Application Exemption Tax For Car Loan

Description

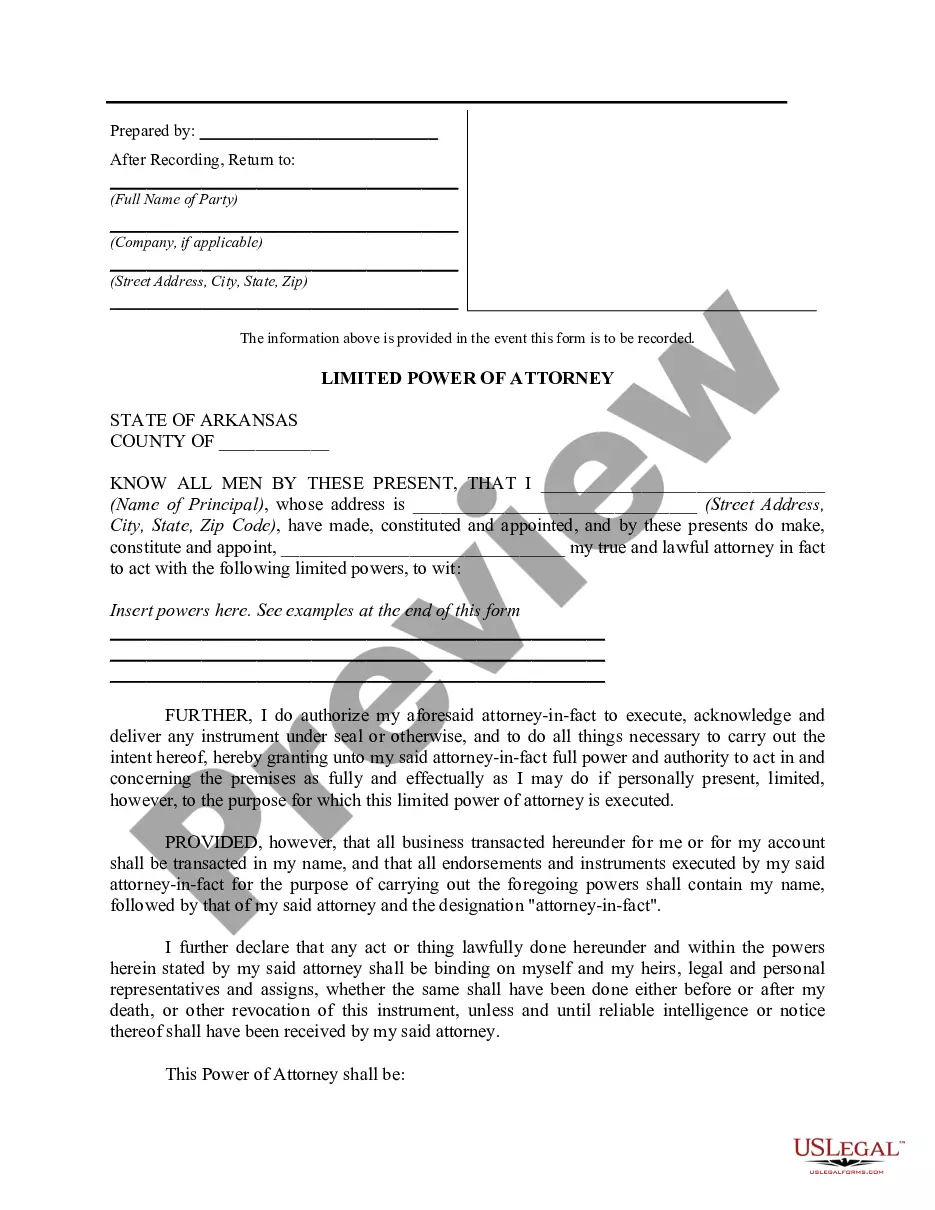

How to fill out Sample Letter Concerning Free Port Tax Exemption?

Locating a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Choosing the correct legal documents requires accuracy and meticulousness, which is why it's crucial to obtain samples of Application Exemption Tax For Car Loan solely from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can modify it with the editor or print it for manual completion. Eliminate the complications associated with your legal paperwork. Browse the vast US Legal Forms catalog to discover legal templates, assess their suitability for your situation, and download them right away.

- Utilize the catalog navigation or search box to find your template.

- Review the form's description to verify if it meets the requirements of your state and county.

- Access the form preview, if available, to confirm that it's the one you need.

- Return to the search to find the suitable template if the Application Exemption Tax For Car Loan does not meet your criteria.

- If you are confident about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing plan that fits your requirements.

- Continue to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Application Exemption Tax For Car Loan.

Form popularity

FAQ

To be tax-exempt, the application for title, or the transfer of license or registration, must be accompanied by a sworn statement that includes a description of the motor vehicle, the name and address of the donor, a statement that the title of the vehicle passed without monetary payment or other consideration valued ...

Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you're a cash method taxpayer (most individuals are), you generally can't take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items of taxable income.

Car loan interest It works in the same way as other vehicle tax deductions, like gas, car repairs or any expense you would enter on Schedule C of your 1040 tax return. The IRS gives you two ways to deduct car loan interest: the standard mileage method and the actual expense method.

Florida sales tax is due at the rate of 6% on the $20,000 sales price of the vehicle. No discretionary sales surtax is due.

To be tax-exempt, the application for title, or the transfer of license or registration, must be accompanied by a sworn statement that includes a description of the motor vehicle, the name and address of the donor, a statement that the title of the vehicle passed without monetary payment or other consideration valued ...