Affidavit With Of Forgery

Description

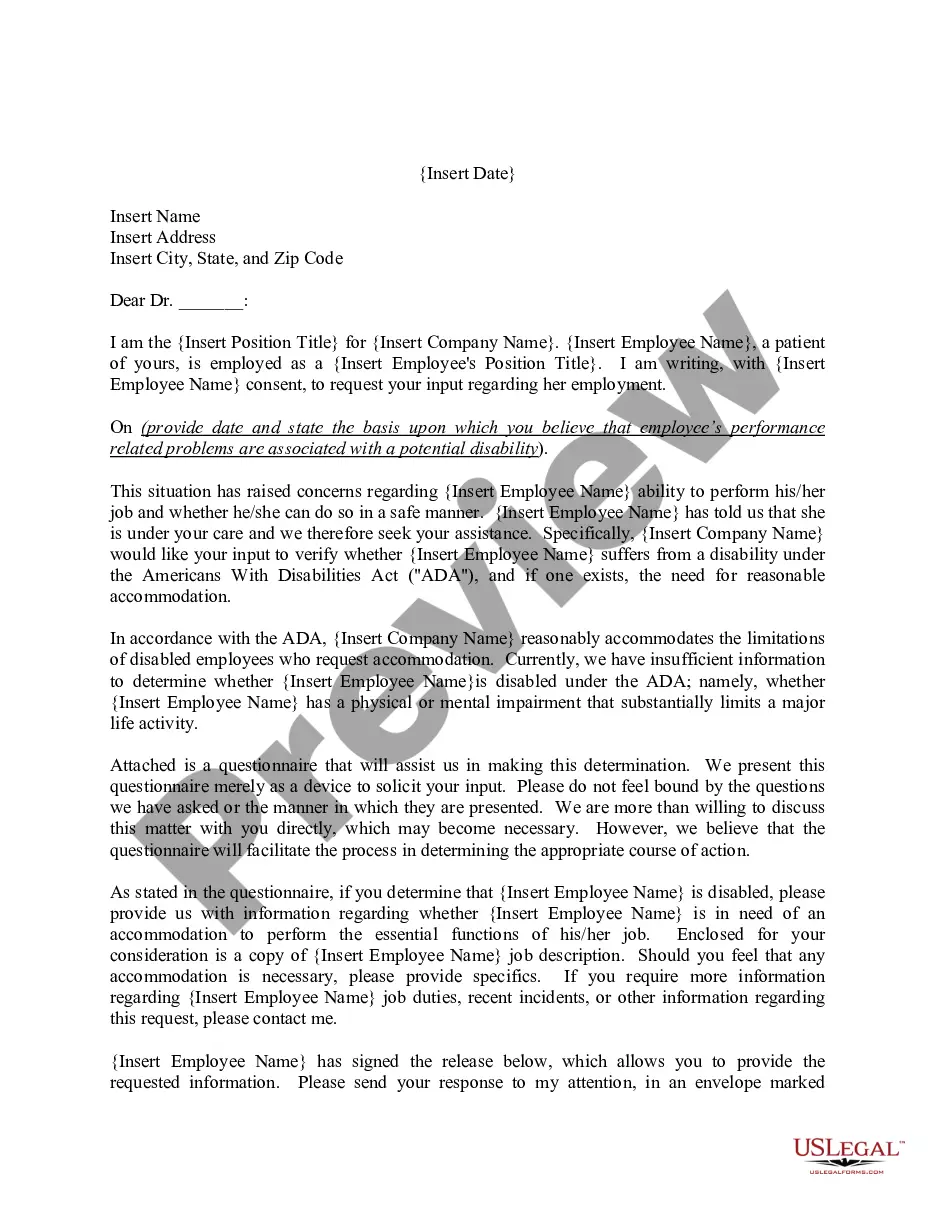

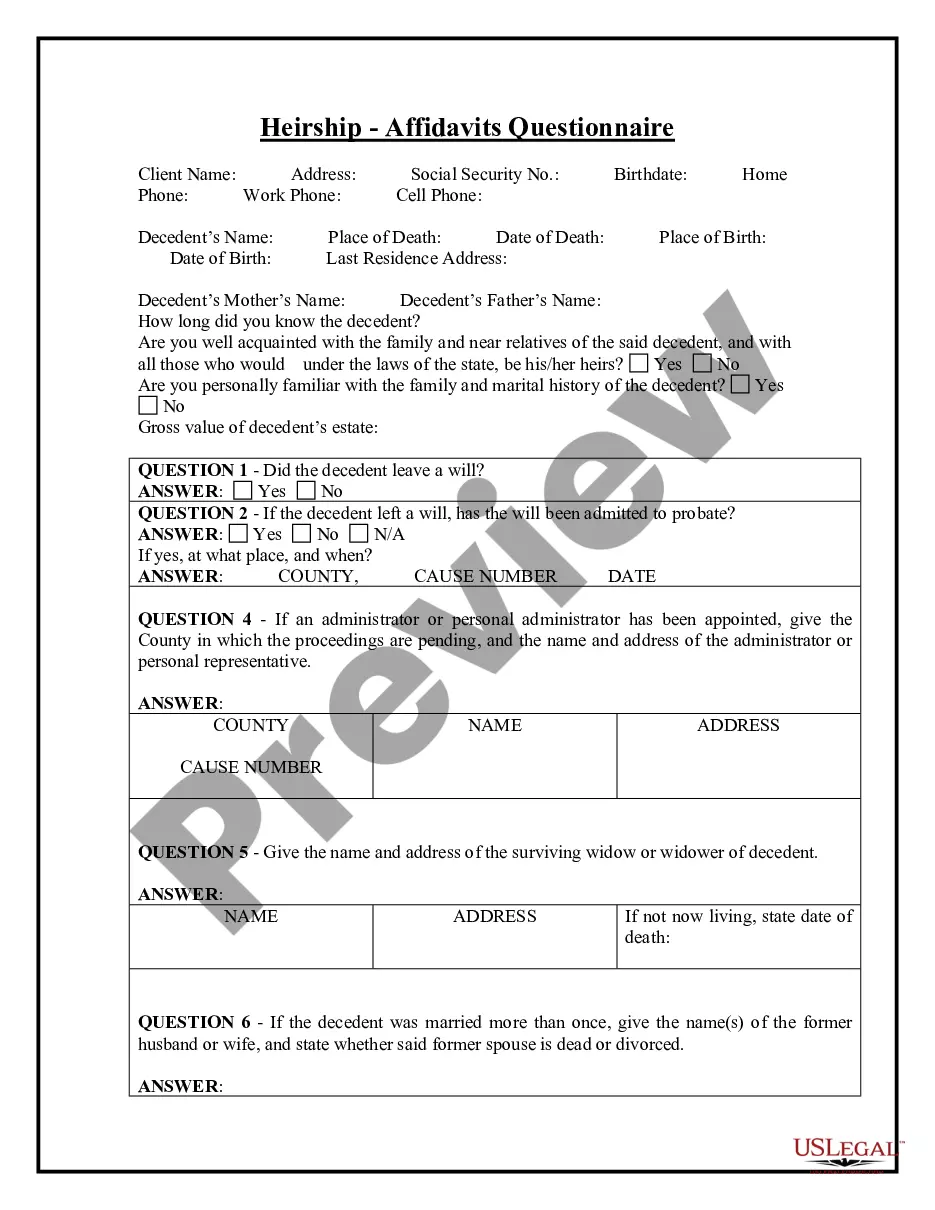

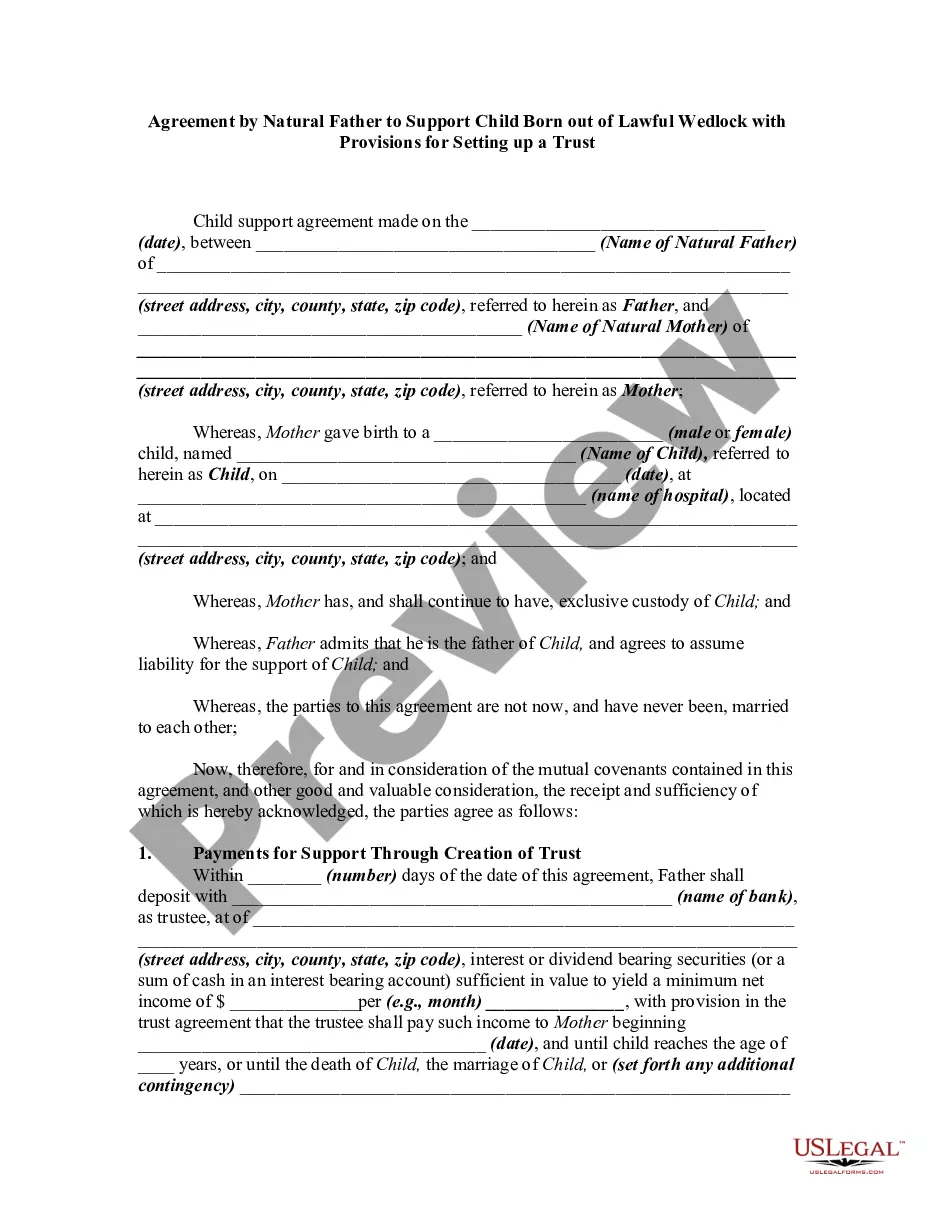

How to fill out Affidavit With Answers To Questions Regarding Observations Of The Health Of A Family Member - Hearing Loss?

Legal administration can be exasperating, even for the most skilled practitioners.

When you are searching for an Affidavit With Of Forgery and lack the time to dedicate to finding the right and current version, the process can be overwhelming.

US Legal Forms addresses all needs you may have, ranging from personal to business documentation, all in one place.

Utilize advanced tools to complete and handle your Affidavit With Of Forgery.

Here are the steps to follow once you have the form you need: Confirm that it is the appropriate form by previewing it and reviewing its details. Ensure that the template is recognized in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription plan. Pick the file format you