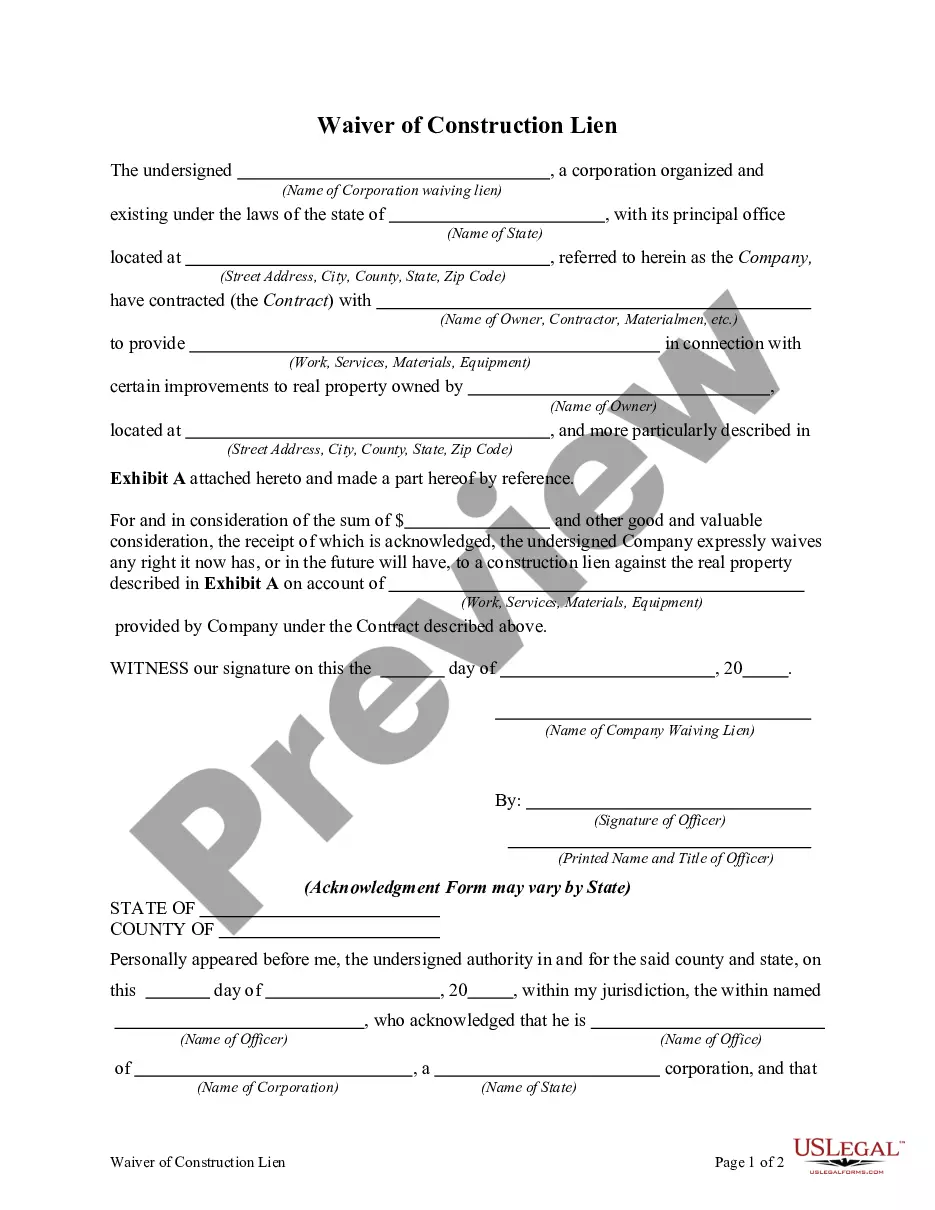

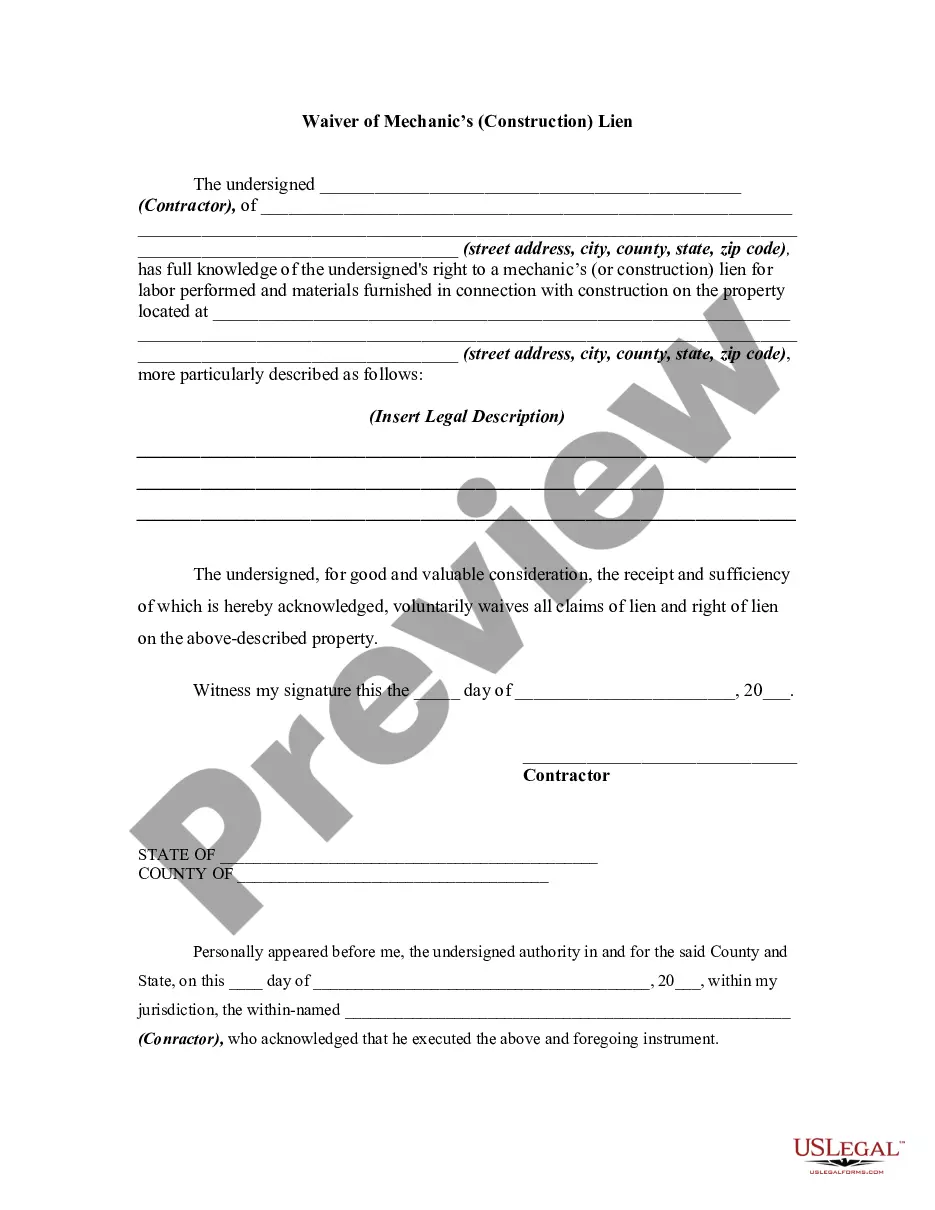

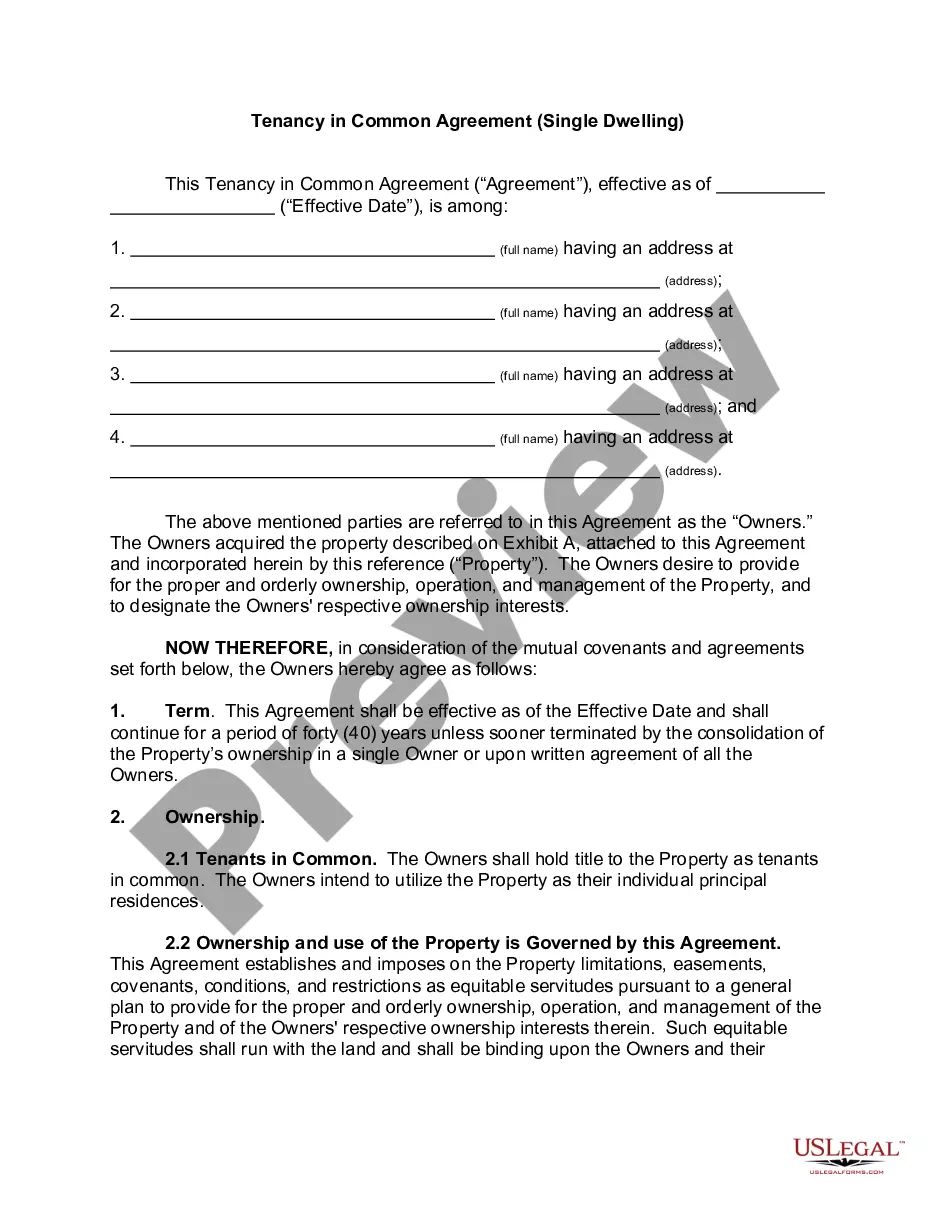

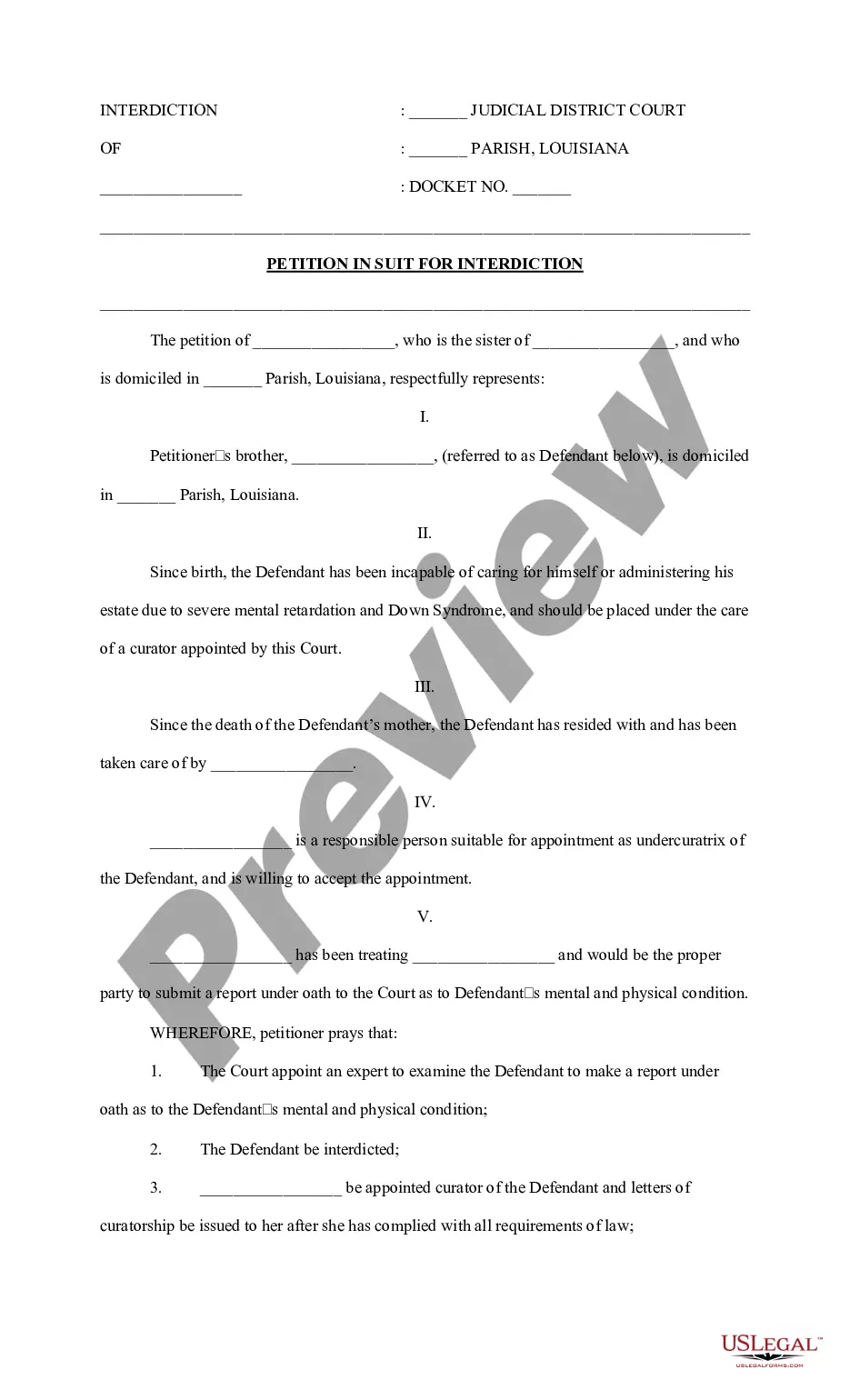

Lein Release Paper With Lien

Description

How to fill out Waiver And Release Of Lien By Contractor?

Creating legal documents from the ground up can frequently be intimidating.

Specific situations may require extensive research and significant financial expenditure.

If you're seeking a more straightforward and cost-effective method for preparing Lein Release Paper With Lien or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online database of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly acquire state- and county-specific templates meticulously compiled by our legal experts.

