Acuerdo De Separación Matrimonial

Description

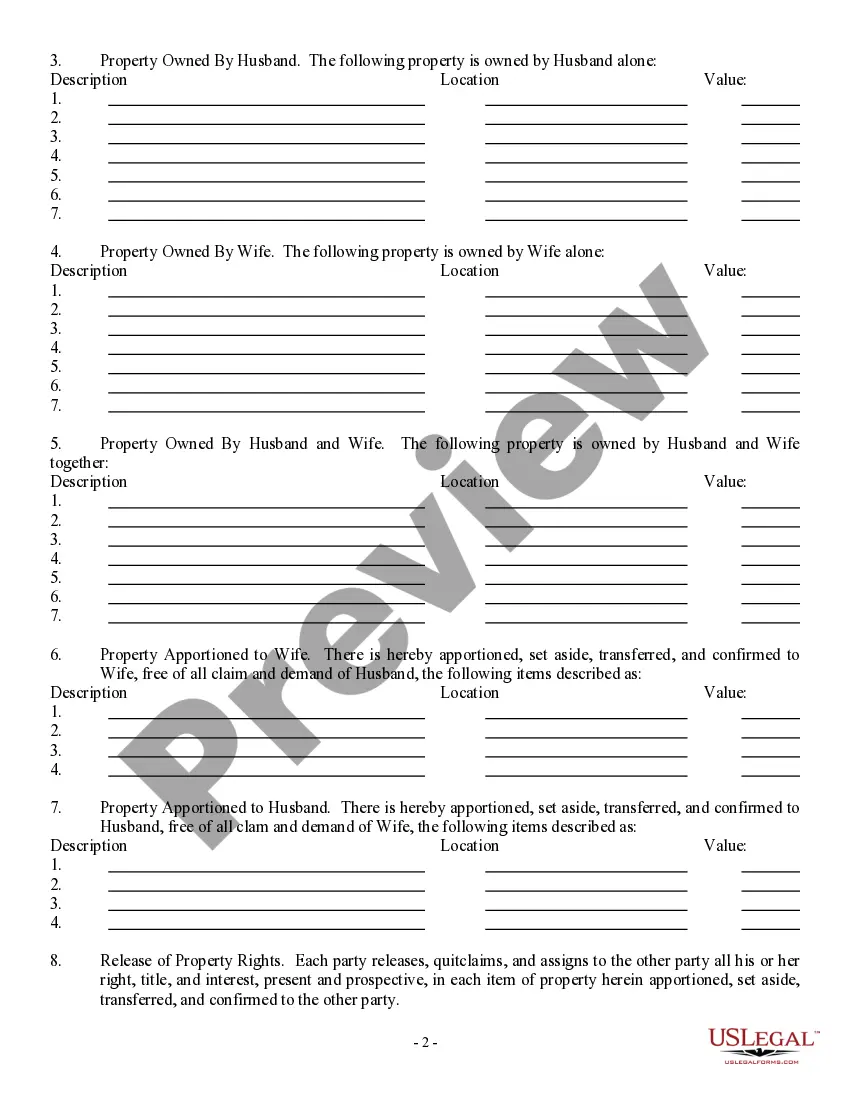

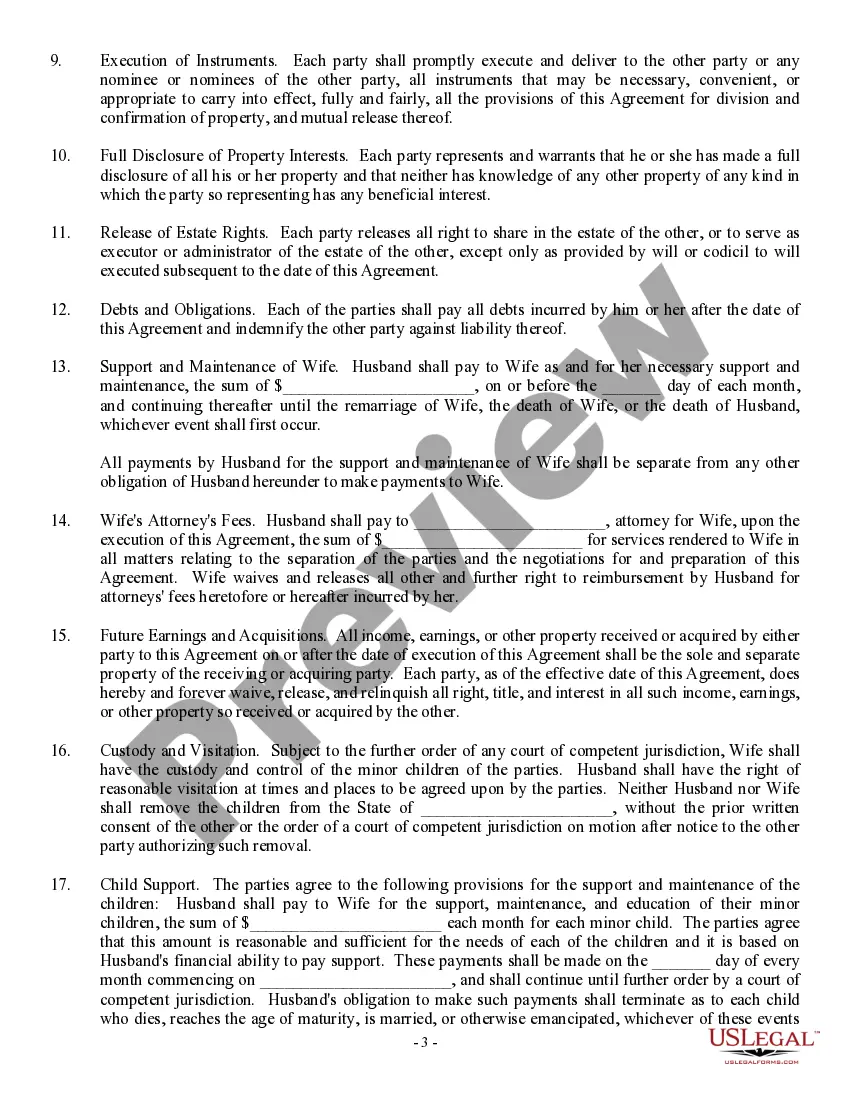

How to fill out Separation Agreement, Property Settlement, Support And Custody Agreement?

Utilizing legal document examples that adhere to national and regional regulations is crucial, and the internet provides numerous choices to select from.

However, what’s the benefit of squandering time hunting for the suitable Acuerdo De Separación Matrimonial template online when the US Legal Forms digital repository already contains such documents gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for any commercial and personal situation. They are easy to navigate with all paperwork categorized by state and intended use.

Explore another sample using the search feature at the top of the page if needed. Click Buy Now once you’ve found the appropriate form and select a subscription plan. Create an account or sign in and process a payment via PayPal or a credit card. Choose the format for your Acuerdo De Separación Matrimonial and download it. All templates you find through US Legal Forms are reusable. To redownload and complete previously saved documents, access the My documents section in your profile. Take advantage of the most extensive and user-friendly legal paperwork service!

- Our experts keep up with legal modifications, so you can always trust that your documents are current and compliant when acquiring an Acuerdo De Separación Matrimonial from our site.

- Acquiring an Acuerdo De Separación Matrimonial is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the necessary document sample in your desired format.

- If you are new to our platform, follow the steps below.

- Examine the template utilizing the Preview feature or through the text description to verify it meets your requirements.

Form popularity

FAQ

