foreclosed property for a varying duration, depending on the foreclosure process. Generally, tenants must receive proper notice before they must vacate the premises. A Notice of Intent to Foreclose form plays a crucial role, as it officially notifies tenants about the foreclosure, ensuring they understand their rights and timelines.

In Pennsylvania, the foreclosure process can take anywhere from six months to over a year. The exact timeline depends on various factors, including court schedules and whether the homeowner contests the foreclosure. It's crucial to stay informed about each step, and having a Notice of Intent to Foreclose form ready can help manage timelines effectively.

Voluntarily foreclosing involves choosing to end your mortgage obligations before the lender takes action. To do this, you can contact your lender and express your intention. They may guide you through the process, which often involves completing a Notice of Intent to Foreclose form. This form signals your decision to relinquish the property and can streamline the foreclosure process.

To get a foreclosure dismissed, you need to present a strong case to the court. This often involves demonstrating that you can meet your mortgage obligations through a payment plan or other agreement. Additionally, completing a Notice of Intent to Foreclose form can show your commitment to resolving the matter. Seeking advice from a legal professional can further enhance your chances of success.

To respond to a foreclosure notice, start by gathering all relevant documents, including the notice itself. You may use the Notice of Intent to Foreclose form to outline your situation and intentions clearly. It's beneficial to consult with a legal expert who specializes in foreclosure cases. This can provide you with guidance tailored to your circumstances.