Provider Workers Insurance For Contractors

Description

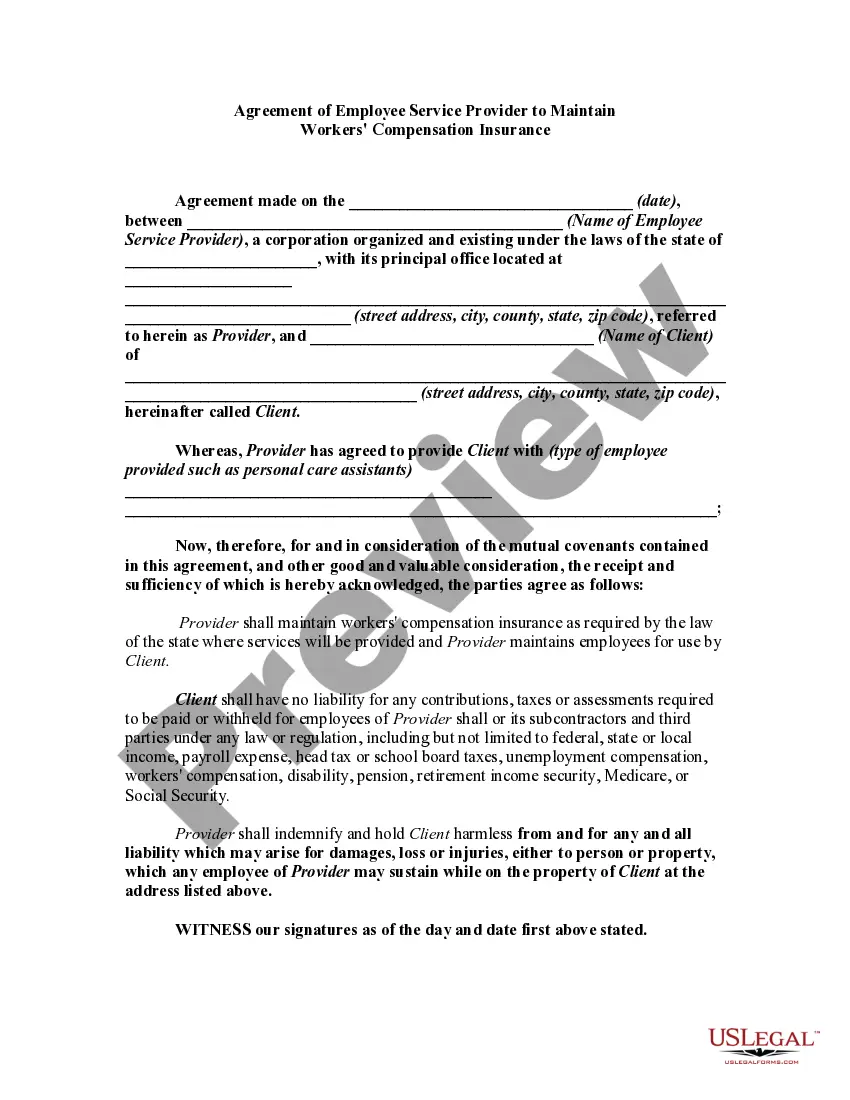

How to fill out Agreement Of Employee Service Provider To Maintain Workers Compensation Insurance?

Acquiring legal document samples that align with federal and state regulations is essential, and the internet provides numerous options to select from.

However, why spend time searching for the accurately composed Provider Workers Insurance For Contractors sample online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 customizable templates crafted by attorneys for various professional and personal situations.

Review the template using the Preview option or through the text outline to confirm it meets your requirements.

- They are straightforward to navigate, with all documents categorized by state and intended purpose.

- Our experts stay updated with regulatory changes, so you can feel assured that your documents are current and compliant when obtaining a Provider Workers Insurance For Contractors from our site.

- Acquiring a Provider Workers Insurance For Contractors is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you require in the appropriate format.

- If you're new to our site, follow the guidelines below.

Form popularity

FAQ

As a contractor, you typically need several types of insurance to protect your business and meet client requirements. Provider workers insurance for contractors is essential, as it covers potential injuries on the job. You may also consider liability insurance, which protects against claims of negligence, and property insurance, which covers your tools and equipment. Assess your specific needs to determine the best coverage for your individual situation.

Yes, you may still need workers' compensation insurance even if you hire 1099 employees. While 1099 workers are technically independent contractors, some states require coverage to protect your business against workplace injuries. Provider workers insurance for contractors offers peace of mind, ensuring that you are prepared for any unexpected incidents that may occur on the job. It’s always best to check your state’s regulations to ensure compliance.

If a contractor does not have workers' compensation insurance, they risk facing severe legal penalties and financial liabilities. Injured workers may seek compensation through lawsuits, putting the contractor's business at risk. It is essential to invest in provider workers insurance for contractors to avoid these issues while providing indispensable support to your workforce.

A few states do not mandate workers' compensation insurance, like Texas and South Carolina, but even in those areas, it's wise to consider obtaining coverage. These exemptions might not apply to all types of workers or jobs, so it’s crucial to understand the specifics of your situation. At uslegalforms, you can find solutions to help navigate the complexities of provider workers insurance for contractors, ensuring you remain compliant and protected.

Workers' compensation insurance is indeed required for many businesses in Arizona. This coverage helps protect both employees and employers from the financial impact of workplace accidents. For contractors, acquiring provider workers insurance for contractors is a critical step in meeting legal obligations and ensuring worker safety.

Yes, Arizona is a mandatory insurance state when it comes to workers' compensation. Employers must carry this insurance to safeguard their workers against workplace injuries. Therefore, obtaining provider workers insurance for contractors is not just advisable, it is a legal requirement to operate confidently in Arizona.

Yes, Arizona requires employers to have workers' compensation insurance, especially for contractors. This insurance protects workers in the event of job-related injuries or illnesses. By securing provider workers insurance for contractors, you ensure compliance with state laws and provide essential coverage for your team.

In Hawaii, certain groups are exempt from workers' compensation requirements, including sole proprietors and certain partners. Small businesses may also have specific exemptions depending on their structure. It is crucial to understand these regulations to avoid compliance issues. Consulting with uslegalforms can help clarify the exemptions applicable to your situation, ensuring you stay informed.

A contractor should carry several types of insurance, including general liability and workers' compensation insurance. Provider workers insurance for contractors often also includes tools and equipment insurance, as well as professional liability insurance for protection against errors. This comprehensive coverage helps manage financial risks and ensures that contractors can operate smoothly. Assessing your needs can guide you in selecting the right policies.

Ensure your contractor has general liability insurance and workers' compensation insurance as a minimum. Provider workers insurance for contractors also may include professional liability insurance, especially for specialized work. This insurance coverage protects you from potential claims and liabilities stemming from their work. Confirming these policies can help safeguard your project.