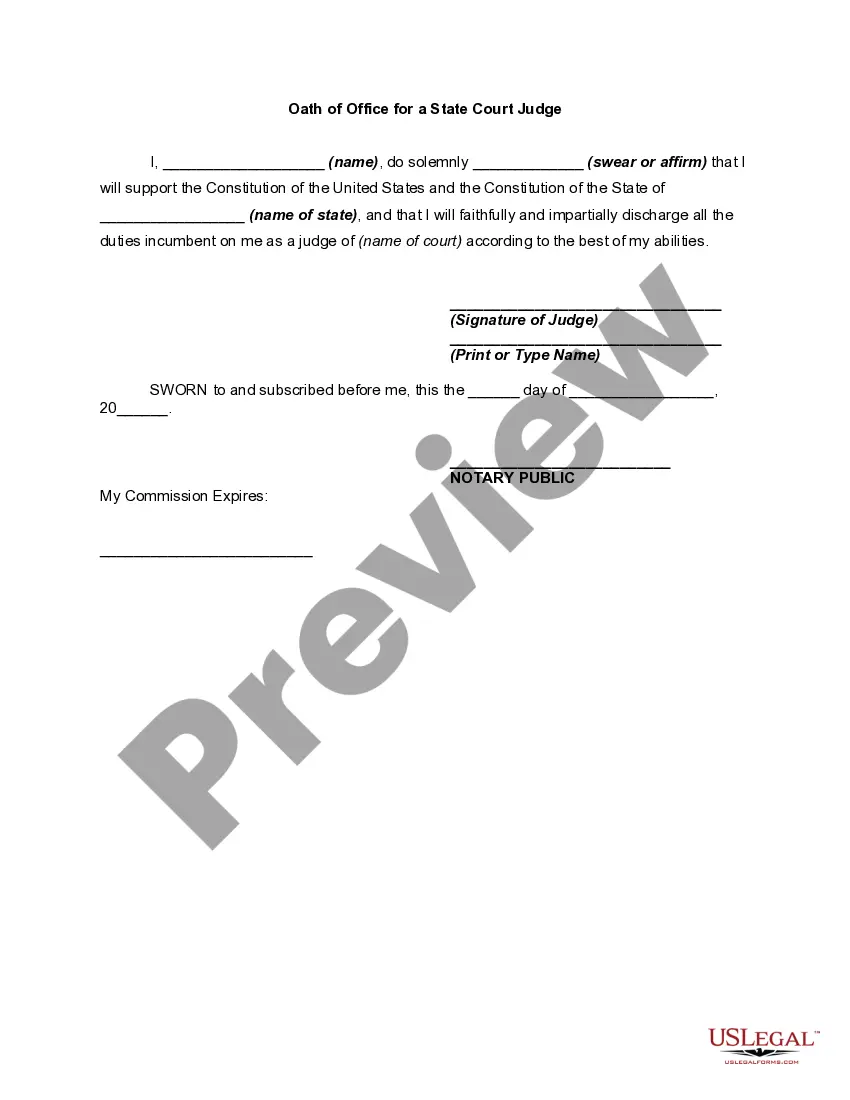

State Court Oath For Executor

Description

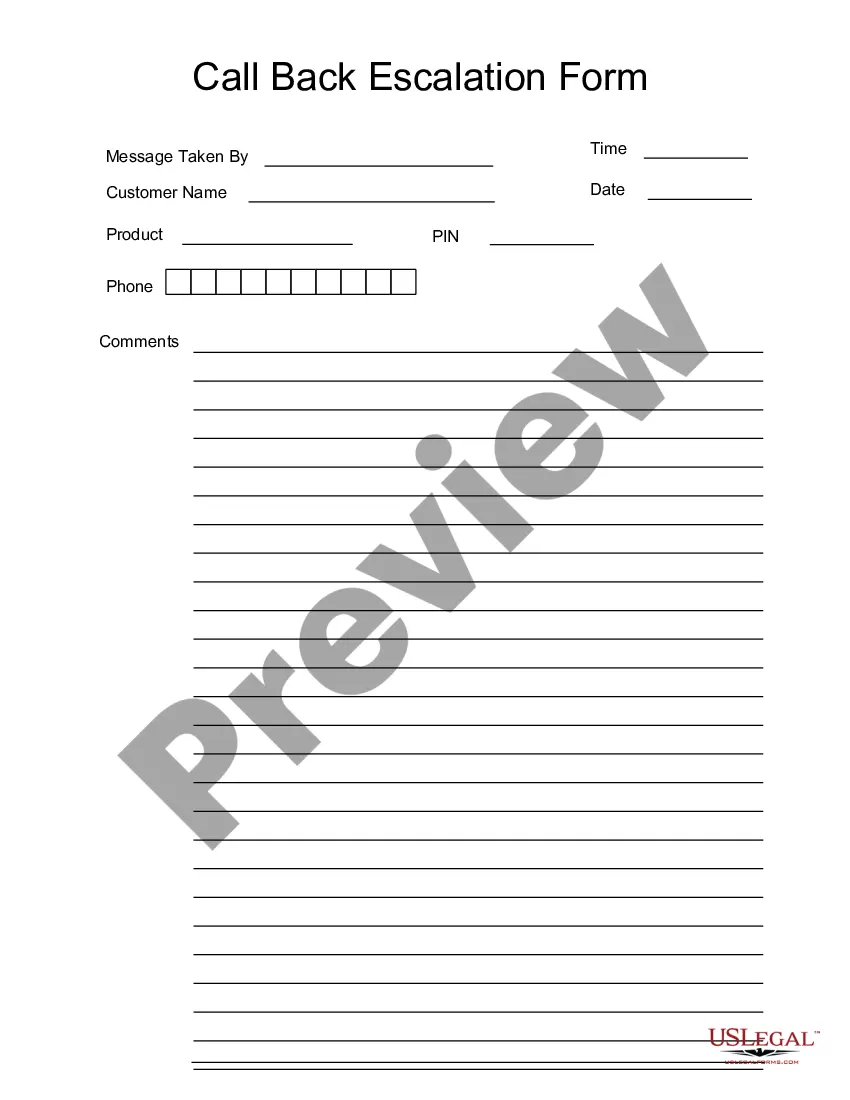

How to fill out Oath Of Office For A State Court Judge?

Managing legal documents can be daunting, even for experienced professionals.

If you need a State Court Oath For Executor and cannot spare the time to search for the correct and current version, the process may become stressful.

Utilize a valuable resource database of articles, guides, and materials pertinent to your circumstances and requirements.

Save time and effort searching for the documents you require, and leverage US Legal Forms’ enhanced search and Review tool to find and download the State Court Oath For Executor.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your everyday document management into a simple and user-friendly process today.

- If you have a subscription, Log Into your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view documents you have previously downloaded and to manage your folders as needed.

- If this is your first time with US Legal Forms, create a free account for unlimited access to all platform benefits.

