Notice For Loan Payment

Description

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a more direct and cost-effective approach to generating the Notice For Loan Payment or other forms without unnecessary complications, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

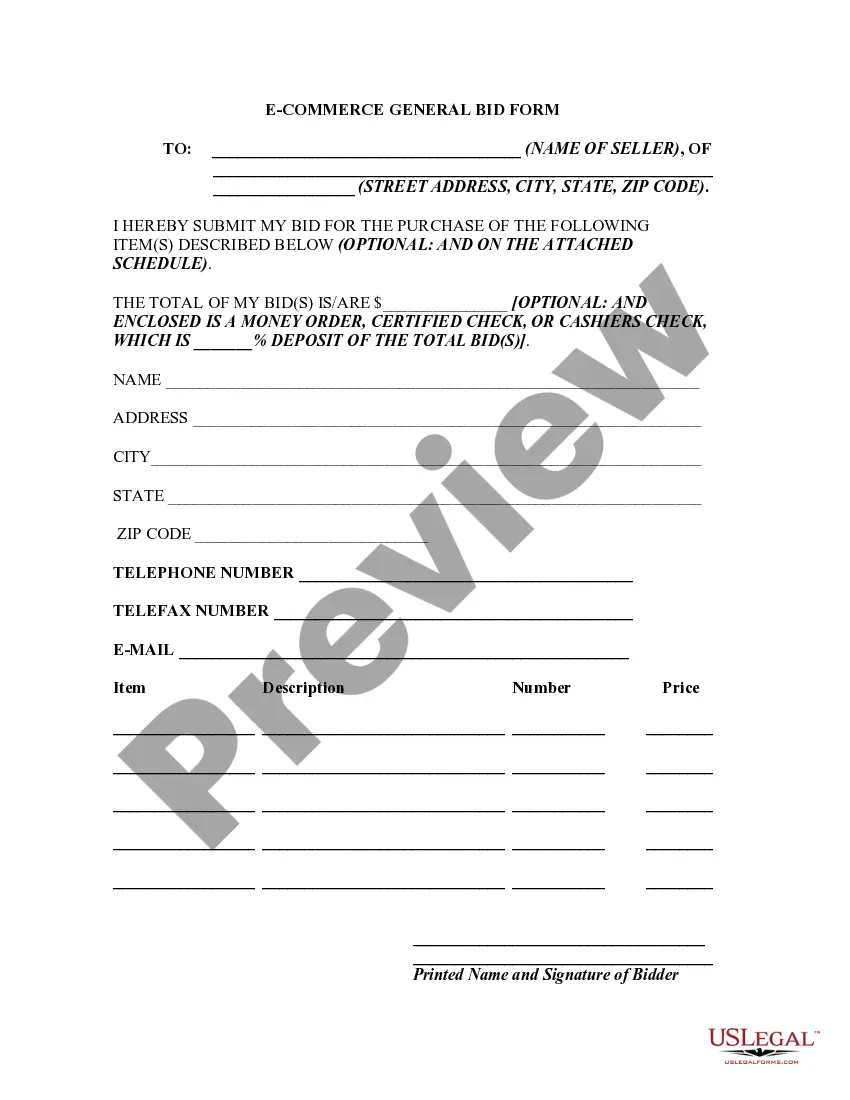

Before proceeding to download the Notice For Loan Payment, consider these tips: Ensure you review the form preview and descriptions to confirm you've located the document you need. Verify that the selected template complies with your state's and county's regulations and laws. Choose the most appropriate subscription plan to obtain the Notice For Loan Payment. Download the document, complete, validate, and print it. US Legal Forms prides itself on a strong reputation and over 25 years of experience. Join us today and transform document completion into a straightforward and efficient process!

- With just a few clicks, you can easily obtain state- and county-compliant templates carefully prepared by our legal experts.

- Utilize our website whenever you seek a dependable service that allows you to effortlessly find and download the Notice For Loan Payment.

- If you're familiar with our site and have previously registered, simply Log In, find the template, and download it or access it later in the My documents section.

- Not yet registered? No problem. It only takes a few minutes to get set up and browse the library.

Form popularity

FAQ

To send a polite payment reminder, start with a courteous greeting and briefly recap the details of the loan. Clearly mention the amount that remains unpaid, along with the original due date. Reinforce the significance of making the payment as described in the notice for loan payment, while expressing appreciation for their attention to the matter. This thoughtful approach can foster better communication and prompt timely responses.

When writing a letter asking for payment, begin with a friendly greeting and a clear statement about the outstanding amount. Provide any relevant details, such as the loan agreement or invoice number, to facilitate recognition of the debt. Include a polite reminder of the payment terms, emphasizing the due date. This method helps convey the necessity of the notice for loan payment while maintaining a respectful tone.

To write a letter requesting payment, start by clearly stating the purpose of your letter at the beginning. Be specific about the amount owed and include the due date. It's helpful to mention any previous communications regarding the loan payment to reinforce your request. This approach ensures that the recipient understands the importance of the notice for loan payment and encourages timely action.

To write a payment notice, start by including your contact information and the date at the top. Clearly state that this document serves as a notice for loan payment, and include the borrower's name, loan details, and amount due. Specify the payment due date and any late fees that may apply if payment is not received on time. Finally, make sure to keep a copy for your records, as this can be useful for both parties in future communications.

A repayment notice is a formal request from lenders, indicating that a borrower needs to resume payment on a loan. This notice may follow a default notice if you have missed several payments. It outlines the new terms or payment schedule that can help you get back on track. Utilizing resources from uslegalforms can assist you in understanding this notice and finding ways to manage it.

A default notice is serious as it indicates that the lender has not received payment as agreed. This notice serves as an official communication that prompts you to act quickly. Ignoring a default notice can exacerbate your financial situation, leading to foreclosure or significant credit damage. Engaging with a reputable platform like uslegalforms can help you better understand your options.

A default notice is a serious reminder of missed payments and can lead to further legal actions. While it signals potential difficulties, it is not the end of the road. Early intervention allows you to explore options, like negotiating with your lender or seeking help from uslegalforms. Taking action after receiving a default notice can lead to solutions that may prevent more severe implications.

The two major consequences of default include damage to your credit score and potential foreclosure of your property. A default can drop your credit score, making it hard to secure future loans or credit. Foreclosure is a legal process where the lender takes possession of the property, leaving you without a home. It's crucial to handle a default notice carefully to mitigate these risks.

After a default notice, you may enter a period of negotiations with your lender. This often includes discussions about repayment plans or loan modification options. If these discussions do not lead to a resolution, the lender may consider taking further legal actions, including foreclosure. It's essential to respond to a default notice promptly to avoid more severe consequences.

When crafting a loan notice, emphasize the amount due and the payment deadline. Keep your language clear and professional, stating any previous communications regarding the loan. Adding the specifics about the payment method will help facilitate smooth transactions, making it a vital reminder regarding the notice for loan payment.