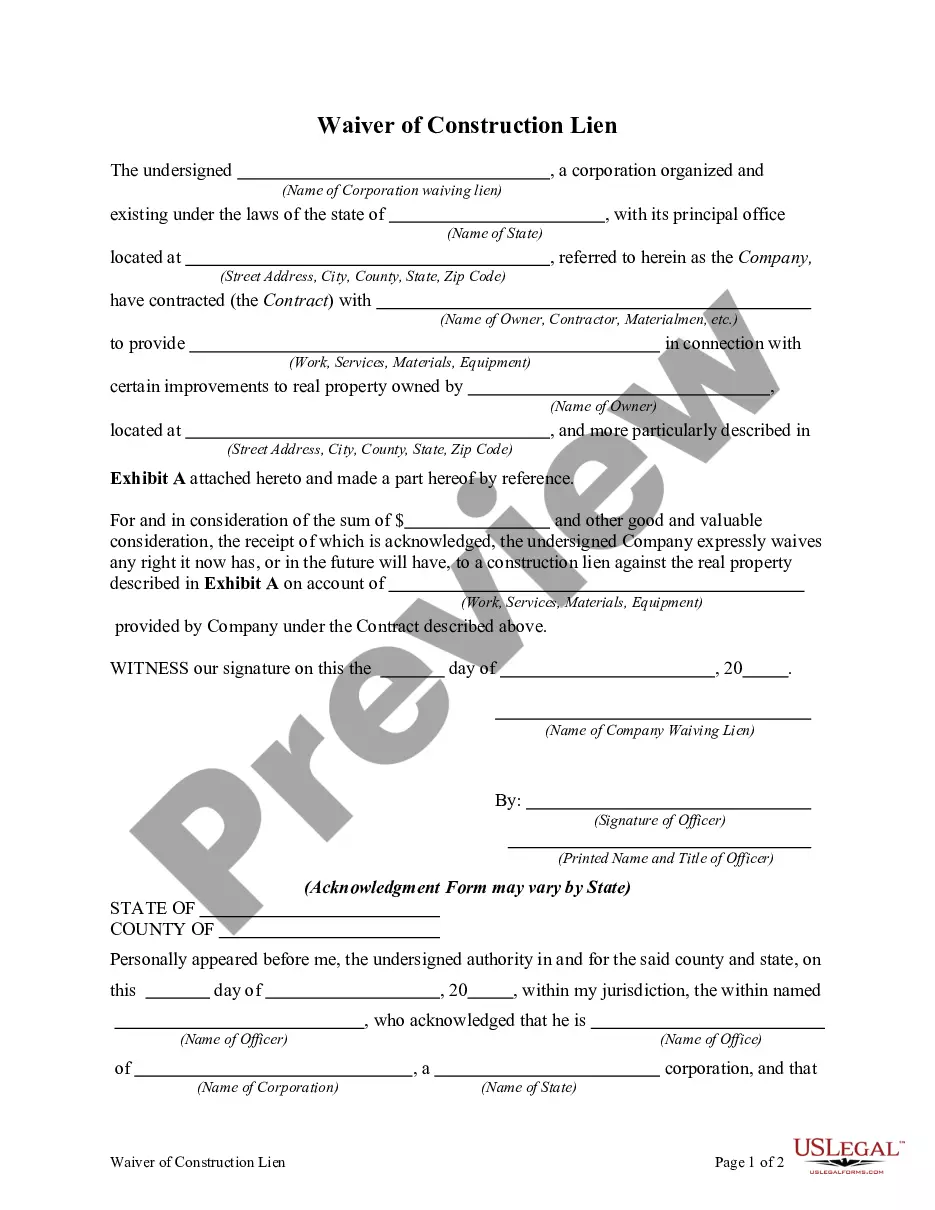

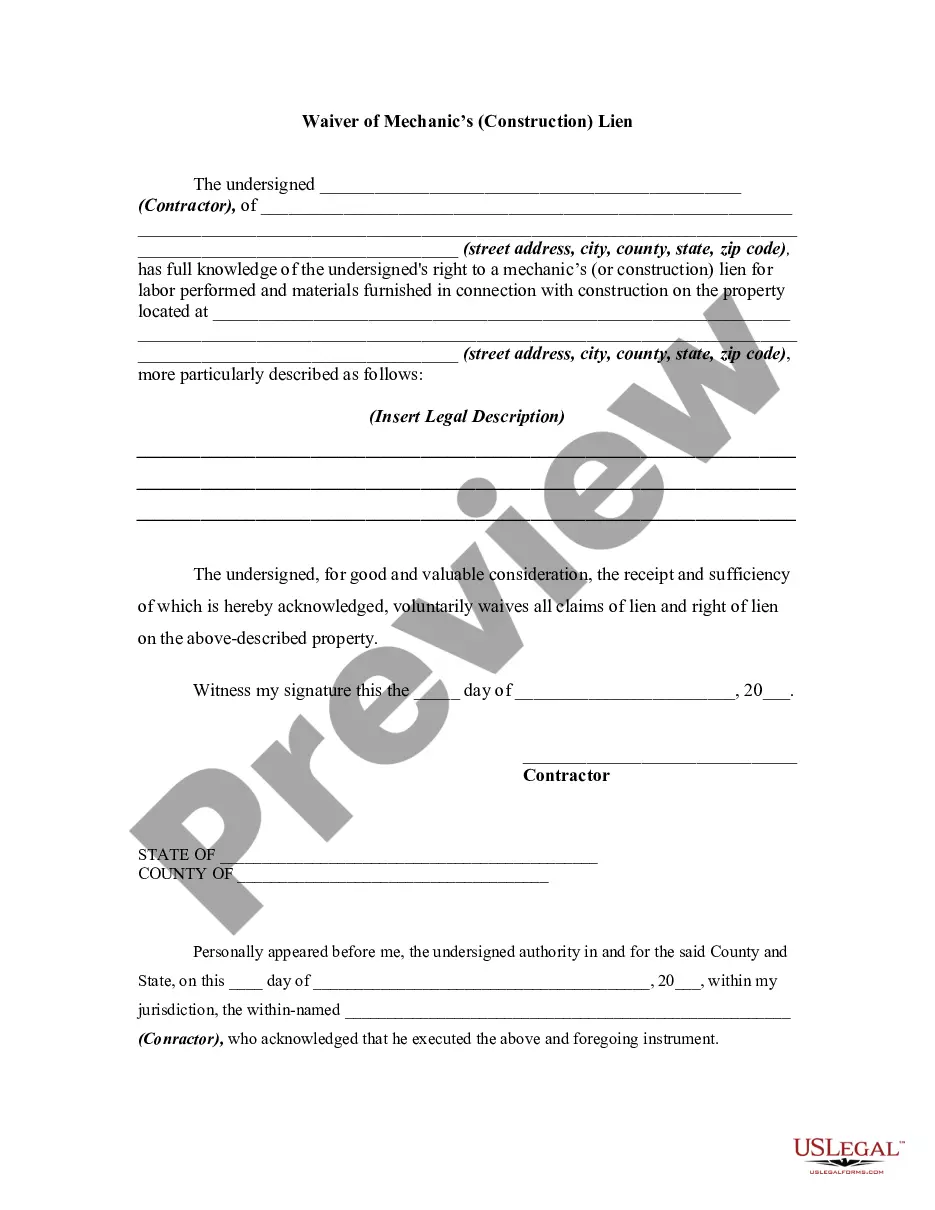

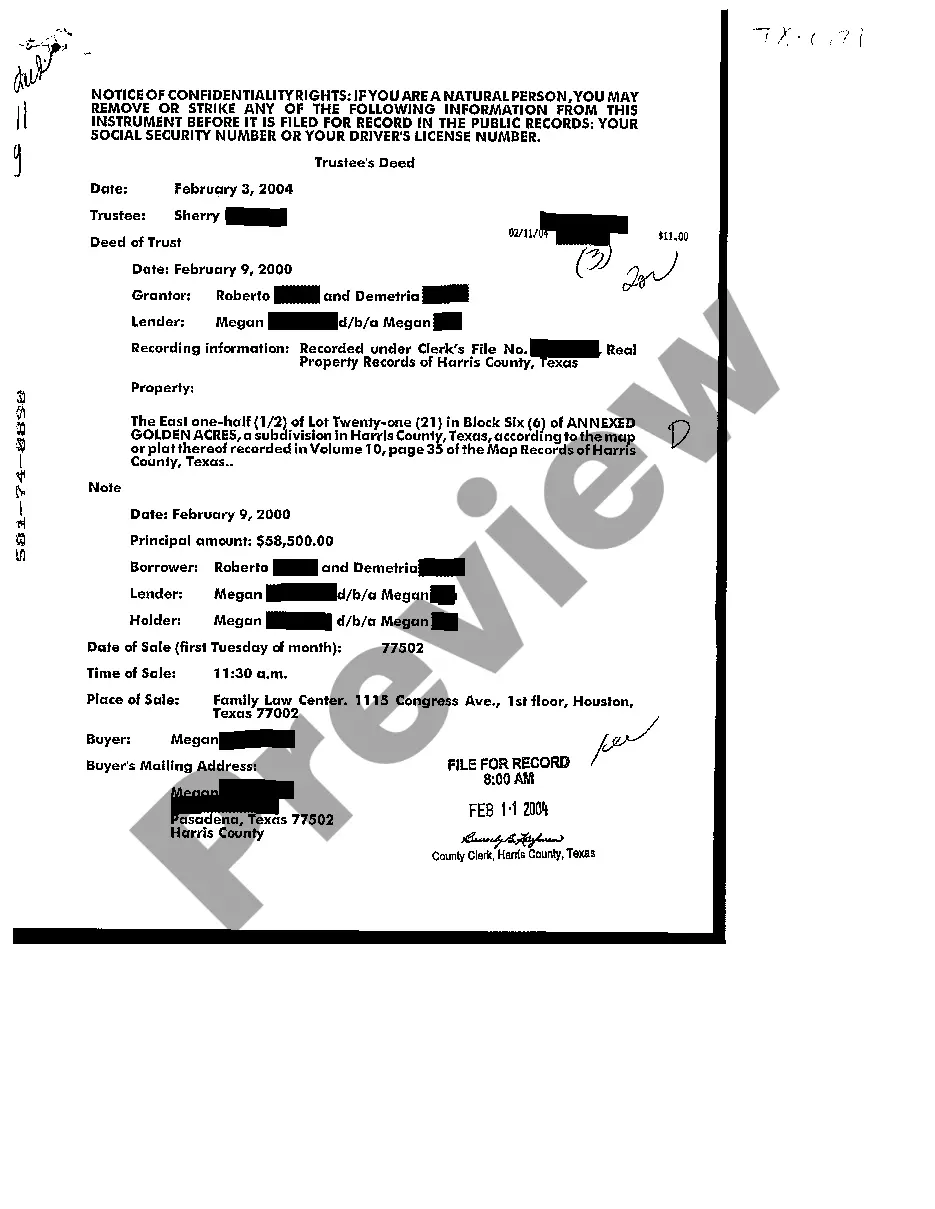

Release Of Lien Example

Description

How to fill out Waiver And Release Of Lien By Contractor?

Whether for professional reasons or for personal issues, everyone must deal with legal matters at some point in their life.

Filling out legal paperwork requires meticulous focus, starting from selecting the correct form template.

With a vast US Legal Forms catalog available, you never have to waste time searching for the right template online. Utilize the library’s easy navigation to find the suitable form for any circumstance.

- For instance, if you choose an incorrect version of a Release Of Lien Sample, it will be rejected once you submit it.

- Thus, it is essential to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Release Of Lien Sample template, follow these straightforward steps.

- Locate the sample you require by using the search bar or browsing through the catalog.

- Review the form’s description to ensure it suits your situation, state, and area.

- Click on the form’s preview to scrutinize it.

- If it is the wrong document, return to the search feature to find the Release Of Lien Sample template you need.

