Payment Agreement Form Irs

Description

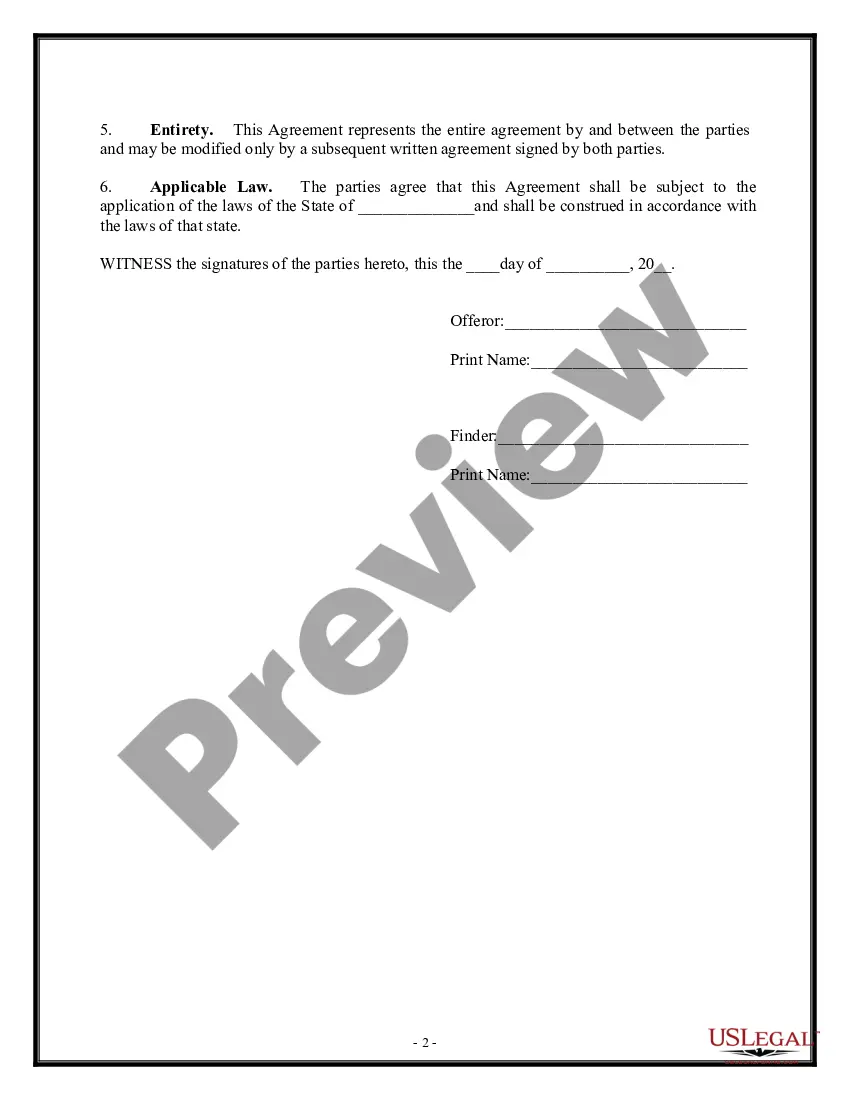

How to fill out Finders Fee Agreement?

Obtaining legal document examples that comply with federal and local regulations is essential, and the internet provides numerous selections.

However, why spend time looking for the appropriately crafted Payment Agreement Form Irs template online when the US Legal Forms digital library already contains such resources consolidated in one location.

US Legal Forms is the most comprehensive online legal directory with more than 85,000 editable templates created by lawyers for any business and personal situation. They are user-friendly with all documents categorized by state and intended use.

All templates available on US Legal Forms are reusable. To re-download and fill out previously acquired forms, navigate to the My documents section in your account. Take advantage of the most extensive and user-friendly legal document service!

- Our experts stay informed about legislative changes, ensuring that you can always be assured your form is current and compliant when acquiring a Payment Agreement Form Irs from our site.

- Acquiring a Payment Agreement Form Irs is straightforward and quick for both existing and new users.

- If you have an account with an active subscription, Log In and retrieve the document sample you require in the preferred format.

- If you are visiting our website for the first time, follow the steps outlined below.

- Review the template using the Preview feature or through the textual description to ensure it meets your requirements.

Form popularity

FAQ

Electronic Payment Options for Businesses and Individuals Credit or Debit Card. Visit here for the list of service providers, their contact information, and convenience fees. ... Direct Pay. ... Electronic Funds Withdrawal. ... Electronic Federal Tax Payment System® ... Online Payment Agreement. ... Same-Day Wire Federal Tax Payments. ... User Fees.

If you'd prefer to fill out the form online, you can do so directly on the IRS website. First, enter identifying information like your name, address, Social Security number, phone number, employer information, and the kinds of taxes you filed for.

Make your check or money order payable to ?United States Treasury.? Don't send cash. If you want to pay in cash, in person, see Pay by cash, later. Make sure your name and address appear on your check or money order. Enter your daytime phone number and your SSN on your check or money order.

How to Complete Form 433-D Your name and address. Social Security Number (SSN) for individual taxpayers or Employer Identification Number (EIN) for businesses. Type of Tax ? Note the form number for the tax return you filed. ... Tax periods ? Note the tax years related to the tax debts you're making payments on.

Use Form 9465 to request a monthly installment agreement (payment plan) if you can't pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. See Streamlined installment agreement, later, for more information.