A (least Hardship)

Description

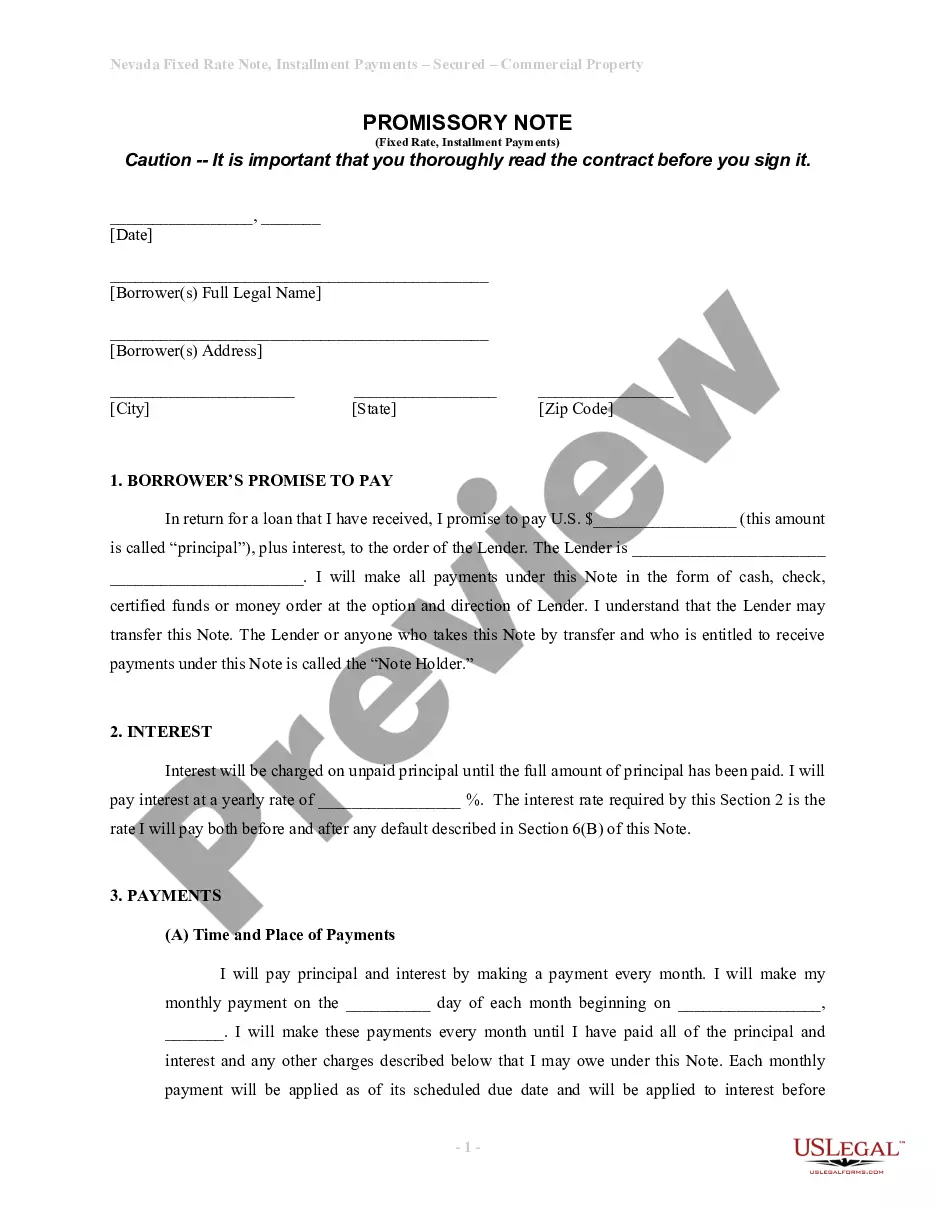

How to fill out Letter To Creditors Informing Them Of Fixed Income And Financial Hardship?

- If you're a returning user, log in to your account and select the form you need. Ensure your subscription is active; if not, renew according to your plan.

- For first-time users, begin by exploring the form collection. Use the Preview mode to find a template that suits your needs and aligns with your local legal requirements.

- If you need to search for a different document, utilize the Search tab to find the exact template that fits your situation.

- Click the Buy Now button to choose a subscription plan, and create an account to access our extensive library of resources.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download your chosen document to your device for easy access and completion. You can always retrieve it later from the My Forms section of your profile.

Using US Legal Forms not only simplifies the process of finding legal documents but also ensures that users have access to a robust selection that surpasses many competitors.

Take the first step towards hassle-free legal documentation today. Visit US Legal Forms and explore your options now!