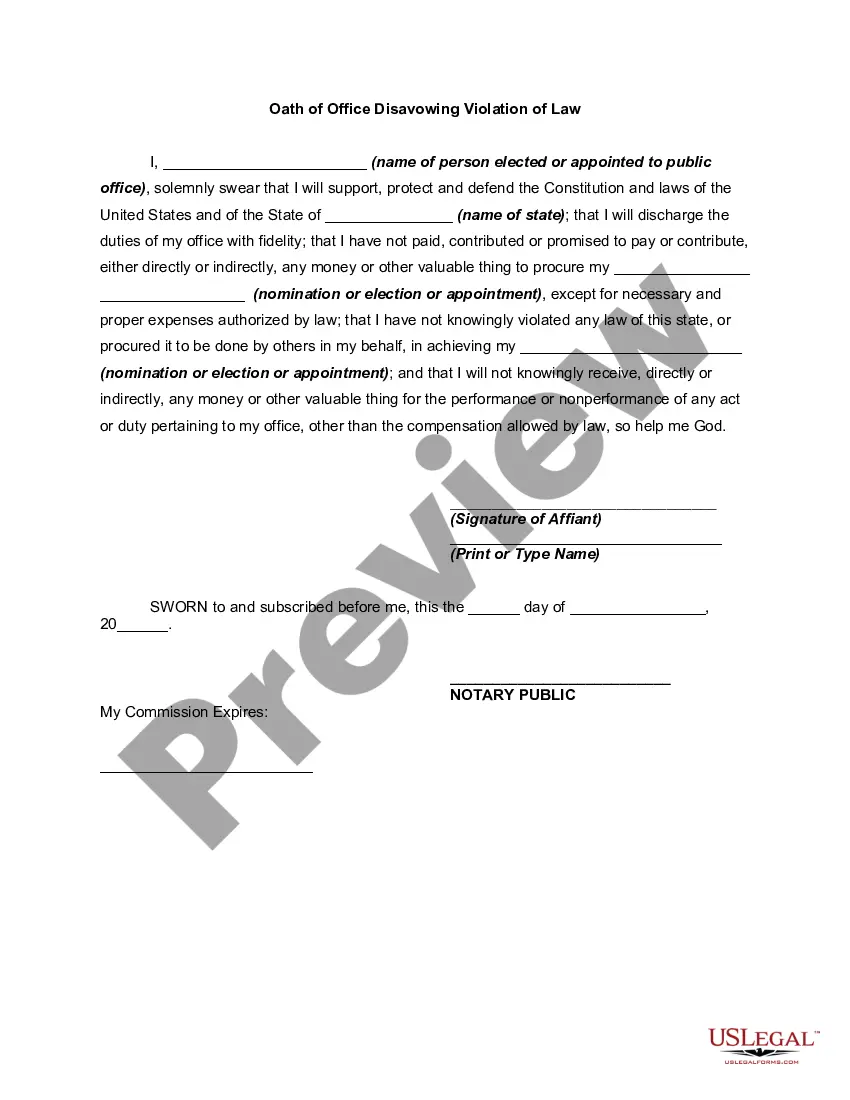

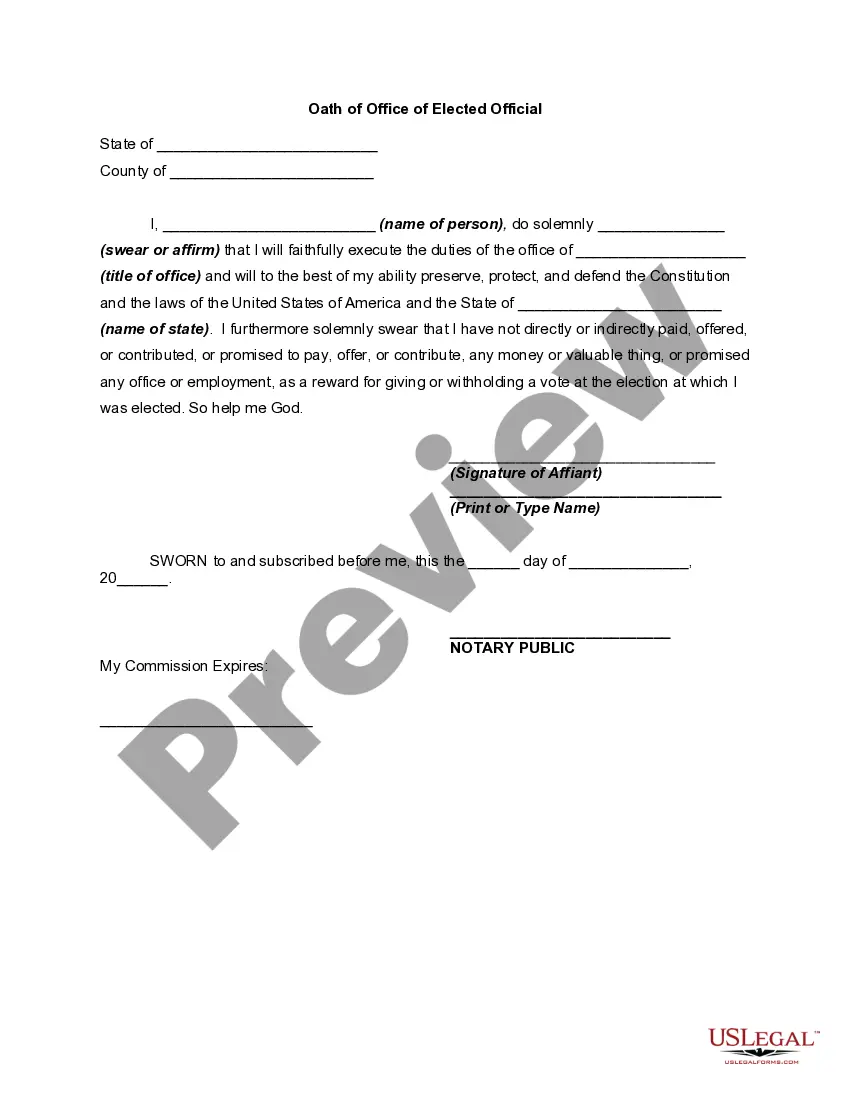

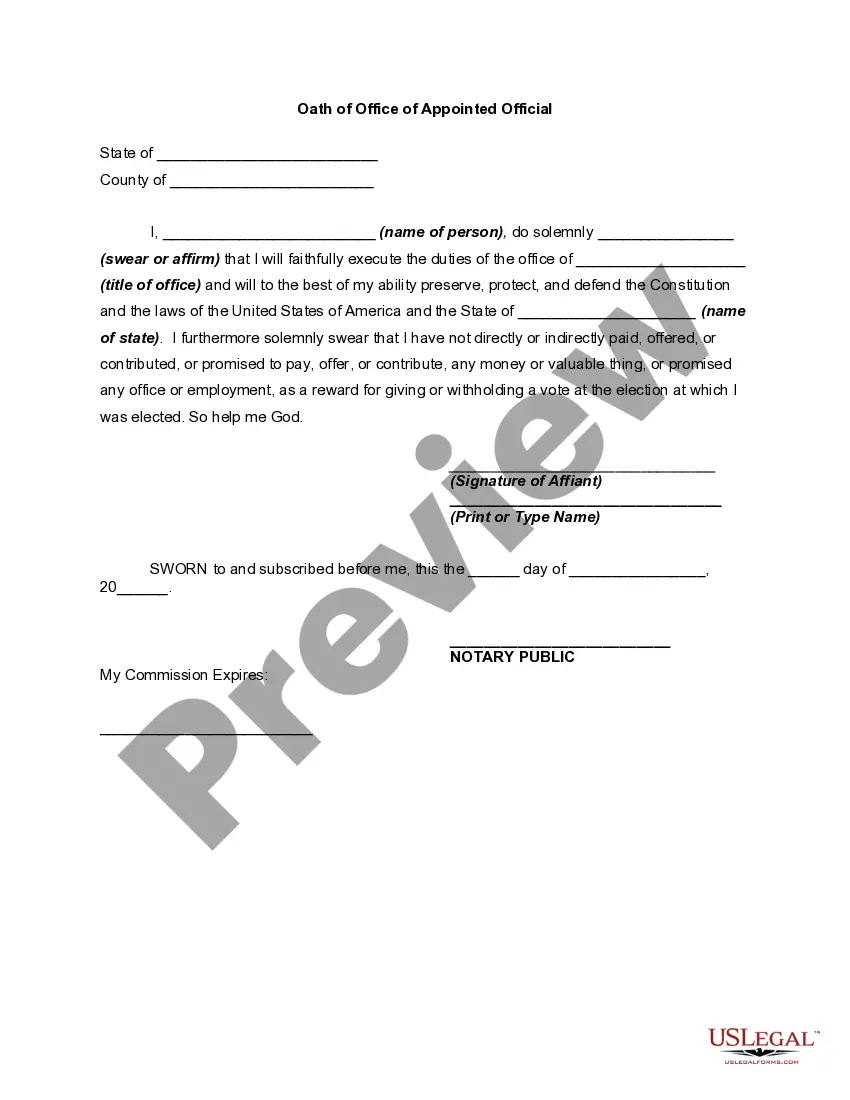

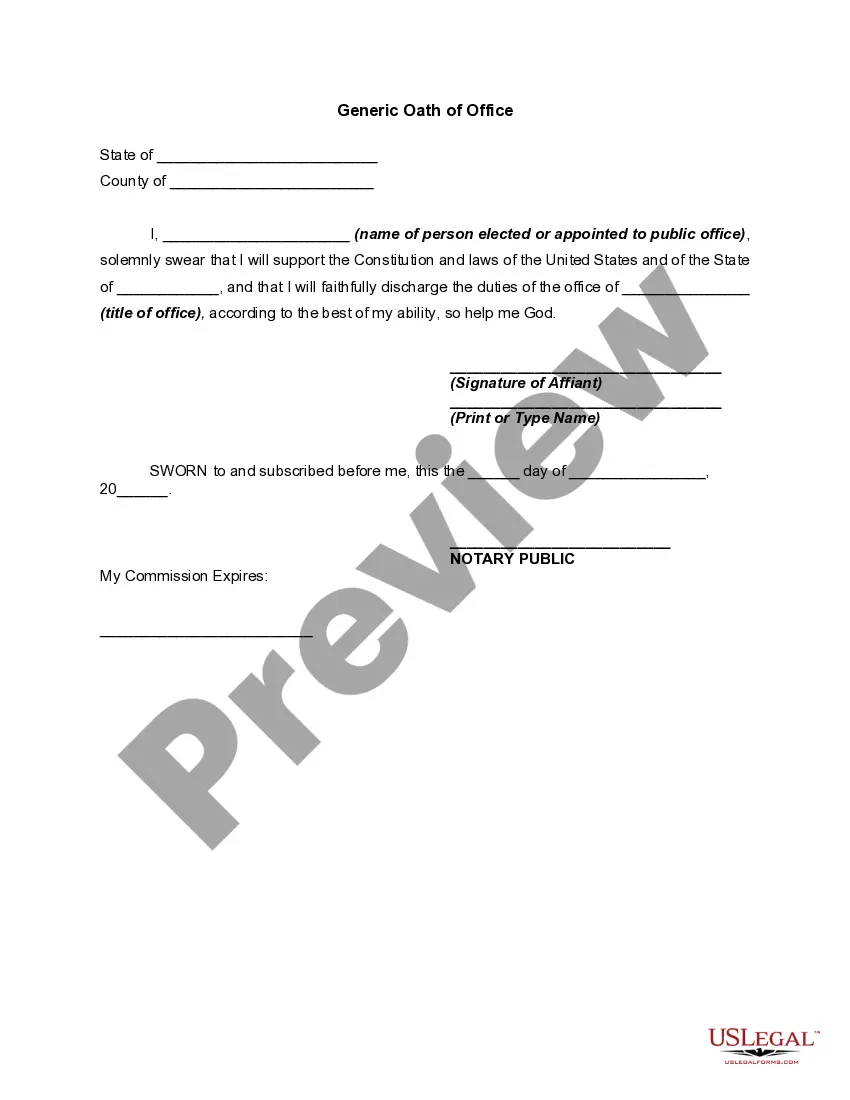

- After acquiring the desired form, verify it by previewing and reading its description.

- Confirm that the form is valid in your state or county.

- Click Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select the required format, then Download, fill out, sign, print, and send your documents.

- Access region- or jurisdiction-specific legal and business documents.

- US Legal Forms addresses every need you might have, from personal to corporate paperwork, all in one location.

- Employ sophisticated tools to complete and manage your State Court Oath For Executor.

Form popularity

FAQ

You must recite a specific oath when you are called to testify or serve as an executor in court. The state court oath for executor emphasizes your obligation to act in the best interest of the estate and its beneficiaries. This oath typically involves pledging to administer the estate according to the law, ensuring honesty and transparency in your actions.

When taking an oath in court, you should clearly state your name and affirm your commitment to tell the truth. In the context of the state court oath for executor, it may also be essential to acknowledge your duties regarding the administration of the estate. This simple yet profound act reinforces your responsibility and integrity as you undertake your role.

