Notice Foreclosure Mortgage

Description

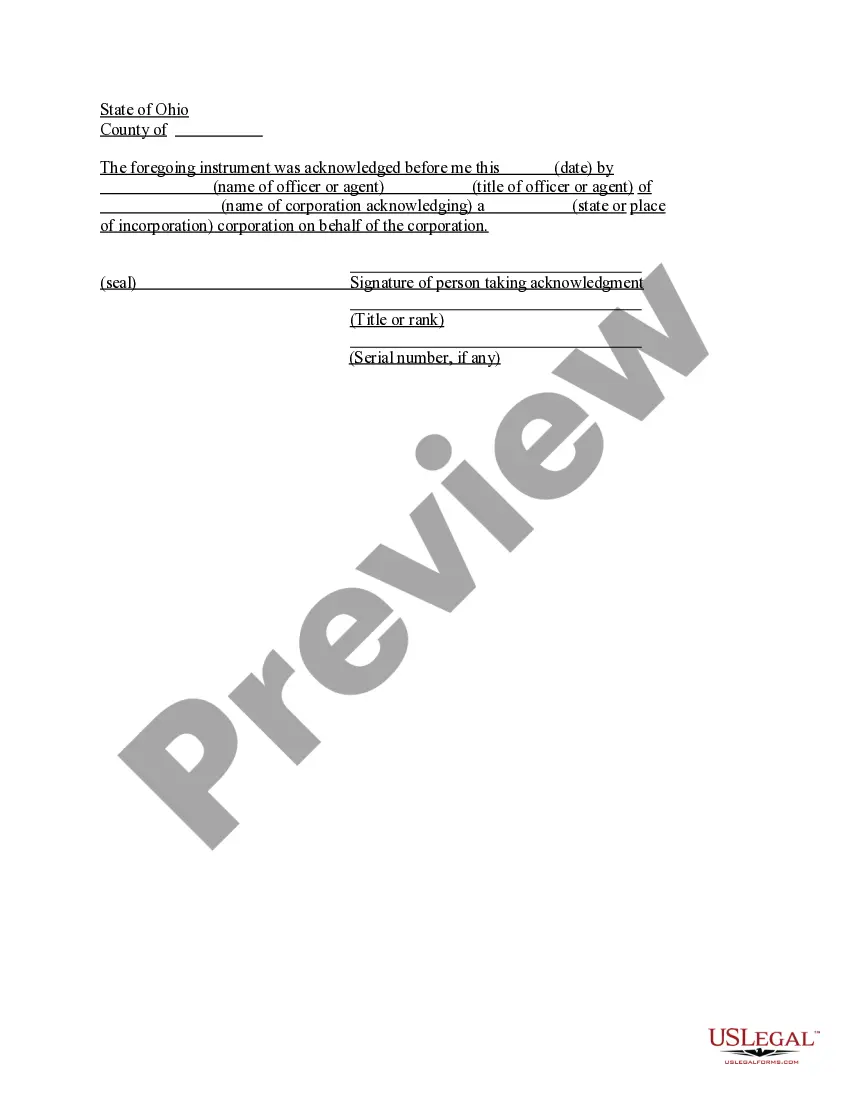

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Managing legal documents and processes can be a lengthy addition to your daily routine.

Observe that Foreclosure Mortgage and similar forms frequently necessitate searching for them and comprehending how to fill them out correctly.

Consequently, if you are dealing with financial, legal, or personal issues, having a thorough and handy online repository of forms readily available will be highly beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific documents and a range of resources to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Sign up and set up your account in just a few minutes, and you will gain access to the form library and Notice Foreclosure Mortgage. Then, follow the steps listed below to complete your form: Ensure you find the correct form using the Review feature and examining the form details. Click on Buy Now when ready and select the monthly subscription plan that meets your requirements. Hit Download and then fill out, sign, and print the form. US Legal Forms has 25 years of experience helping clients handle their legal documents. Locate the form you need today and streamline any process without breaking a sweat.

- Explore the collection of pertinent documents available to you with a single click.

- US Legal Forms provides you with state- and county-specific forms that can be downloaded at any time.

- Protect your document management processes with a top-notch service that allows you to create any form within minutes without additional or hidden fees.

- Simply Log In to your account, search for Notice Foreclosure Mortgage, and obtain it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

To apply for a foreclosure letter, contact your lending institution and inquire about their specific process. Each lender may have different requirements, so it's essential to gather your mortgage documents ahead of time. This letter will serve as a crucial notice foreclosure mortgage, indicating where you stand in the foreclosure proceedings. Utilizing resources from Uslegalforms can streamline this application process.

In Oklahoma, the foreclosure process can take several months to complete, generally ranging from three to twelve months. It often depends on numerous factors, including the lender's actions and any legal challenges that may arise. Understanding the timeline helps borrowers prepare effectively for a potential notice foreclosure mortgage. Staying informed throughout the process can aid you in making timely decisions.

You can find foreclosure notices through various sources, including your local courthouse and online databases. Many states provide public access to these documents, making it easier to stay informed. Additionally, the Uslegalforms platform can guide you through accessing these notices effectively. Make sure to check regularly for the most current information on notice foreclosure mortgage.

A foreclosure letter is a communication from your lender that indicates their intention to initiate foreclosure on your home due to missed mortgage payments. This letter generally outlines the outstanding amounts and the actions you can take to avoid foreclosure. Understanding what this letter means is crucial for making informed decisions moving forward. Turn to US Legal Forms to find guidance and support regarding your notice foreclosure mortgage.

In Oklahoma, the foreclosure process can take roughly three to six months, depending on various factors. After receiving a notice of foreclosure, you should prepare for the next steps, which may include court involvement or auction proceedings. Being informed helps you take proactive measures during this sensitive time. Use US Legal Forms to find the appropriate forms and information you need for a smooth process.

If you foreclose on your house in Texas, the lender will take possession of your property after the foreclosure process concludes. This means you will lose ownership and may face challenges in finding housing. Importantly, realizing the implications of a notice foreclosure mortgage is vital before taking any further steps. Utilize US Legal Forms to access valuable resources and ensure proper navigation of the process.

In Arizona, the foreclosure process typically takes around 90 to 120 days from the time a notice of foreclosure is issued. However, this timeline may vary based on the specifics of each case and whether legal proceedings are involved. It's crucial to act quickly if you receive a notice foreclosure mortgage to explore your options. US Legal Forms can assist you in understanding your rights and navigating this process effectively.

A notice of foreclosure is a legal document that informs you that your lender intends to reclaim your property due to non-payment of the mortgage. This notice serves as a warning and usually provides you with a specific timeframe to remedy the situation. Understanding this document is essential, as it outlines your rights and options. If you are facing this issue, consider using US Legal Forms to access the necessary paperwork and resources related to your notice foreclosure mortgage.

The 37-day foreclosure rule refers to a specific timeframe in which homeowners must respond to certain foreclosure notices. This rule ensures that homeowners have adequate time to address their mortgage defaults before actions are taken against them. Understanding this rule is vital to protecting your home and can help you explore alternatives to foreclosure. For detailed assistance with foreclosure processes, consider using uslegalforms for up-to-date information and templates.

A formal foreclosure letter is an official notification that the lender is starting the foreclosure process on a property due to non-payment of the mortgage. This letter serves as a legal document that informs the homeowner of their default status and the potential consequences, including loss of the home. Knowing how to respond to a formal foreclosure letter is essential, and uslegalforms can guide you through your options and rights.