Qit Account Update For 10

Description

How to fill out Qualified Income Miller Trust?

- Log in to your existing account by clicking here. Ensure your subscription is up-to-date. If not, renew it based on your payment plan.

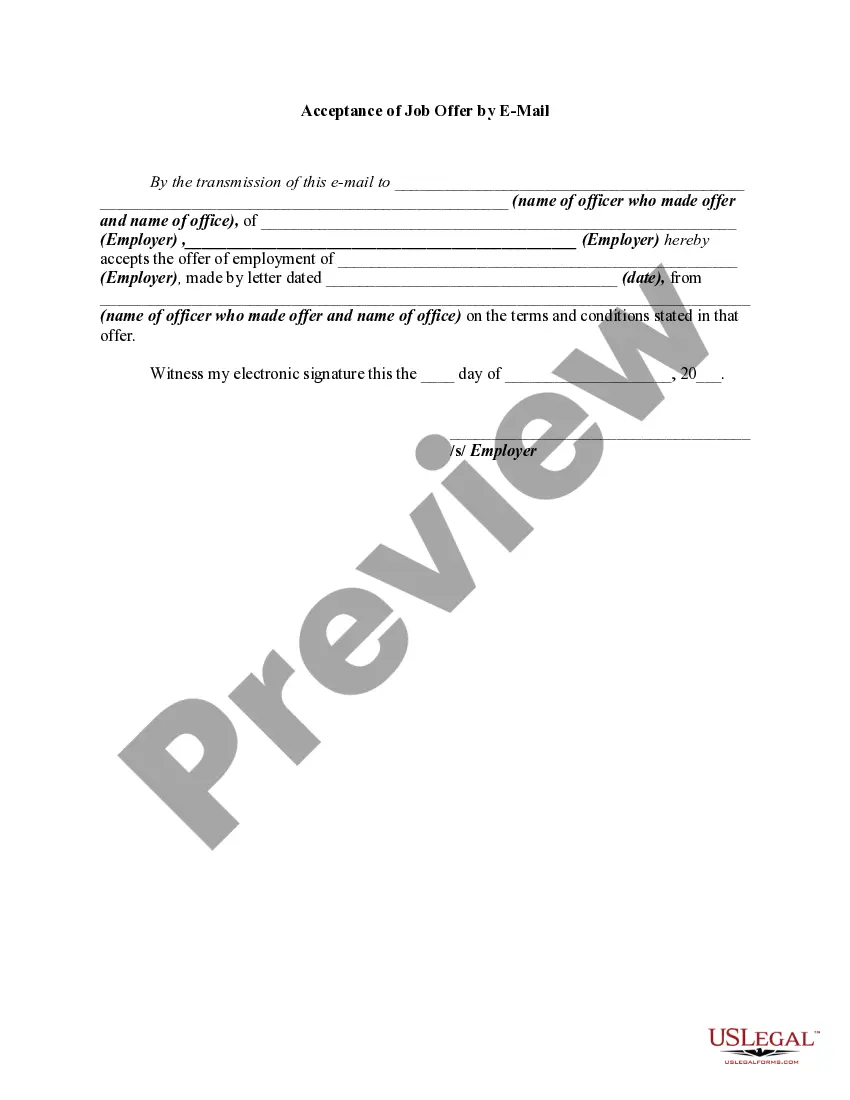

- For first-time users, start by browsing our extensive legal form library. Use the Preview mode to verify that you select the appropriate document that matches your local jurisdiction requirements.

- If you need additional forms, utilize the Search feature to navigate through our vast collection until you find the right one.

- Once you've identified your document, click the Buy Now button to select your desired subscription plan. You will need to create an account to proceed.

- Enter your payment details using either a credit card or PayPal to finalize the purchase.

- After your payment is confirmed, download the template directly to your device. You can access it at any time through the My Forms section.

By choosing US Legal Forms, you benefit from a robust collection of legal documents, which surpasses competitors' offerings. Our library is specifically designed to provide both individuals and attorneys with a streamlined experience in executing legal paperwork.

Ready to facilitate your legal needs? Start updating your Qit account today and unlock seamless access to our vast resources!

Form popularity

FAQ

Q trustee to trustee transfer is generally not taxable if the funds are moved from one qualified account to another. However, it is crucial to ensure that the transfer complies with IRS rules to avoid taxes. When updating your Qit account for 10, keep documentation of the transfer for your records. For further assistance and accurate guidance, consider using the US Legal Forms platform to navigate the complexities of your account updates.

A QIT account for Medicaid serves as a specialized trust designed to help individuals qualify for Medicaid benefits while maintaining their income. This account allows individuals to set aside excess income, protecting their financial resources. By using your Qit account update for 10 effectively, you ensure better access to Medicaid services without jeopardizing eligibility.

After the death of the individual, a qualified income trust typically becomes inactive, and funds within the trust may be subject to estate claims. It's essential to have a clear plan for handling these funds to settle debts and distribute remaining assets appropriately. Keeping up with your Qit account update for 10 will ensure you know what steps to take in managing the trust after death.

Ohio 529 funds are designed to help families save for higher education expenses, such as tuition, fees, and room and board. In addition to traditional college expenses, these funds can cover vocational training, apprenticeship programs, and K-12 tuition. As you explore options for education funding, consider that a Qit account update for 10 does not relate to Ohio 529 accounts, but both can be valuable for different financial goals.

A QIT account can primarily be used to hold and manage income that exceeds the Medicaid eligibility limit. This feature is essential for individuals seeking assistance while maintaining their financial stability. By efficiently utilizing your Qit account update for 10, you can allocate funds for medical expenses, personal care, and other qualifying costs.

Qit funds in Ohio can be used for various essential expenses, such as medical bills, housing costs, and necessary living expenses. When managing your QIT account update for 10, it is crucial to ensure that the funds are spent appropriately to remain compliant with Medicaid regulations. Using QIT funds wisely can help you receive the care you need while protecting your financial assets.

Upon the death of an individual, the qualified income trust must be dissolved according to specific legal procedures. Typically, any remaining funds in the QIT account will go through the estate process, which may involve paying off debts or taxes before distribution to heirs. The Qit account update for 10 ensures proper handling of these funds, maintaining compliance with state and federal laws. It is crucial to consult with a legal expert to navigate these matters effectively and ensure that your wishes are honored.

A QIT account operates as a specialized financial tool designed to manage specific types of income, particularly for individuals who require Medicaid assistance. When you place funds into a QIT account, these funds are set aside to ensure eligibility for government programs while still being available for use. The Qit account update for 10 ensures that your income remains at the required limit for Medicaid, allowing you to receive essential care and maintain your financial stability. Overall, it functions as a protective measure for your assets while providing necessary access to medical services.

QIT funds can only be used for certain allowable expenses, such as medical care, nursing home costs, or other health-related bills. These restrictions ensure that funds are spent on necessary services aligned with Medicaid requirements. Always keep precise records of how you utilize these funds for compliance. Utilizing a legal service can simplify your QIT account update for 10 and help you stay informed.

A Qualified Income Trust in New Jersey is a legal arrangement that enables individuals to qualify for Medicaid while preserving a portion of their income. This trust helps in managing excess income to meet state requirements, ensuring you receive essential health services without financial strain. Understanding the specifics of a QIT can significantly ease your eligibility process. For assistance, rely on platforms like uslegalforms for your QIT account update for 10.