Foreclosure Homes

Description

How to fill out Petition To Enjoin Foreclosure Sale And Seeking Ascertainment Of Amount Owed On Note And Deed Of Trust?

- If you are a returning user, login to your account and download the necessary form template by clicking the Download button. Ensure your subscription is active; renew it if necessary.

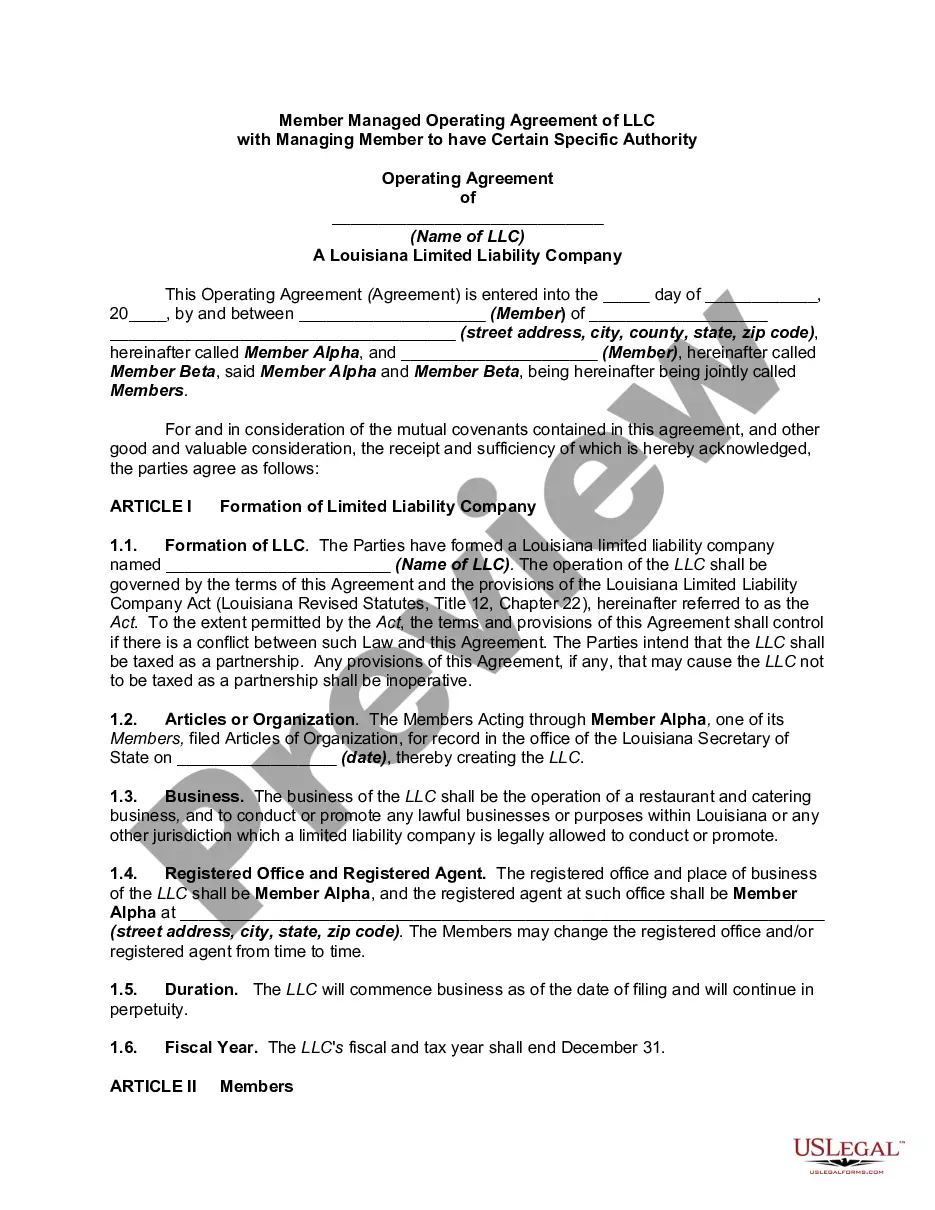

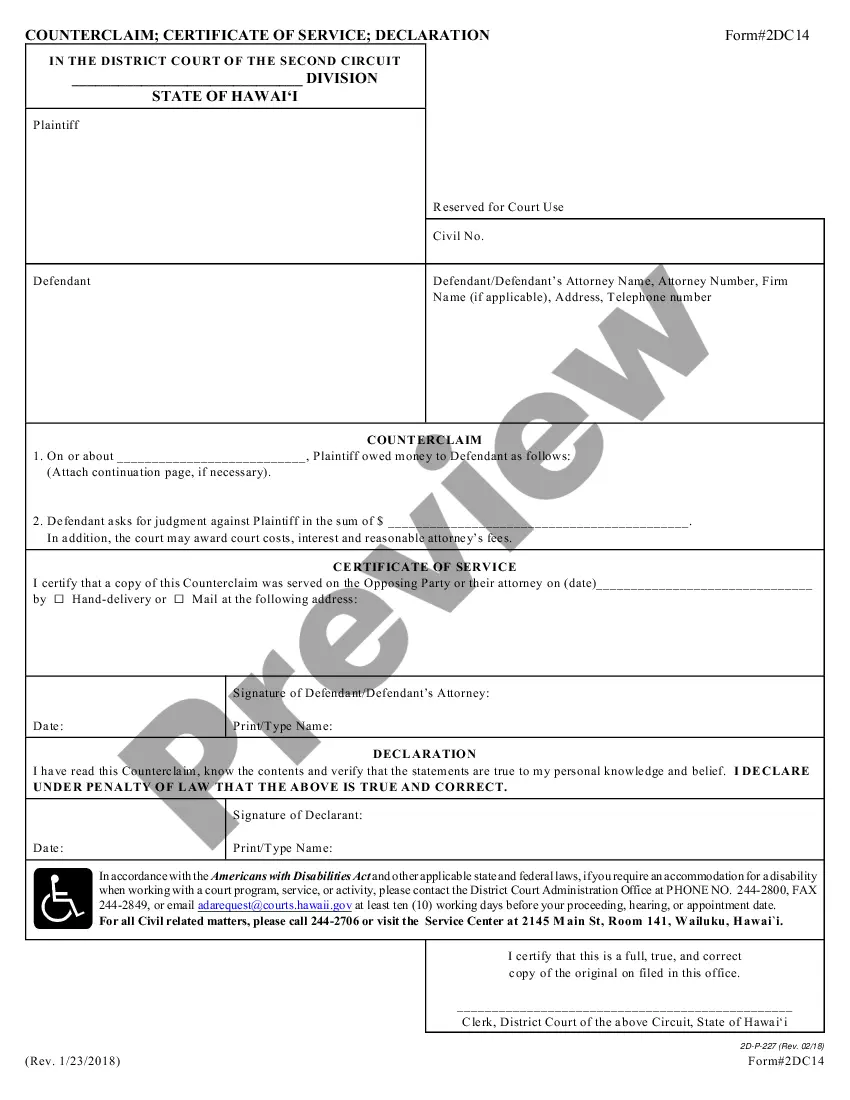

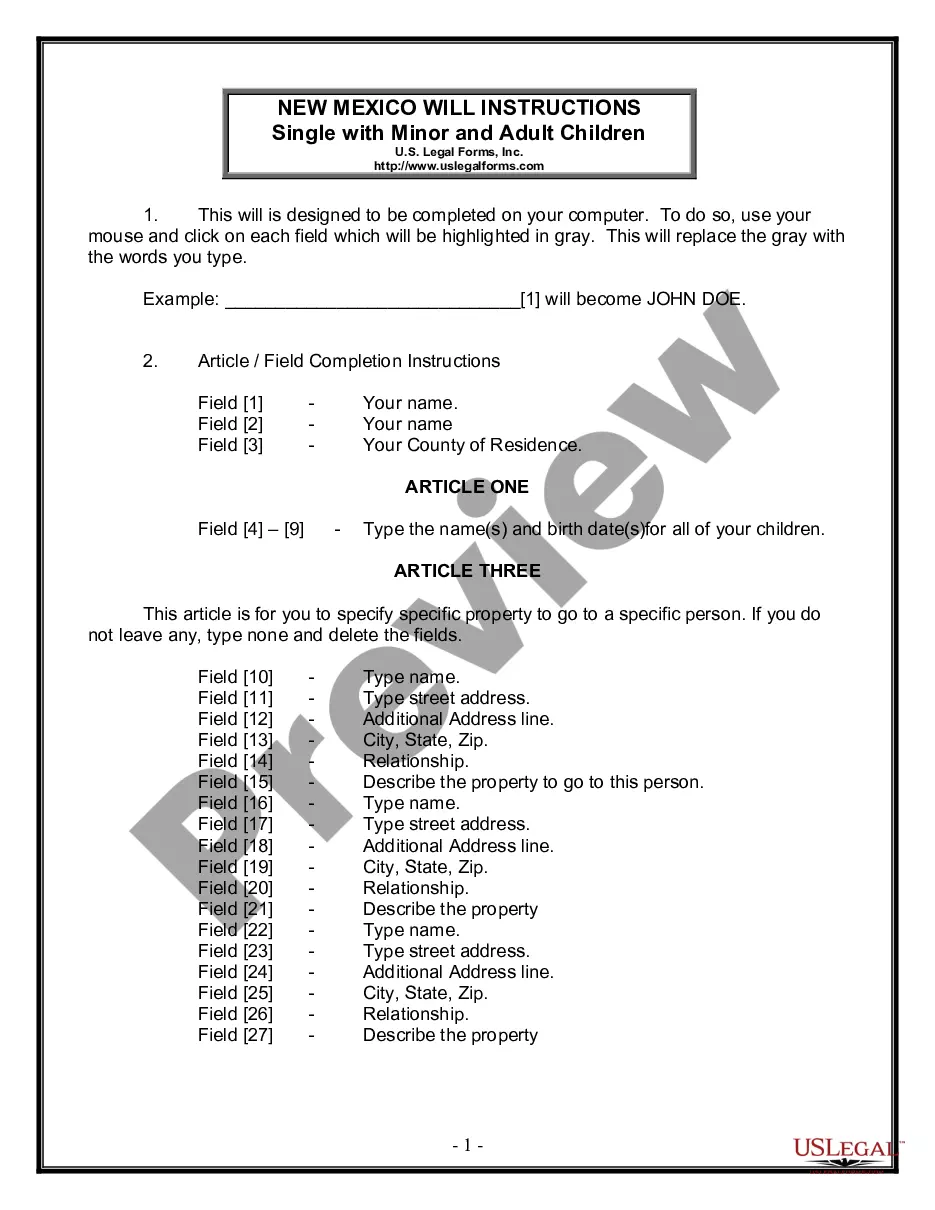

- For first-time users, start by checking the Preview mode and form descriptions. Confirm you've selected the template that meets your specific requirements and local jurisdiction standards.

- If you identify discrepancies, use the Search tab to find an appropriate form. Once you find a suitable template, proceed to the next step.

- Purchase the document by clicking the Buy Now button, and select your preferred subscription plan. You'll need to create an account to access the library's resources.

- Complete your payment using a credit card or PayPal. After successful payment, download your form to your device.

- Access your downloaded document anytime from the My Forms section in your profile to complete it and keep it on hand.

In conclusion, US Legal Forms not only provides an extensive collection of over 85,000 legal forms but also empowers users to navigate their legal needs effortlessly. With access to premium experts, you can ensure that your documents are accurate and legally sound.

Start securing your foreclosure homes documentation today by visiting US Legal Forms!

Form popularity

FAQ

Purchasing foreclosure homes in NYC involves several steps to ensure a smooth transaction. Start by researching properties through online listings and attending local auctions. You can also collaborate with experienced real estate agents who specialize in foreclosures. Once you find a property, conduct thorough inspections and prepare your financing to make a competitive offer, ensuring you understand the legal implications of buying foreclosed homes.

