Nonprofit Organization

Description

How to fill out Subscription Agreement With Nonprofit Corporation?

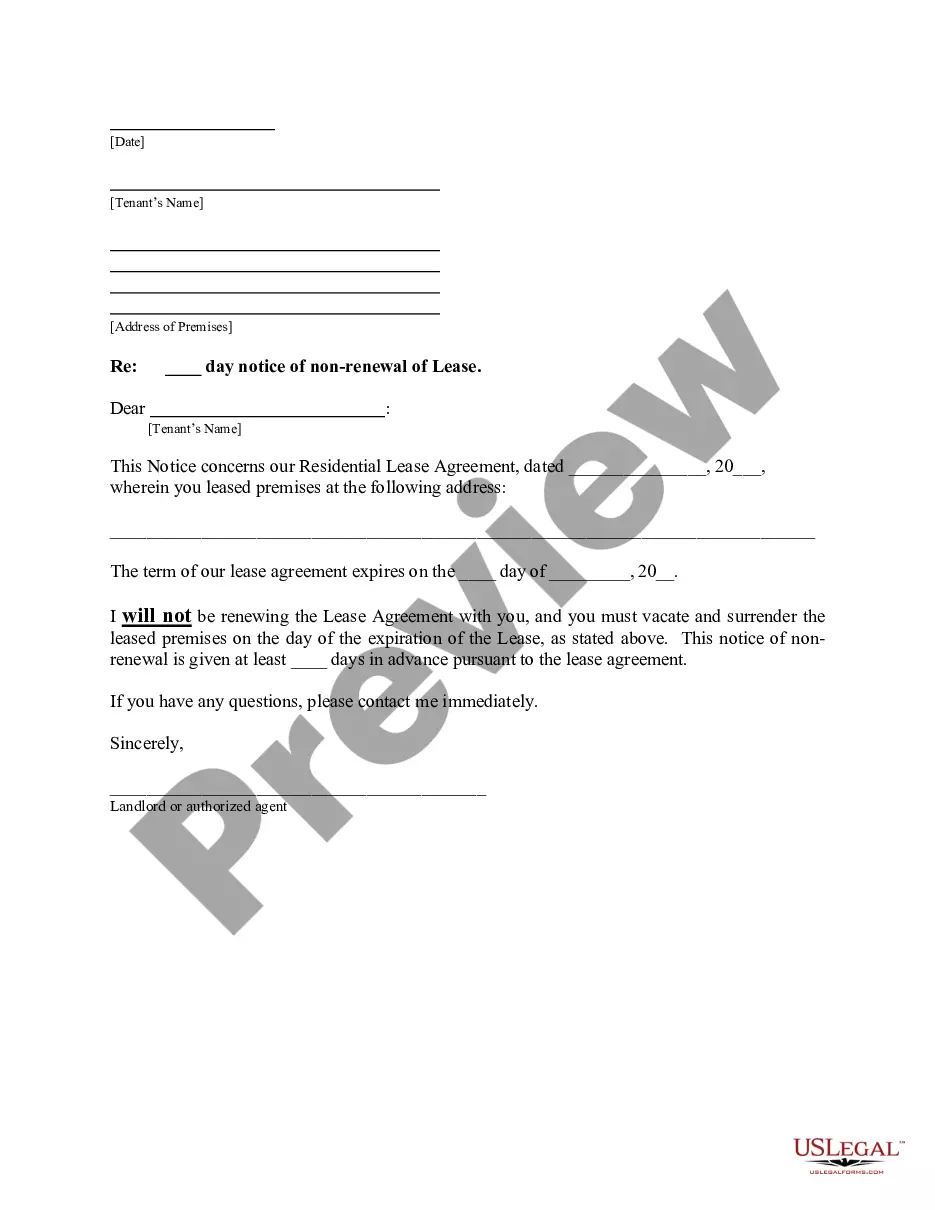

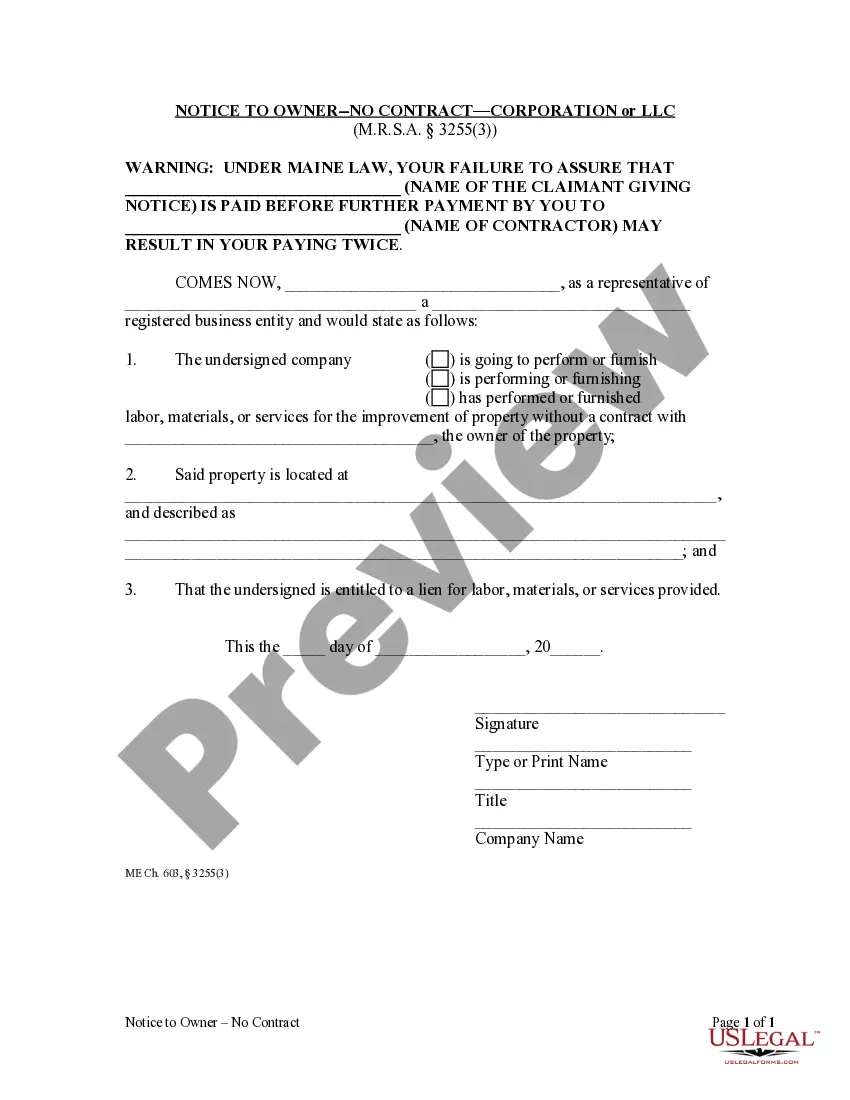

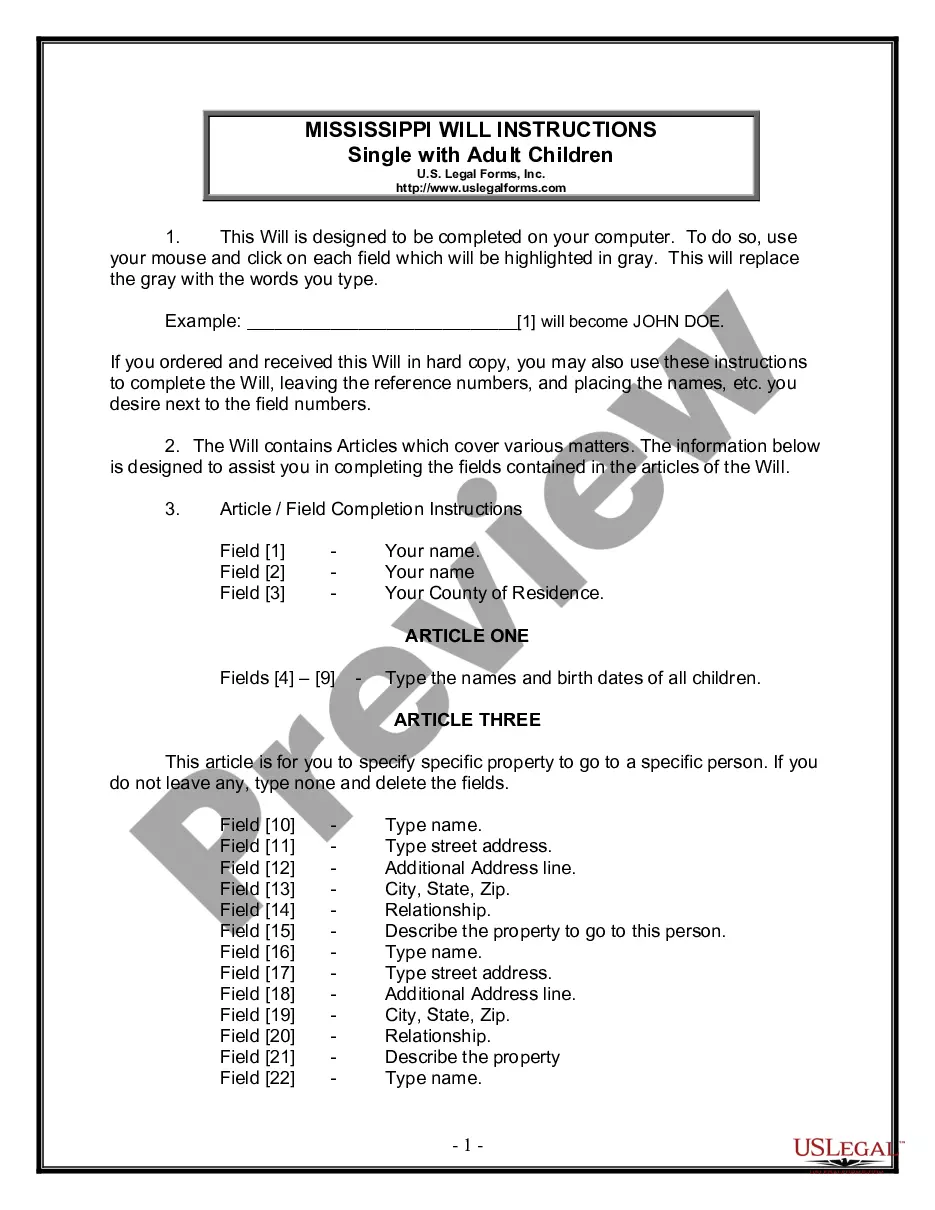

- If you're an existing user, log in to your account and select the required template from your dashboard. Ensure your subscription is active, renewing it if necessary.

- For first-time users, browse through the extensive library. Use the Preview mode to verify you have the correct form suitable for your nonprofit organization's specific requirements.

- In case you need a different template, utilize the Search tab to find forms pertinent to your needs and jurisdiction. Confirm the document aligns with your nonprofit's objectives.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. An account registration will grant you access to the full library of resources.

- Complete your transaction by entering your payment details, either through a credit card or PayPal.

- Finally, download your legal document to your device for immediate use, and access all stored forms conveniently in the My Forms section.

By following these simple steps, your nonprofit organization can benefit from a comprehensive collection of legal forms. With access to precise and editable documents, you can streamline your legal processes.

Don't hesitate—start utilizing US Legal Forms today to ensure your nonprofit's legal compliance and operational success!

Form popularity

FAQ

To qualify as a not-for-profit organization, you must establish a clear mission that benefits the public, avoiding the distribution of profits to stakeholders. Your organization should operate on a voluntary basis, with its income and resources dedicated to fulfilling its objectives. Compliance with specific state and federal regulations is essential for recognizing your organization as a not-for-profit. US Legal Forms provides necessary documentation and support for this qualification.