US Legal Forms enjoys a flawless reputation and over 25 years of expertise. Join us today and make form completion a seamless and efficient process!

- Utilize our platform whenever you require dependable and trustworthy services to easily locate and download the Lein Release Paper With Lien.

- If you’re familiar with our website and have previously established an account, just Log In to your account, find the form, and download it or re-download it any time later in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to sign up and browse the library.

- Before you rush to download Lein Release Paper With Lien, consider these recommendations.

Form popularity

FAQ

Contents Name your Oregon LLC. Choose your registered agent. Prepare and file articles of organization. Receive a certificate from the state. Create an operating agreement. Get an Employer Identification Number.

Mail filings: In total, mail filing approvals for Oregon LLCs take 6-8 weeks. This accounts for the 4-6 week processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Oregon LLCs take 2-3 business days.

If you do not mind your name and address on public record, you may act as your own registered agent in Oregon. Keep in mind that you must keep regular business hours at this address, as to be available to accept certain documents in person.

Oregon doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

Changing Your Oregon Registered Agent FAQs There is no fee required to change your registered agent in Oregon. For an optional confirmation copy, include $5.

Starting an LLC costs $100 in Oregon. This is the state filing fee for a document called the Oregon Articles of Organization. The Articles of Organization are filed with the Oregon Secretary of State. And once approved, this is what creates your LLC.

Information about businesses registered in Oregon, including the registered agent and registered office is a matter of public record and is available online through business name search.

For LLCs classified as partnerships, taxes are the same as for S corporations. The business owes the minimum excise tax of $150, while the business owners pay personal income tax on the income that passes through.