Citizen With Residence

Description

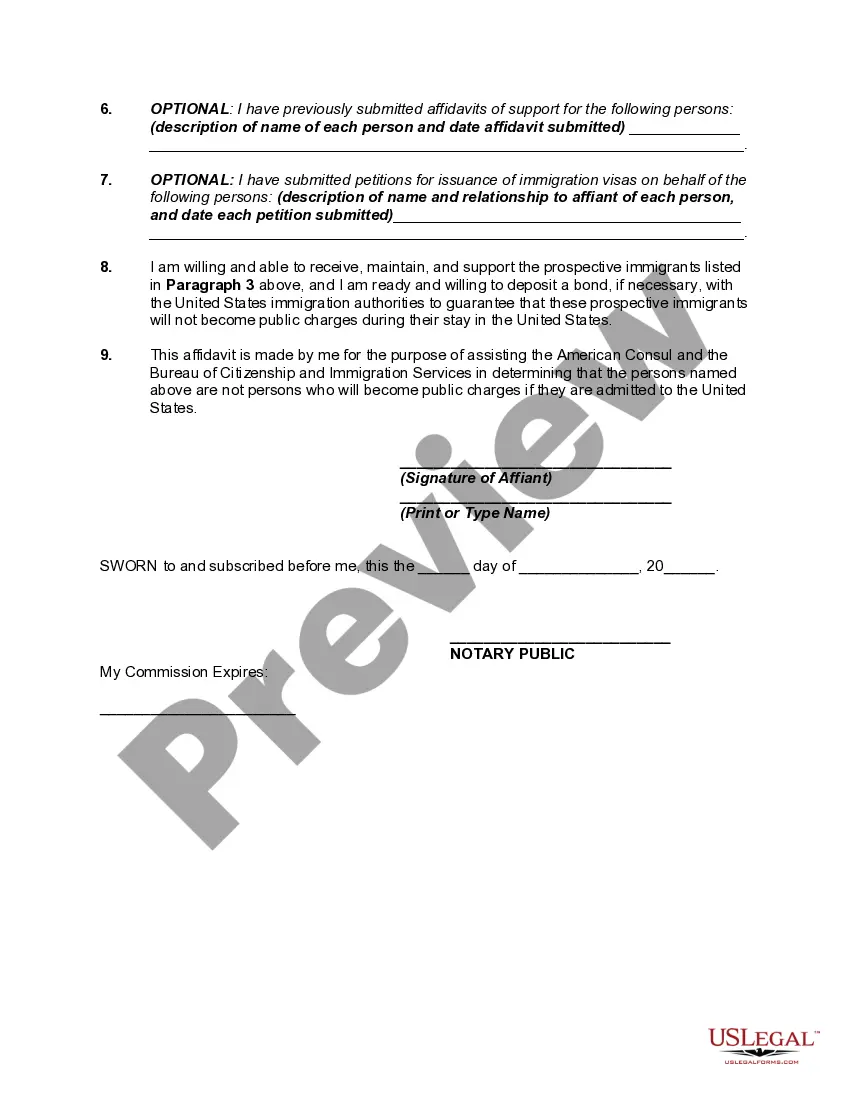

How to fill out Affidavit And Proof Of Citizenship Or Residence Of United States In Support Of Relatives Desiring To Emigrate?

The Resident Citizen you see on this page is a versatile legal template crafted by expert attorneys in compliance with national and local regulations.

For over 25 years, US Legal Forms has been supplying individuals, businesses, and lawyers with more than 85,000 verified, state-specific documents for any professional and personal situation.

Select the format you desire for your Resident Citizen (PDF, Word, RTF) and download the document onto your device. Complete and sign the document. Print the template to fill it out by hand, or use an online versatile PDF editor to efficiently and accurately fill out and sign your form with a legally-binding electronic signature. Download your forms again whenever necessary. Access the My documents tab in your account to redownload any forms previously purchased. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the necessary document and examine it.

- Browse the file you searched and preview it or review the form description to ensure it meets your needs. If it doesn't, use the search bar to find the correct one. Click Buy Now when you have identified the template you require.

- Sign up and Log In.

- Choose the pricing option that works for you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

How can you remove collections from a credit report? Step 1: Ask for proof. There needs to be evidence that the debt is genuinely yours to pay for it to stay on your credit report. ... Step 2: Look for and report inaccuracies. ... Step 3: Ask for a pay-for-delete agreement. ... Step 4: Write a goodwill letter to your creditor.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

The Fair Credit Extension Uniformity Act regulates the debt collection activities of debt collectors and creditors in Pennsylvania. This law, effective as of June 26, 2000, prohibits debt collectors and creditors from engaging in certain unfair or deceptive acts or practices while attempting to collect debts.

The following items are exempt from execution by most creditors under Pennsylvania and Federal law: Most public benefits, Social Security benefits, money in retirement accounts (such as 401ks and pensions), and unemployment benefits. (SocialSecurity benefits are still exempt once they are in the bank.)

The amended FDCPA allows debt collectors to use newer technologies, such as email and text messages, to communicate with consumers regarding their debts, subject to certain limitations, which protect consumers against harassment or abuse.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.