Declining to take the oath in court is generally not an option if you are required to appear as a witness or an executor. Taking the state court oath for executor is essential; it demonstrates your commitment to fulfilling your role honestly. However, if you have personal objections to swearing an oath, you may discuss this with the court to explore alternatives, which could include affirmations instead.

The oath you take in court is generally a promise to tell the truth, often phrased as 'I swear to tell the truth, the whole truth, and nothing but the truth.' Specifically for executors, the state court oath for executor may include additional commitments about managing the deceased's estate wisely and lawfully. This oath establishes a foundation of trust between the court and the executor.

A sworn statement for court usually takes the form of an affidavit. This document is a written statement confirmed by the oath of the person making it. For executors, the state court oath serves as a vital part of the process, ensuring that the executor upholds their responsibilities honestly and faithfully. An example could include a declaration affirming the executor's intent to administer the estate according to relevant laws.

To obtain proof of executorship, you need to file the required documents with the probate court in your state. This typically includes the will and a petition for probate. Once the court validates your will and issues the state court oath for executor, you will receive official letters testamentary. These documents serve as your proof of executorship, allowing you to manage the estate effectively.

The steps to become an executor include obtaining the will, filing it with the probate court, and petitioning to be appointed by the court. You will also need to notify beneficiaries and take the state court oath for executor, confirming your role and responsibilities. Following these steps carefully ensures a smoother transition into your executor duties. For additional support, consider using ulegalforms, which can provide helpful guidance.

To prove you are an executor, you must provide the court with the valid will along with your letters testamentary, which are official documents issued by the probate court. These documents authorize you to act on behalf of the estate. Additionally, ensuring that you take the state court oath for executor can reinforce your legal standing. Utilizing platforms like ulegalforms can simplify the documentation process.

While you are not required to have a lawyer to become an executor, consulting with one can be highly beneficial. A lawyer can help navigate the complexities of probate law, ensure compliance with court requirements, and assist in completing necessary paperwork. Taking the state court oath for executor also entails responsibilities that might require legal advice. Ulegalforms offers valuable templates and resources to ease this journey.

To petition the court to become an executor, you need to file a formal request in the probate court where the decedent lived. This request should outline your relationship to the decedent and your eligibility to serve as executor. Importantly, you may also need to take the state court oath for executor, which affirms your commitment to managing the estate responsibly. Utilizing resources from ulegalforms can guide you through the petitioning process.