Letter Hardship Form Sample For Irs

Description

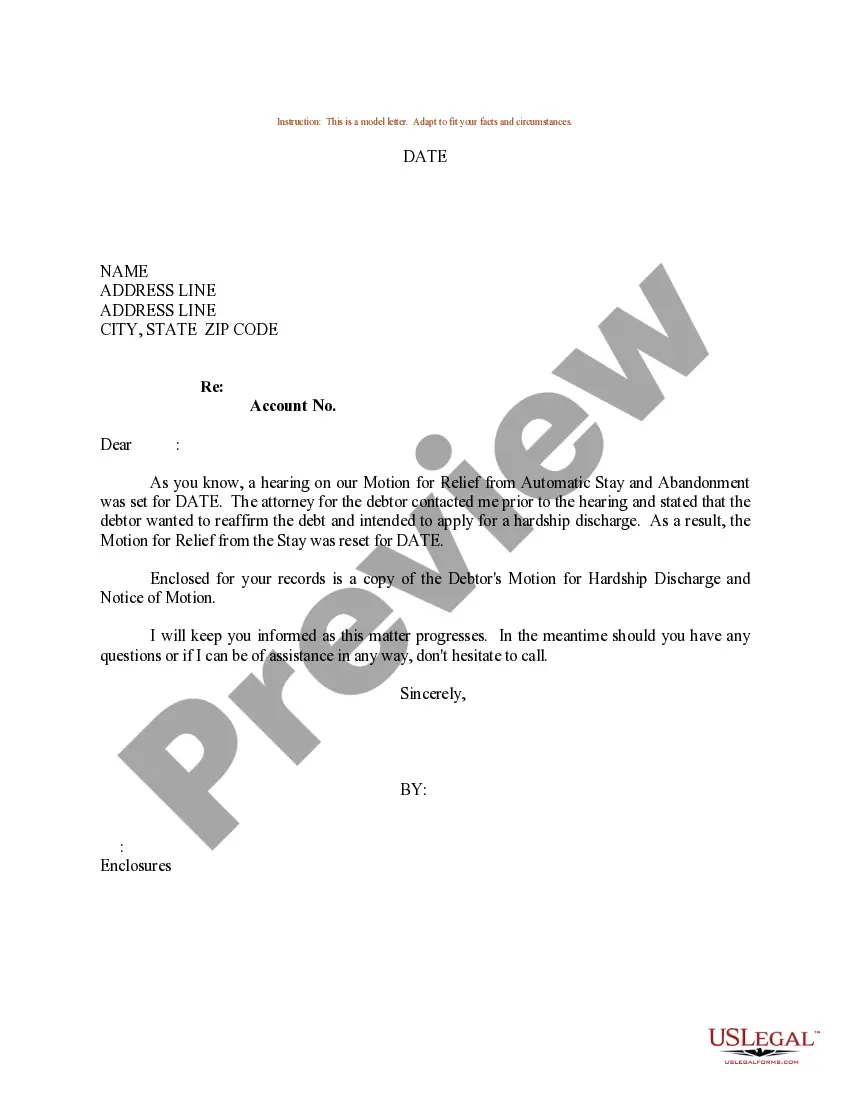

How to fill out Sample Letter For Debtor's Motion For Hardship Discharge And Notice Of Motion?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly prepare Letter Hardship Form Sample For Irs without the need of a specialized background. Creating legal forms is a time-consuming process requiring a specific training and skills. So why not leave the preparation of the Letter Hardship Form Sample For Irs to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and obtain the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Letter Hardship Form Sample For Irs is what you’re looking for.

- Start your search over if you need any other template.

- Register for a free account and select a subscription option to buy the form.

- Pick Buy now. As soon as the transaction is through, you can download the Letter Hardship Form Sample For Irs, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

To prove tax hardship to the IRS, you will need to submit your financial information to the federal government. This is done using Form 433A/433F (for individuals or self-employed) or Form 433B (for qualifying corporations or partnerships).

Instead, you should try to be polite and professional. You should also include your name, contact information, and the reason for writing. You can also include any relevant documents that support your request such as transcripts or income tax filings.

Your hardship letter should include the following essential steps: Write an introduction. ... Detail your hardship. ... Highlight how you're being proactive about your financial situation. ... State your request. ... Provide assurance of financial recovery. ... Submit supporting documentation.

IRS Hardship is for taxpayers not able to pay their back taxes. The technical term used by the IRS is Currently Non-Collectable Status. If you owe taxes but you are unable to pay because you have just enough money to support yourself and your family, you can apply for IRS Hardship.

DO include specific details about your circumstances. The IRS wants to know the reasons for your hardship. For example, maybe you were self-employed but suffered a failed business, which resulted in your failure to pay taxes.