prefer, and Download, fill out, sign, print, and dispatch your document. Take advantage of the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- Access a valuable resource pool of articles, guides, and handbooks that are pertinent to your situation and needs.

- Conserve time and effort in locating the documents you require, and take advantage of US Legal Forms’ advanced search and Review tool to find Affidavit With Of Forgery and obtain it.

- If you are a subscriber, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents tab to view the documents you have previously saved and to organize your folders as you wish.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to the full benefits of the library.

- A comprehensive online form catalog can be a game-changer for anyone looking to manage these issues effectively.

- US Legal Forms is a frontrunner in online legal documents, boasting over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

To prove forgery, gather all relevant documents and evidence that support your claim. This can include witness statements, original documents, and expert analyses of signatures or handwriting. Presenting this evidence in your affidavit with forgery can strengthen your case and help convince authorities or a court of the fraudulent activities.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

There are two main parts of a loan: The principal -- the money that you borrow. The interest -- this is like paying rent on the money you borrow.

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

There are two main parts of a loan: The principal -- the money that you borrow. The interest -- this is like paying rent on the money you borrow.

Loan Amount and Duration: A loan agreement clearly specifies the amount of loan (also called Principal Amount) given to the borrower. The document also defines the time period for which the loan is granted. Interest Clause: It states the rate of interest to be paid along with the principal by the borrower.