Advantages Of A Trust With The Court

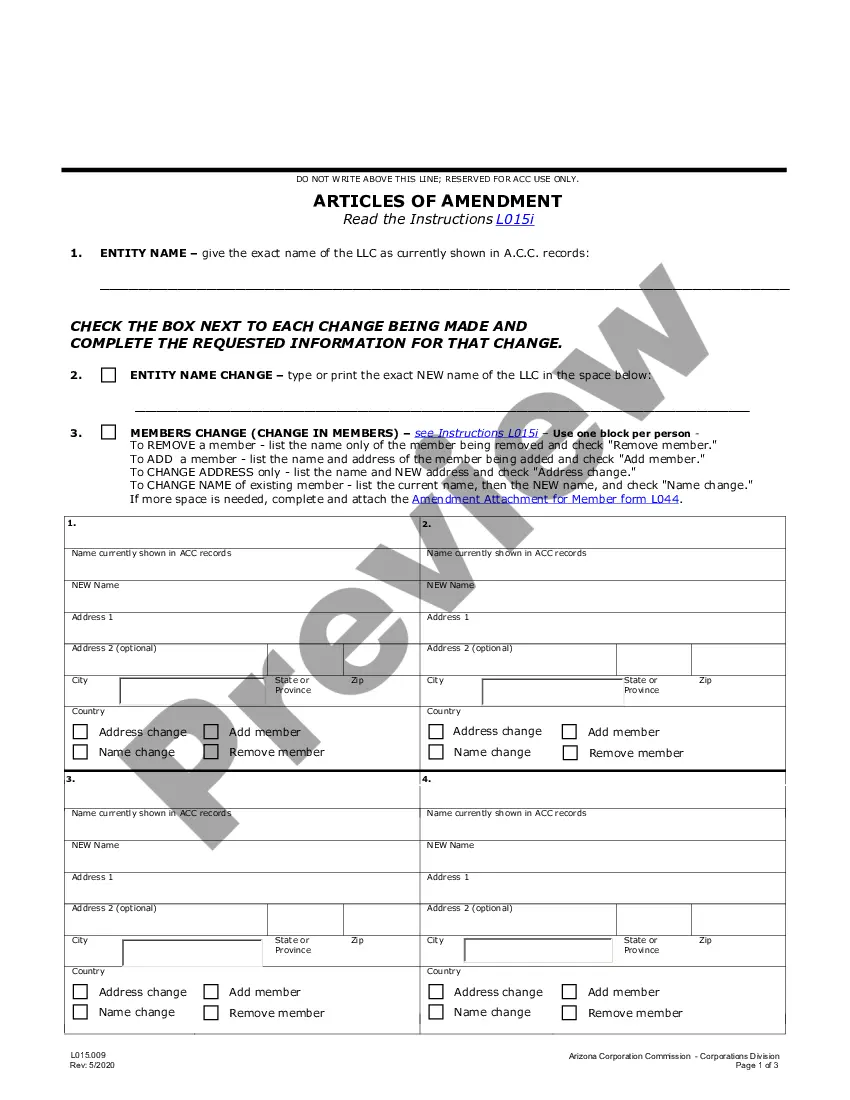

Description

How to fill out Qualified Income Miller Trust?

Locating a reliable source to obtain the most up-to-date and pertinent legal documents is part of the challenge of navigating bureaucracy.

Identifying the correct legal forms necessitates accuracy and careful attention, which is why it is essential to acquire samples of Advantages Of A Trust With The Court solely from credible providers, such as US Legal Forms. An incorrect document will squander your time and delay your current situation.

Once you have the form saved on your device, you can edit it with the editor or print it and fill it out by hand. Eliminate the stress associated with your legal paperwork. Explore the vast library of US Legal Forms to find legal samples, verify their applicability to your circumstances, and download them instantly.

- Use the directory navigation or search option to locate your document.

- Examine the document’s details to determine if it meets the criteria of your state and region.

- Check the document preview, if available, to confirm that the template is indeed what you are searching for.

- Continue searching and look for the correct document if the Advantages Of A Trust With The Court does not meet your specifications.

- If you are confident about the document’s suitability, download it.

- As a registered user, click Log in to verify and access your selected forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the document.

- Select the payment plan that fits your requirements.

- Proceed with registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Advantages Of A Trust With The Court.

Form popularity

FAQ

One significant mistake parents make when setting up a trust fund is not clearly defining their objectives. Understanding the advantages of a trust with the court can guide parents in specifying how the assets should be managed and distributed. Additionally, neglecting to select a reliable trustee can lead to complications later. It is crucial to choose someone trustworthy to handle the trust effectively.

A trust allows you to manage your assets flexibly and strategically, ensuring they are used according to your wishes. You can designate specific beneficiaries, set conditions for asset distribution, and avoid probate, which speeds up the transfer process. Ultimately, the advantages of a trust with the court mean you can plan your estate with confidence and clarity.

A trust is a legal contract that ensures your assets are managed ing to your wishes during and after your lifetime. Among the many benefits trusts offer are potential tax benefits and the ability to set parameters for how and when your assets will be used and distributed.

The property in the trust avoids probate and so avoids probate costs and delays. It can remove management responsibilities from your shoulders. It is less subject to dispute by disappointed heirs. All of the above are advantages of a living trust.

A living trust is a private document between the parties involved and does not become part of the public record. In other words, no one can later go and search public records to find out more about the distribution of your estate. A will, on the other hand, is public record, so everything in it becomes public as well.

The property in the trust avoids probate and so avoids probate costs and delays. It can remove management responsibilities from your shoulders. It is less subject to dispute by disappointed heirs. All of the above are advantages of a living trust.

Living Trusts Offer More Legal Protection if Challenged. Living Trusts are more likely to withstand legal challenges than Wills. A Will only goes into effect when a person dies. A Living Trust is different and goes into effect as soon as the trust document is signed.