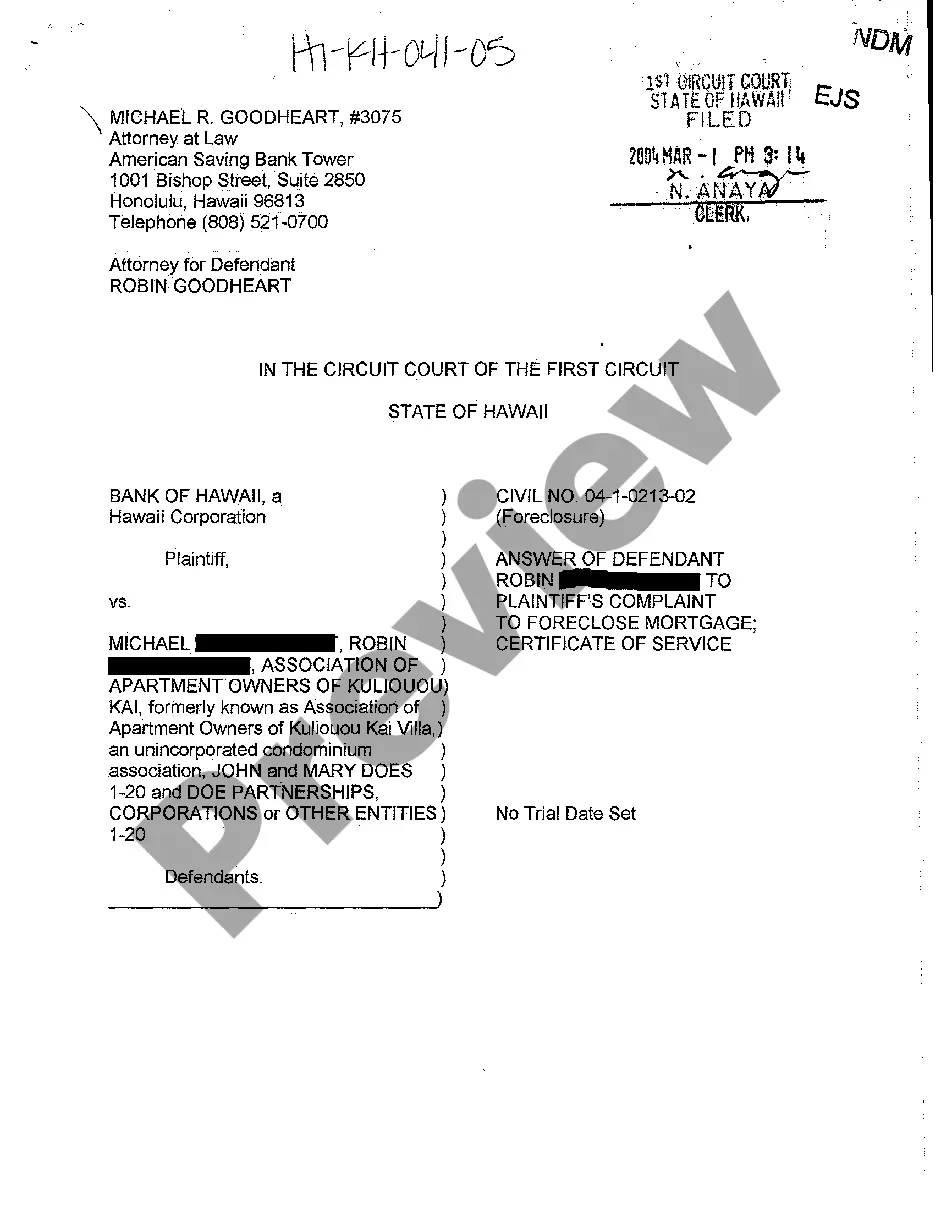

Certificate Template Completion Of Training

Description

How to fill out Certification Of Completion By Contractor?

Handling legal documents and activities can be a labor-intensive addition to your schedule.

Certificate Template Completion Of Training and similar forms generally necessitate that you look for them and comprehend the most effective method to finish them correctly.

Consequently, if you are managing financial, legal, or personal issues, possessing a comprehensive and functional online repository of forms on hand will be significantly beneficial.

US Legal Forms is the leading online resource for legal templates, containing over 85,000 state-specific documents and various tools to help you complete your forms effortlessly.

Is this your initial experience with US Legal Forms? Register and create your account in just a few minutes, and you will have access to the form library and Certificate Template Completion Of Training. Then, follow the steps outlined below to finish your form.

- Browse the collection of relevant documents available to you with a simple click.

- US Legal Forms provides you with state- and county-specific templates available for download at any time.

- Protect your document management procedures using a high-quality service that enables you to prepare any form in minutes without additional or concealed fees.

- Just Log In to your account, find Certificate Template Completion Of Training, and get it instantly from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

It costs $20 to reserve a business name in Vermont. Business name reservations are usually used by people who have the perfect name for their business, but aren't yet ready to register their business with the state. You can file an Entity Name Reservation form online with Vermont's Corporation's Division.

Filing as an S Corp in Vermont Step 1: Choose a Business Name. ... Step 2: Appoint Directors and a Registered Agent. ... Step 3: File Articles of Organization. ... Step 4: Create an S Corp Operating Agreement. ... Step 5: Apply for an Employer Identification Number. ... Step 6: File Form 2553 for S Corporation Election.

To start a corporation in Vermont, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State, Corporations Division. You can file this document online or by mail. The articles cost $125 to file.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes.

Zero Income Tax: If you register a new business in Vermont as an S Corporation, you can benefit from the fact that there will be no income taxes levied and an S corporation income or loss will be passed through to the stockholders. It is also important to know that there are a few exceptions.

If you plan to sell tangible personal property, rent rooms, sell meals and/or alcohol, or hire employees, you must register for a business tax account before doing business. Each tax type?Vermont Sales and Use Tax, Vermont Meals and Rooms Tax, and Vermont Withholding Tax?requires a separate account.

How much does it cost to form an LLC in Vermont? The Vermont Secretary of State charges $125 to file the Articles of Organization. You can reserve your LLC name with the Vermont Secretary of State for $20.

The fee for forming a Vermont LLC is $125. You'll also need to pay $35 every year to file Vermont's Annual Report. These are the two main costs for forming an LLC in the Green Mountain State.