Sba Release Of Lien For Partial

Description

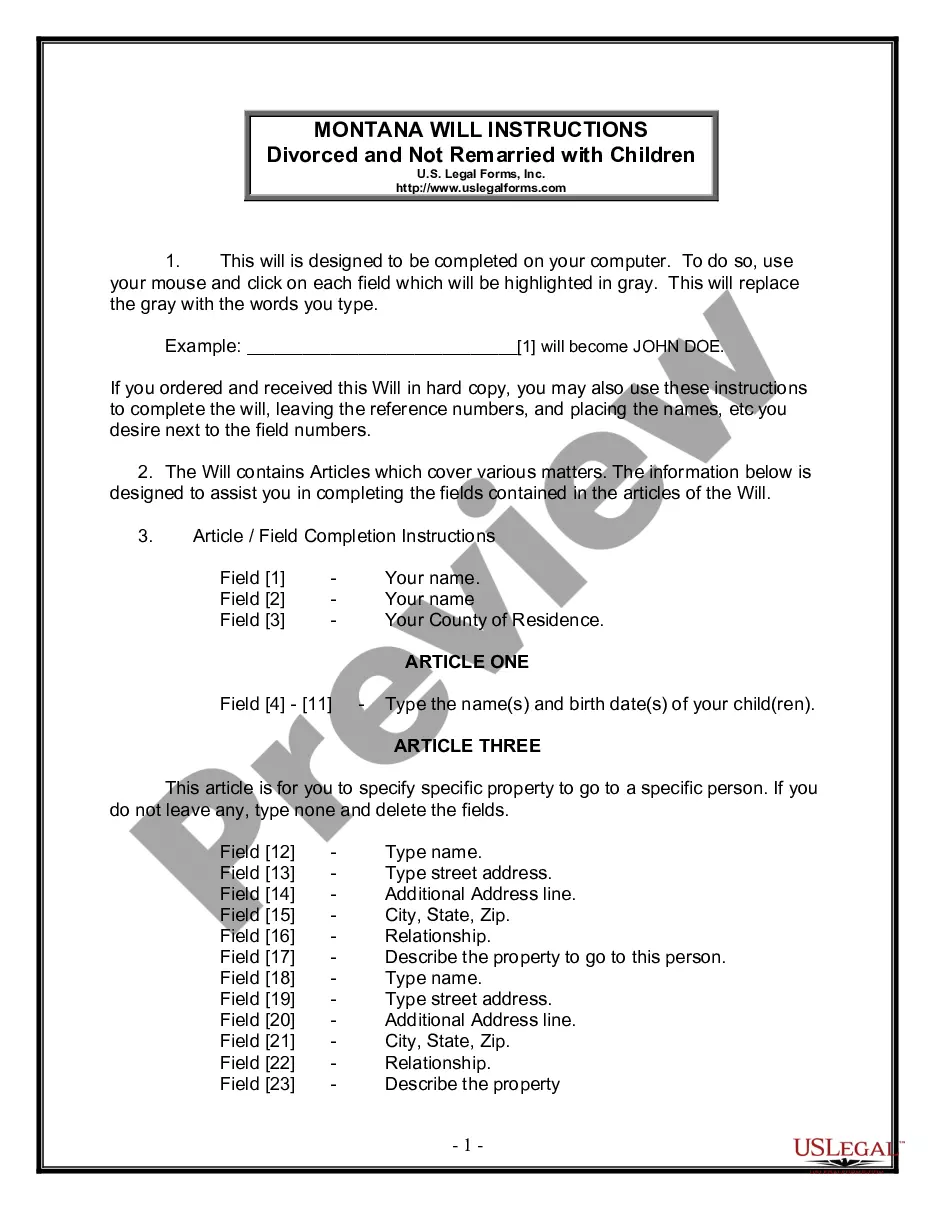

How to fill out Waiver And Release Of Lien By Contractor?

The Sba Release Of Lien For Partial you see on this page is a reusable legal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Sba Release Of Lien For Partial will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to confirm it fits your needs. If it does not, utilize the search bar to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Sba Release Of Lien For Partial (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your paperwork again. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Pay your loan in full To request a payoff amount, contact COVID-19 EIDL Customer Service at 833-853-5638 (TTY:711) from a.m. to p.m. ET, Monday through Friday, email COVIDEIDLServicing@sba.gov , or send a message through the MySBA Loan Portal.

At the same time, it's important to note that all SBA loans require some form of collateral from the borrower. Lenders of SBA loans need to meet the administration's minimum requirements, but make final collateral determinations on a case-by-case basis.

In the normal procedure for selling collateral, you would either first pay off the loan or you would use the funds from the sale to pay off the finance company's lien. Once the loan is paid in full, the finance company will file a lien release with the appropriate state or county authority.

The SBA requires the lender to liquidate any collateral with a recoverable value greater than $5,000 for business personal property and $10,000 for the real property unless there is a documented compelling reason not to.

Borrowers can obtain their EIDL loan payoff information by contacting the SBA Disaster Loan Servicing Center at (800) 736-6048.