Example Of Personal Loan Agreement

Description

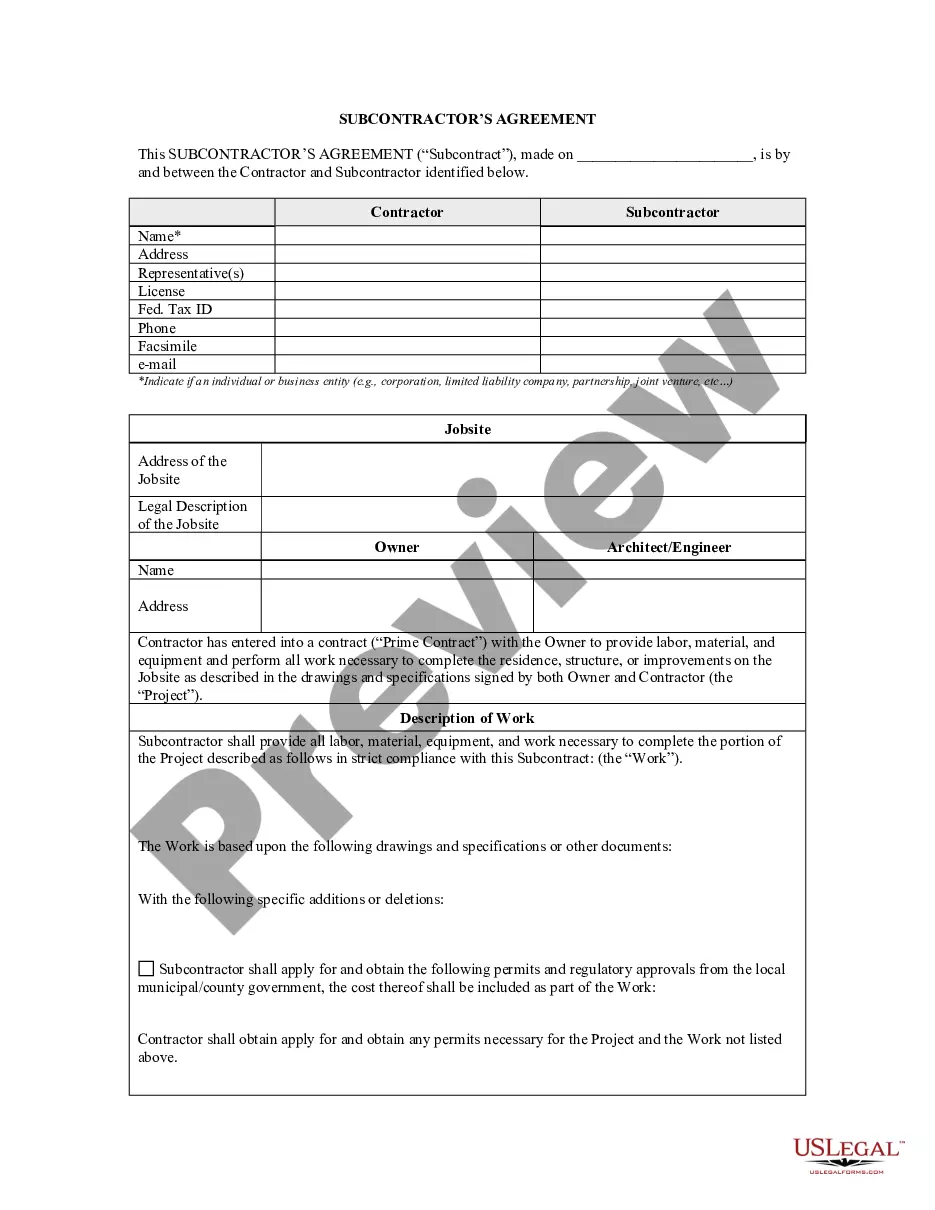

How to fill out Consumer Loan Application - Personal Loan Agreement?

The Sample Personal Loan Agreement displayed on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal scenarios.

Reuse your document whenever necessary. Access the 'My documents' section in your profile to redownload any previously purchased documents. Subscribe to US Legal Forms to have authenticated legal templates for every circumstance ready at your convenience.

- Search for the document you require and review it.

- Browse through the example you searched and view it or read the form description to ensure it meets your needs. If it doesn’t, utilize the search function to find the appropriate one. Click 'Purchase Now' when you have found the template you seek.

- Select a pricing plan that aligns with your needs and set up an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Choose the format you prefer for your Sample Personal Loan Agreement (PDF, DOCX, RTF) and save the document onto your device.

- Print the template to fill it out by hand. Alternatively, engage an online versatile PDF editor to quickly and efficiently complete and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

In order to make your South Carolina Health Care Power of Attorney legal, you must sign and date it or acknowledge your signature in the presence of two witnesses.

The specific requirements and restrictions for PoA forms will vary in each state; however, in South Carolina, your Power of Attorney will require notarization and the signatures of two witnesses. If your agent will manage real estate transactions, the Power of Attorney must be notarized and recorded with your county.

The specific requirements and restrictions for PoA forms will vary in each state; however, in South Carolina, your Power of Attorney will require notarization and the signatures of two witnesses. If your agent will manage real estate transactions, the Power of Attorney must be notarized and recorded with your county.

A South Carolina General (Financial) Power of Attorney Form provides a person to grant the power to act on their behalf in broad financial matters to another party. This Agent can act with Powers similar to those delivered through a durable power document.

Filing the Power of Attorney You can mail a paper copy of the completed SC2848 to PO Box 125, Columbia, SC 29214-0400. If you have a tax matter pending (such as an audit) you can mail, email, or fax the SC2848 to the SCDOR division that is handling the tax matter.

Steps for Making a Financial Power of Attorney in South Carolina Create the POA Using Software or an Attorney. ... Sign the POA in the Presence of Two Witnesses and Get It Notarized. ... File a Copy With the Land Records Office. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact.

A South Carolina Tax Power of Attorney (Form SC-2848) or ?Department Of Revenue Power Of Attorney And Declaration Of Representative? is a required submission when you wish to grant someone with the authority to act on your behalf when dealing with the South Carolina Department of Revenue.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.