Lien Release For Missouri

Description

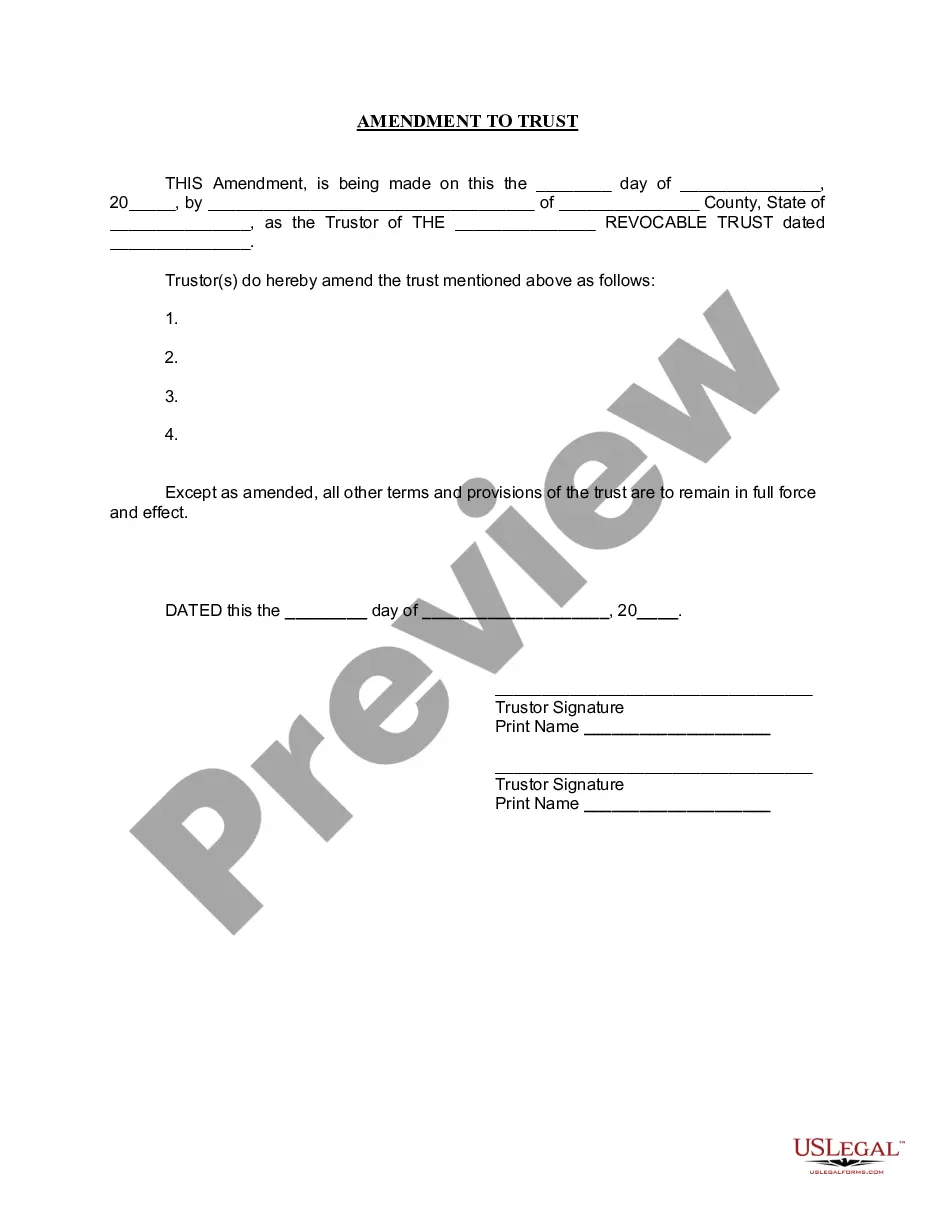

How to fill out Waiver And Release Of Lien By Contractor?

The Lien Release for Missouri displayed on this page is a reusable legal document created by experienced attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific forms for any professional and personal situation. It’s the quickest, easiest, and most reliable method to access the documents you require, as the service ensures the highest standards of data security and anti-malware measures.

Register with US Legal Forms to have trusted legal templates for all of life's circumstances readily available.

- Look for the document you require and examine it.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card for immediate payment. If you already possess an account, Log In and verify your subscription to continue.

- Select the format you wish for your Lien Release for Missouri (PDF, DOCX, RTF) and download the template onto your device.

- Print the template to fill it out manually. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Use the same document again whenever necessary. Navigate to the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

To obtain a lien release letter for Missouri, you should first contact the lender who issued the lien. After confirming that the debt has been satisfied, request the lien release letter from them. If you're not sure how to navigate the request process, platforms like US Legal Forms provide templates and guidance to help you draft and submit your request efficiently.

To get your lien released, first ensure that you have settled the debt associated with the lien. Then, request a lien release from the lien holder, who will provide you with the necessary documentation. After obtaining this paperwork, file it with your local county recorder’s office. Platforms like US Legal Forms can guide you through these steps, ensuring you have everything you need for a successful lien release in Missouri.

To confirm a lien release in Missouri, you can check with the local county recorder’s office where the lien was originally filed. They maintain public records and can verify whether the lien has been officially released. Additionally, reviewing your property title can provide clarity on any recorded liens. Using US Legal Forms can assist you in obtaining the necessary title reports quickly and efficiently.

To obtain a lien release in Missouri, you typically need a copy of the original lien document, proof of payment, and a completed lien release form. These documents will help verify that the debt associated with the lien has been settled. Remember, having all necessary paperwork will speed up the process significantly. Using platforms like US Legal Forms can simplify this process by providing the right templates and guidance.

While notarization is not strictly required for lien releases in Missouri, it is recommended as it enhances the credibility of the document. By having your lien release notarized, you add assurance that the document is legitimate and that all parties have agreed to the terms. Consider checking with local laws to be certain of the best practice in your case.

To release a lien in Missouri, begin by preparing the lien release document with accurate information about the original lien and associated parties. Submit this document to the relevant county clerk's office along with proof of debt satisfaction. This process will officially clear the lien from public records.

Releasing a lien in Missouri involves filing the lien release with the appropriate county office where the original lien was recorded. Start by completing the necessary lien release form and gathering required documentation. Once you submit these documents, the office will process your request and update their records.

In Missouri, not all lien releases need to be notarized, but notarization adds an extra layer of validity. It is generally a good practice to have your lien release notarized to ensure that it holds up legally if questioned. Always check specific local regulations to confirm the requirements for your situation.

Writing a lien release letter for Missouri involves a few key elements, including your name, address, and the debtor's information. Clearly state your intention to release the lien and provide details about the original lien, such as dates and amounts. A well-structured letter not only simplifies the process but also formalizes the release in written form.

To obtain a lien release for Missouri, you need specific documents that demonstrate the debt has been satisfied. Primarily, you will require the original lien authorization, proof of payment, and identification records. These documents help ensure the lien removal process is smooth and efficient.