Your business qualifies as a nonprofit when it is structured to operate without the goal of generating profits for owners or shareholders. Activities should be directed toward advancing social, educational, or charitable goals rather than financial gains. Additionally, any revenue generated must be reinvested into the organization’s mission. For help with documentation and formalities, check out US Legal Forms.

Starting a nonprofit organization by yourself begins with defining your mission and ensuring it serves a public purpose. Next, you need to draft your articles of incorporation and bylaws, and then apply for federal tax-exempt status with the IRS. Following this, secure any necessary state registrations and permits. The US Legal Forms platform offers templates and guides that make this process more straightforward.

You are recognized as a nonprofit organization when your primary aim is to serve the public rather than to make a profit. This means you operate solely to support specific causes, such as arts, education, or social services. Furthermore, your financial activities must align with the purpose of creating a public benefit. Utilizing US Legal Forms can help you navigate the steps needed to establish your nonprofit identity.

To qualify for nonprofit status, an organization must operate primarily for charitable, educational, or religious purposes. This status allows the organization to apply for tax-exempt status under the IRS Section 501(c)(3). Additionally, it must ensure that profits are reinvested back into its programs instead of being distributed to owners or shareholders. Consider consulting the US Legal Forms platform for guidance on the qualification process.

There are three primary types of nonprofit organizations: charitable nonprofits, social advocacy groups, and trade associations. Charitable nonprofits focus on providing community services or funding for social causes. Social advocacy groups work to promote specific social issues or policy changes. Trade associations represent the interests of particular industries and work to support professionals within that sector. Understanding these types can help you find the right nonprofit structure for your mission.

While nonprofits can indeed generate surplus revenue, it is important to understand that profit-making is not their primary objective. Instead, nonprofits focus on achieving their mission and supporting their community. Any profits realized should be allocated toward furthering the organization's goals. This allows nonprofits to sustain their efforts and create a lasting impact.

A nonprofit organization can make a profit, but it must be careful about how this profit is handled. Any surplus generated from activities should be reinvested into the organization's programs or mission. Unlike traditional businesses, nonprofits cannot distribute profits to owners or shareholders. Therefore, making a profit can enhance a nonprofit's ability to fulfill its charitable goals.

Yes, nonprofit organizations can generate earned income. This often comes from services, products, or events they offer to the public. Such income can help support their mission and cover operational costs. However, it is essential for nonprofits to balance earned income with their core mission to maintain their nonprofit status.

A nonprofit organization is a group that operates for a purpose other than making a profit. Typically, these organizations focus on social causes, community services, or charitable missions. Nonprofits reinvest any surplus funds back into their activities, rather than distributing profits to shareholders. This unique structure allows them to work towards their mission while enjoying certain tax benefits.