Finder Fee

Description

How to fill out Venture Capital Finder's Fee Agreement?

Whether for corporate reasons or personal matters, everyone must confront legal circumstances at some stage in their lives. Finalizing legal documents requires meticulous care, starting from selecting the correct form template.

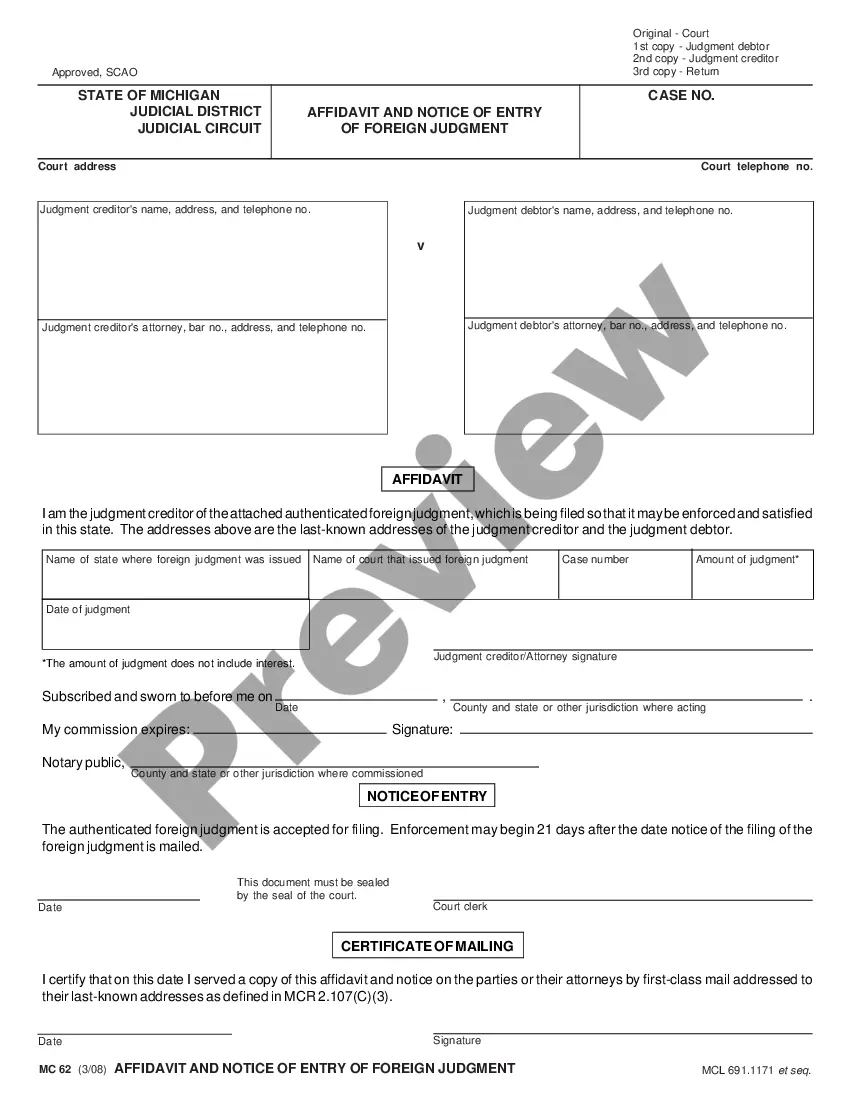

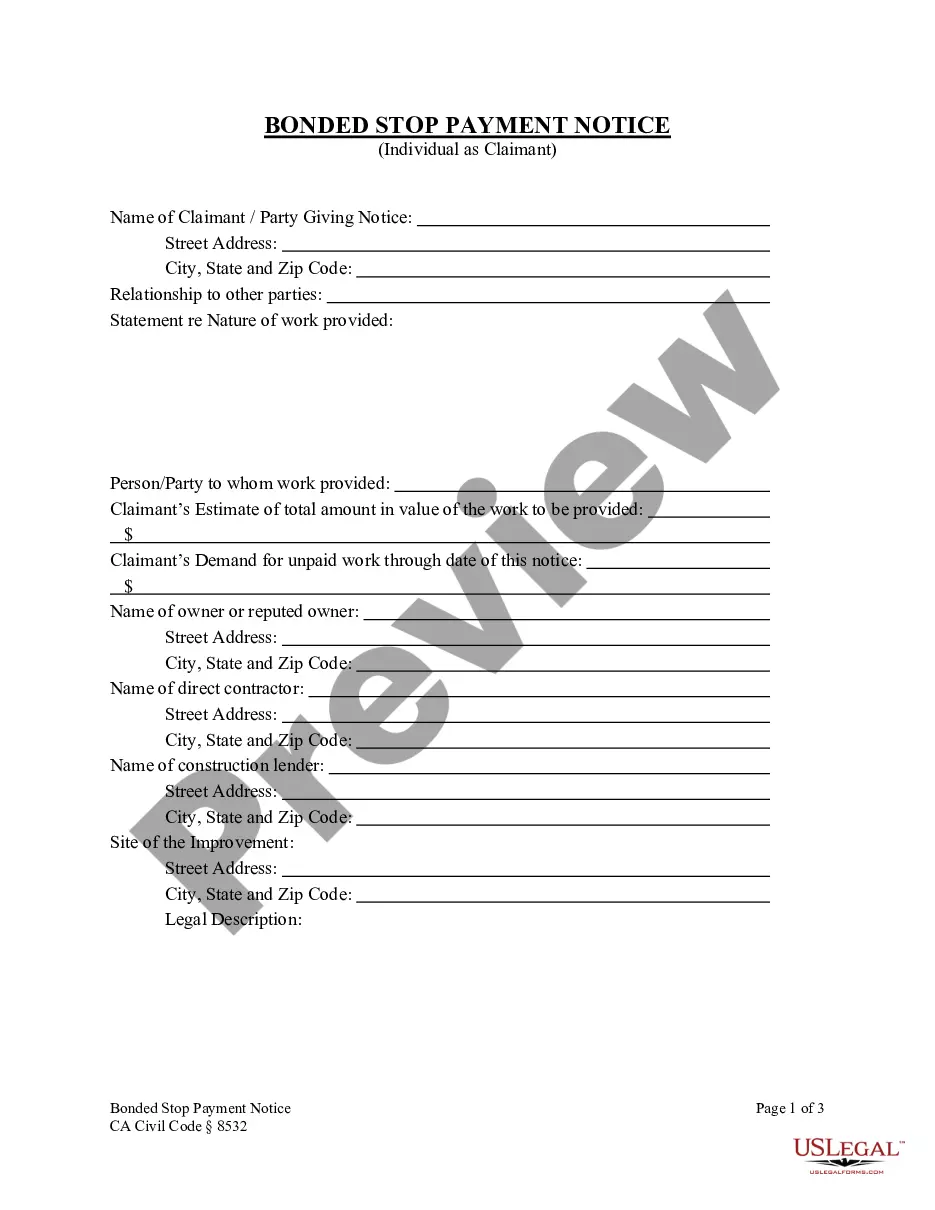

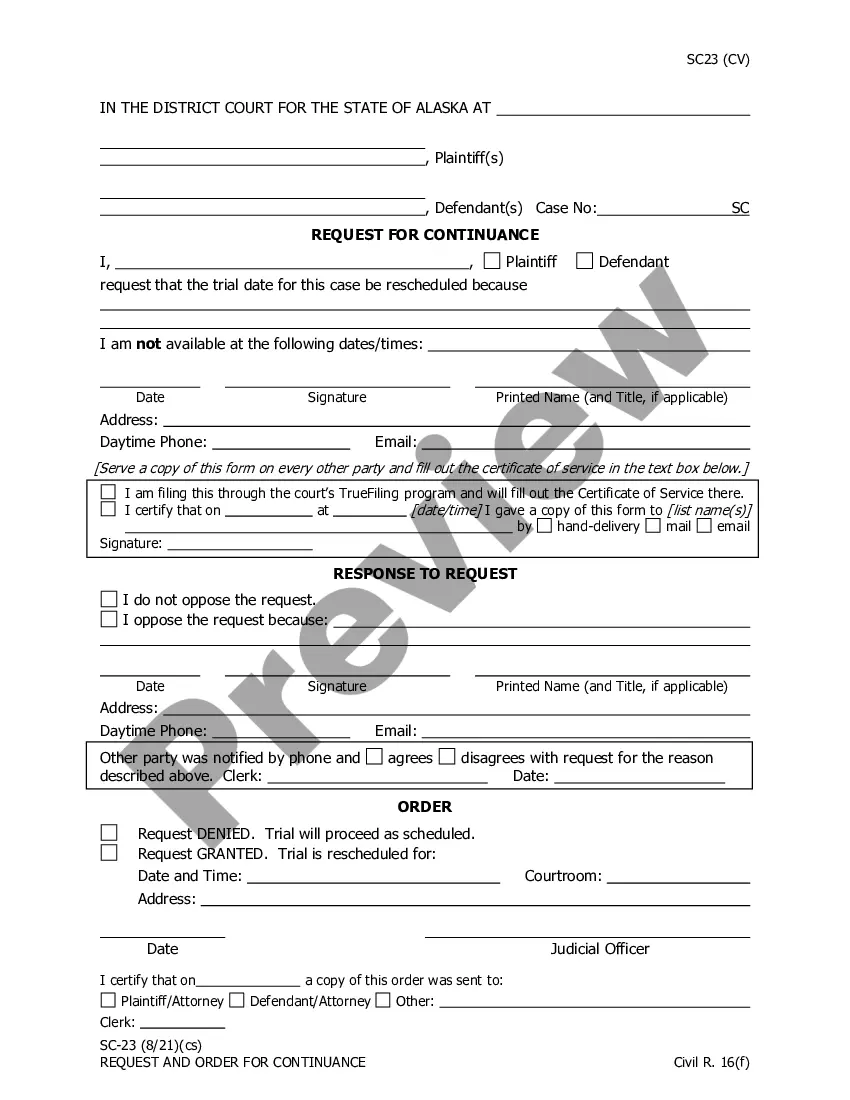

For example, if you select an incorrect version of a Finder Fee, it will be rejected upon submission. Thus, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

Once it is saved, you can complete the form using editing software or print it out and finish it by hand. With a vast US Legal Forms collection available, you do not have to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the suitable form for any event.

- Locate the sample you need by using the search box or browsing the catalog.

- Review the form’s details to confirm it aligns with your scenario, state, and locality.

- Click on the form’s preview to assess it.

- If it is not the correct form, return to the search feature to find the Finder Fee template you need.

- Download the template if it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you prefer and download the Finder Fee.

Form popularity

FAQ

Collecting finder's fees could be lucrative. But this isn't always free money; individuals and businesses that receive finder's fees may have to report them as taxable income to the IRS. Finder's fees, referral fees, and referral bonuses can all be reported on Form 1099-MISC or 1099-NEC.

What Is a Typical Finder's Fee? A finder's fee need not be excessive ? the most common structure is between 5-15% of the deal value (agreed upon by both parties ahead of time).

Sometimes a finder's fee is money, and other times it's a gift. It's common practice for finders to sign a written agreement with brokers to secure their percentage and type of payment before referring any potential buyers.

To calculate the finder's fee, multiply the total price of the deal by the rate of the finder's fee. The result is the finder's fee.

Collecting finder's fees could be lucrative. But this isn't always free money; individuals and businesses that receive finder's fees may have to report them as taxable income to the IRS. Finder's fees, referral fees, and referral bonuses can all be reported on Form 1099-MISC or 1099-NEC.