Foreclosure Notice Sample For Owner

Description

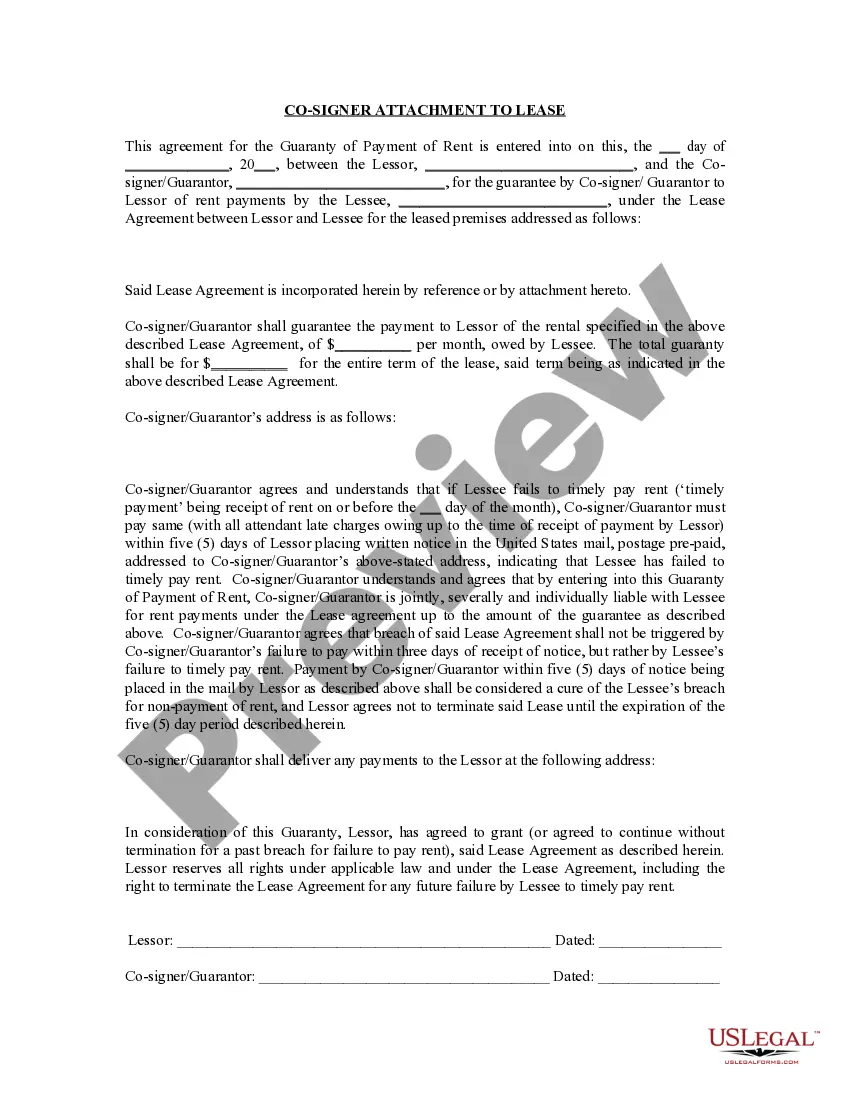

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Finding a go-to place to access the most current and relevant legal templates is half the struggle of working with bureaucracy. Discovering the right legal files demands accuracy and attention to detail, which explains why it is vital to take samples of Foreclosure Notice Sample For Owner only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the details regarding the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to complete your Foreclosure Notice Sample For Owner:

- Use the catalog navigation or search field to find your template.

- View the form’s description to ascertain if it fits the requirements of your state and area.

- View the form preview, if available, to ensure the template is definitely the one you are searching for.

- Resume the search and find the appropriate document if the Foreclosure Notice Sample For Owner does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (bank card or PayPal).

- Select the file format for downloading Foreclosure Notice Sample For Owner.

- When you have the form on your gadget, you can change it using the editor or print it and complete it manually.

Remove the headache that comes with your legal paperwork. Check out the comprehensive US Legal Forms catalog where you can find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Personal Loan Closure Letter Format Dear Sir/Ma'am, I am Sudharshana Karthik, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 1526xx4656. I have paid all my EMIs, and the loan tenure is complete.

Foreclosure is a process that begins when a borrower fails to make their mortgage payments. When a home is foreclosed upon, the lender typically repossesses and attempts to sell the house. This happens because mortgage loans are secured by real estate, meaning your home is used as collateral.

The significant impacts for homeowners include the loss of Down Payment, Mortgage Loan Payments, and of the Equity in the home. Through foreclosure, homeowners lose the down payment made at the time of purchase and the mortgage loan payments they made during the ownership of their home.

Guidelines For Writing a Foreclosure Letter Address the letter to the head of the financial institution. ... Subject must be on point. In the body, always mention your name and loan account number. If you don't know the foreclosing procedure, then ask them to guide you.

Foreclosure is when a lender uses a legal process to force the sale of a property (like a home) to cover a debt. This can happen when someone takes out a mortgage to buy a home and then stops making payments (defaults on the mortgage).