Form popularity

FAQ

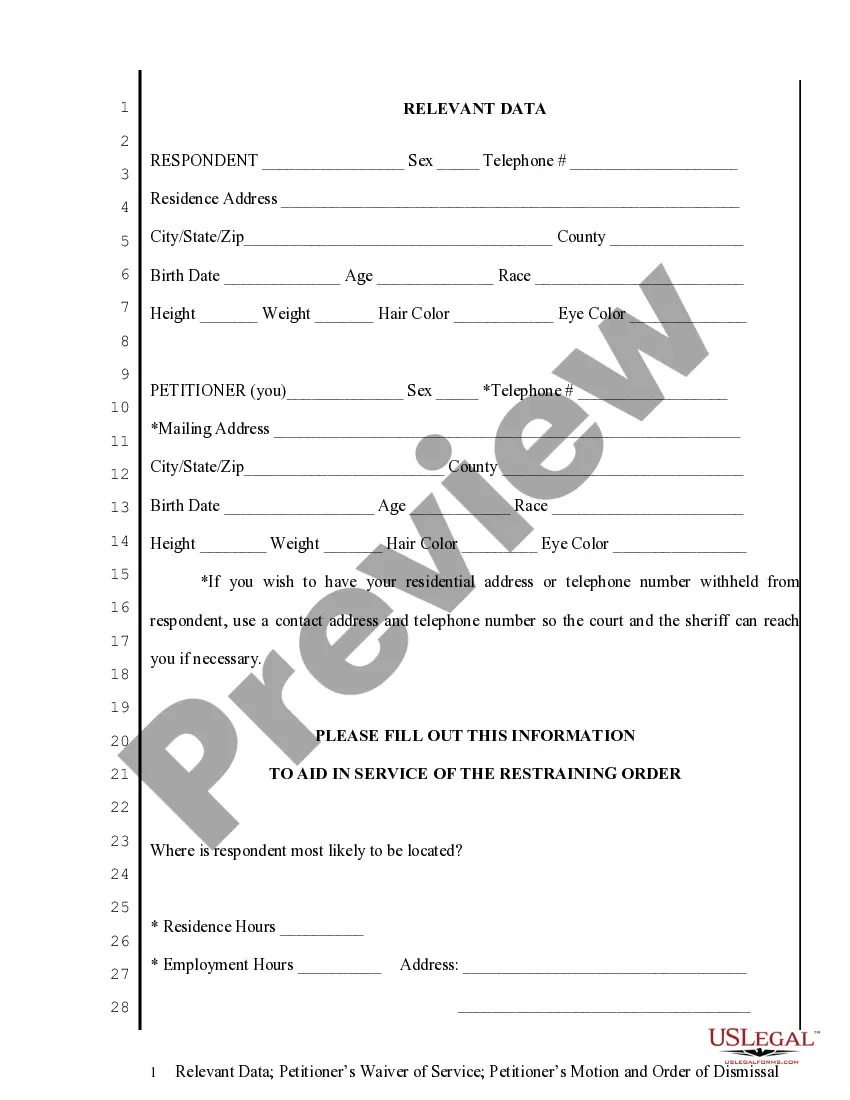

The documents typically required for financial hardship include proof of income, any relevant bills, and statements of expenses. Additional documentation may include tax forms and letters from creditors. By preparing these documents systematically, you ensure that your application for A (least hardship) support is comprehensive and compelling.

To effectively overcome hardship, consider reaching out for financial counseling or assistance programs tailored to your needs. Addressing outstanding debts, creating a budget, and exploring available relief options can significantly help. Utilizing resources like uslegalforms can support you in navigating solutions for A (least hardship).

Proving financial hardship involves compiling and presenting relevant financial documents that illustrate your inability to meet bills and obligations. It is important to provide a detailed account of your income, expenses, and any sudden changes that impacted your financial status. This documentation will help you access programs focused on A (least hardship).

To qualify for hardship relief, you often need to demonstrate that your situation meets specific criteria established by relief programs. This usually involves providing documentation that outlines your financial constraints and the events that led to your hardship. Platforms like uslegalforms can guide you through the process of qualifying for A (least hardship) relief.

A hardship typically refers to situations that impose significant difficulties in everyday life, such as illness, unemployment, or family emergencies. Identifying genuine hardship is essential when applying for assistance or relief. When you document these challenges, it helps clarify your need for programs that focus on A (least hardship).

Financial hardship occurs when an individual cannot meet their basic expenses due to specific setbacks. This might include loss of income, unexpected medical bills, or significant emergencies that disrupt financial stability. Understanding what qualifies as a hardship is crucial for seeking relief options effectively, especially when considering A (least hardship).

The hardship level indicates the degree of difficulty faced by personnel in a specific location, aiding in the determination of applicable benefits. A (least hardship) is essential in assessing how much support employees require in their respective environments. Knowing the hardship level can ensure you are well-prepared and adequately supported during your assignment.

A hardship duty station refers to a workplace located in an area that presents significant challenges for employees. These locations often fall under the A (least hardship) criteria, and understanding your duty station's status can help you prepare for potential difficulties. This knowledge also ensures you receive appropriate support from your employer.

Hardship classification is a system that ranks locations according to the difficulties encountered by personnel stationed there. It serves to guide employers in providing appropriate support based on the level of A (least hardship) present. Being aware of your location's classification can help you prepare for any necessary adjustments.

The UN hardship classification categorizes locations based on the severity of conditions faced by employees. This system helps to identify areas that require A (least hardship) considerations in terms of benefits and allowances. Familiarizing yourself with these classifications ensures you understand the challenges associated with different postings.