State Custodial Parent For Fafsa

Description

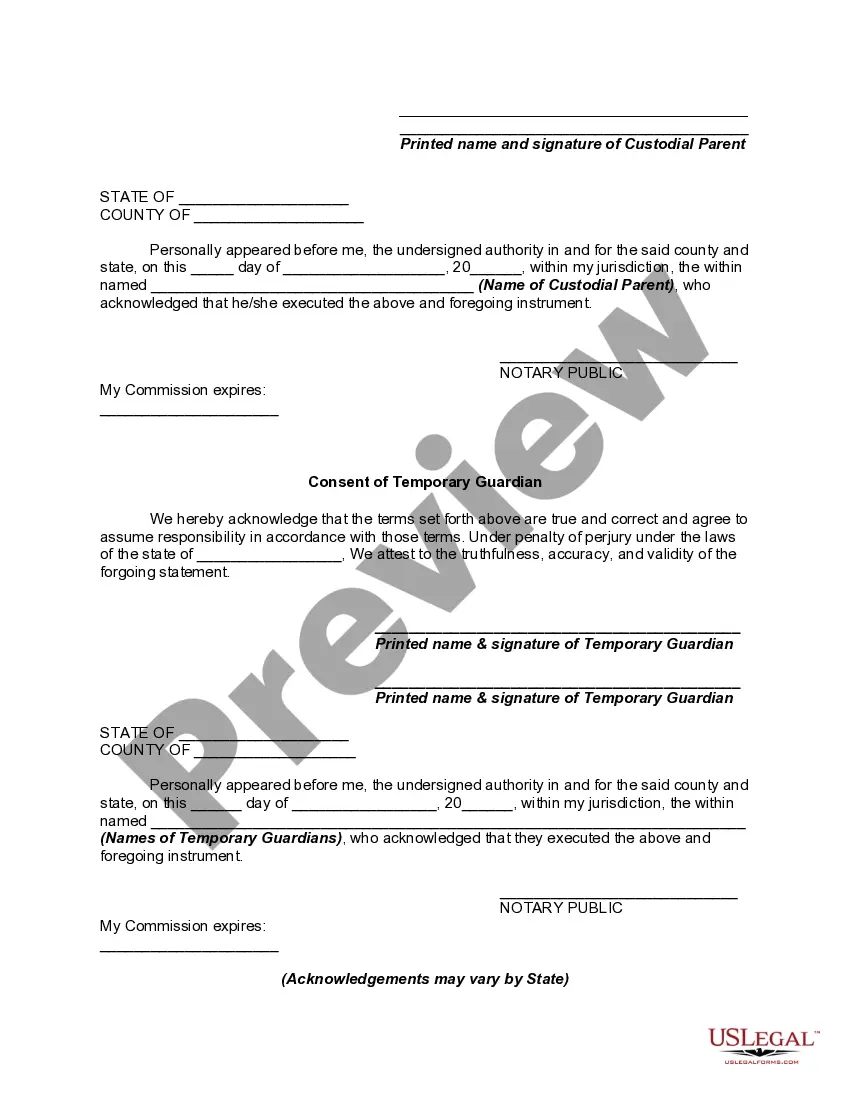

How to fill out Temporary Guardianship Agreement With Detailed Authorization Regarding The Acquiring Of Medical Care For Minor Children - Including Consent Of Temporary Guardians?

Legal administration can be perplexing, even for experienced professionals.

When you are searching for a State Custodial Parent For Fafsa and lack the time to devote to finding the correct and current version, the process can be daunting.

Access a repository of articles, guides, and resources pertinent to your situation and requirements.

Save time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Preview tool to locate the State Custodial Parent For Fafsa and obtain it.

Select Buy Now when you are prepared. Choose a subscription plan, select the format you want, and Download, complete, sign, print, and send your documents. Enjoy the US Legal Forms web library, backed by 25 years of experience and reliability. Enhance your daily document management in a simple and user-friendly manner today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the document, and obtain it.

- Visit the My documents tab to review the documents you have previously saved and to manage your folders as needed.

- If it's your first time with US Legal Forms, create a free account and gain unlimited access to all the benefits of the platform.

- Here are the steps to follow after accessing the document you desire.

- Verify it is the correct document by previewing it and reviewing its description.

- Ensure that the template is validated in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms accommodates any requirements you may have, from personal to corporate paperwork, all in a single place.

- Utilize sophisticated tools to complete and manage your State Custodial Parent For Fafsa.

Form popularity

FAQ

To resolve an unknown error on your FAFSA, first, double-check all entered information, especially about your status as a state custodial parent for FAFSA. Make sure there are no typos or missing fields. If the error continues, try clearing your browser's cache or using a different browser. For tailored support, you may explore helpful options on the US Legal Forms platform.

Life insurance proceeds, savings accounts, retirement benefits and other accounts should have named beneficiaries. If your accounts name your chosen beneficiary, when you die your money in that account is directly transferred to your named beneficiary without undergoing probate.

The primary methods for avoiding probate in Illinois include joint tenancy, living trusts, beneficiary designations, and Payable-on-Death (POD) or Transfer-on-Death (TOD) accounts.

While a pour-over will works closely with a trust, it doesn't inherently avoid probate. The assets that get poured into the trust upon your death still have to go through the probate process. To avoid probate altogether, you would need to place your assets directly into a trust prior to your passing.

How do you write a pour-over will? Set up a living trust. Before you can make a pour-over will, you first need to create a living trust. ... Name your trustee as the beneficiary in your pour-over will. ... Name a will executor. ... Consider your other estate-planning needs.

The main downside to pour-over wills is that (like all wills), the property that passes through them must go through probate. That means that any property headed toward a living trust may get hung up in probate before it can be distributed by the trust.

Illinois Small Estate Affidavit: If the size of your estate, is small enough, the State of Illinois will allow you to use something called a small estate affidavit to transfer property without involving the probate court.

Steps to Create a Will in Illinois Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses.

This will is suitable for a married or single individual with or without children. The will directs the testator's estate to a revocable trust, which is used with a pour-over will to help the settlor avoid probate, maintain privacy, and ease the transition in asset management on the settlor's incapacity or death.