- Obtain the file if it aligns with your requirements.

- If you possess a US Legal Forms account, click Log in to access previously stored files in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the account registration form.

- Choose your payment method: you may use a credit card or PayPal account.

- Select the document format you prefer and download the Release Of Lien Sample.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

In accounting, a lien example may involve businesses that secure loans against their inventory. When a lender provides funds, they often require a lien on the company's inventory to mitigate risk. If the business defaults, the lender can take possession of the inventory. Being aware of a 'release of lien example' can help businesses understand how to clear these financial obligations and protect their assets.

The most common type of lien is a mortgage lien, which secures the bank's interest in your property. When you take out a mortgage, the bank places a lien on the home to ensure repayment. If you fail to make your mortgage payments, the bank has the right to foreclose on the property. Understanding the 'release of lien example' can be crucial for homeowners aiming to understand their rights and responsibilities.

Step 1: Name Your North Dakota LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the North Dakota Articles of Organization. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect North Dakota S Corp Tax Designation.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

The fee typically charged will vary by state between $800 and $1,000. Some states, like Nevada, don't charge a franchise tax fee, making them an alluring place to do business. Miscellaneous government filing fees: Government filing fees may vary from $50 to $200 depending on the state and the type of business.

The difference is that Form 1120 is used by C corps (which are liable for corporate federal taxes), while Form 1120-S is used exclusively by S corps. In contrast to C corps, S corps are exempt from corporate federal taxes due to income, credits, deductions, and losses being passed through to shareholders.

Note that an S corporation is a tax category and not a registration category, meaning that you will establish your corporation as a C corp and then apply for S corp status with the IRS. This makes starting an S corp in California really simple.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders.

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.