Many realtors consider foreclosure homes to be challenging transactions. These properties often require extensive repairs, and negotiations can be more complex. Additionally, selling foreclosure homes typically takes longer, as they may involve dealing with banks and auction processes. Despite these challenges, skilled realtors can still help buyers navigate the process effectively.

Buying foreclosure homes can be a smart financial decision. These properties often sell at below market value, providing you with a chance to invest in real estate with lower upfront costs. However, potential buyers should carefully evaluate the condition of the property and understand the risks involved. With the right approach and thorough research, foreclosure homes can offer excellent value.

When considering how low to offer on foreclosure homes, it's wise to start with a competitive yet realistic bid. Analyze comparable sales in the area to gauge the property's value and condition. Often, bids at 70% or lower than market value can be appealing to sellers. Utilizing platforms like uslegalforms can provide crucial documentation to help streamline your offer process.

The basic requirement for foreclosure typically involves the homeowner defaulting on their mortgage payments. Lenders must legally notify the homeowner and provide an opportunity to rectify the situation before proceeding. Specific requirements can vary by state, making it important to understand the local laws and regulations. By learning about foreclosure homes, you can make informed decisions in the event of a property default.

Buying foreclosure homes may seem daunting, but it can be manageable with the right approach. You need to research properties thoroughly and often be prepared for competitive bidding. Buyers should also consider potential repairs and hidden costs associated with these homes. With careful planning and the right resources, you can successfully navigate this market.

When purchasing foreclosure homes, the down payment requirements can vary. Typically, a buyer might need to put down anywhere from 3% to 20% depending on the lender's policies and the property's condition. It’s crucial to be prepared for additional costs such as repairs and closing fees. Conducting thorough research allows you to budget effectively for your investment.

The foreclosure process in Ohio typically begins when a homeowner fails to make mortgage payments. Lenders must file a lawsuit to initiate foreclosure proceedings, and homeowners receive legal notice of the action. After a court's decision, the property can be sold at a public auction. Understanding foreclosure homes in Ohio helps you navigate this complex process and protect your interests.

The speed at which a house can be foreclosed depends on state regulations and the specific circumstances of the mortgage. Generally, foreclosures can occur as quickly as a few months after the first missed payment. Being proactive can make a difference in managing potential foreclosure homes, so knowing your options and acting sooner is beneficial. Uslegalforms can assist by providing forms and resources to empower you during this critical time.

The six phases of foreclosure typically include default, notice of default, notice of sale, auction, redemption period, and final sale. Each phase has specific timeframes and requirements that vary by state. Familiarity with these phases is vital for homeowners to understand what to expect if they face foreclosure homes. If you require more detailed guidance, uslegalforms can offer solutions tailored to your situation.