The two most obvious signs of a potential debt relief scam are: They Contact You First. If you receive an unsolicited call or contact from someone offering to help you eliminate your debt, be extra cautious. ... They Ask for Fees Upfront. ... Credit Counseling. ... Debt Consolidation. ... Debt Settlement.

Debt relief companies, sometimes called debt settlement companies, are one option for those struggling with credit card debt, tax debt, personal loan debt, and other types of unsecured debt. These companies can help you manage certain types of debt, but they won't be the right solution for everyone.

InCharge provides free, nonprofit credit counseling and debt management programs to Massachusetts residents. If you live in Massachusetts and need help paying off your credit card debt, InCharge can help you.

Massachusetts laws The statute of limitations for consumer-related debt is six years.

You enroll in the program through a credit counseling organization. They help you find a monthly payment you can afford and then work with your creditors to reduce or eliminate interest.

While there isn't a specific government debt relief program solely for credit card debts, various options exist to manage and reduce your debt. These options, such as credit counseling and debt management programs, are available for different types of debts, including credit card debts.

Yes, your scores are likely to drop after you settle the debt, but you can start working to increase your credit scores right away. If you're not sure where to start, a nonprofit credit counselor can help you explore options, including a debt management plan.

You can sue the debt collector for violating the FDCPA. If you sue under the FDCPA and win, the debt collector must generally pay your attorney's fees and may also have to pay you damages. If you're having trouble with debt collection, you can submit a complaint with the CFPB.