Statute Barred For Dummies

Description

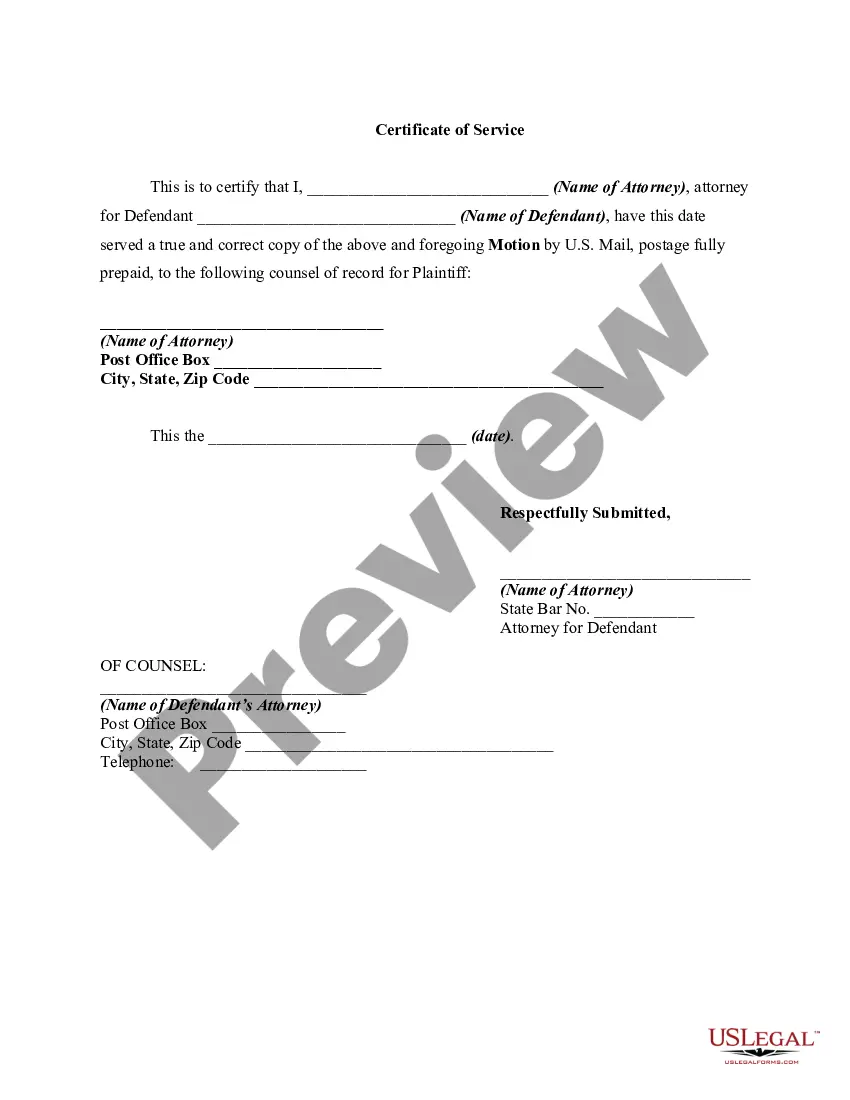

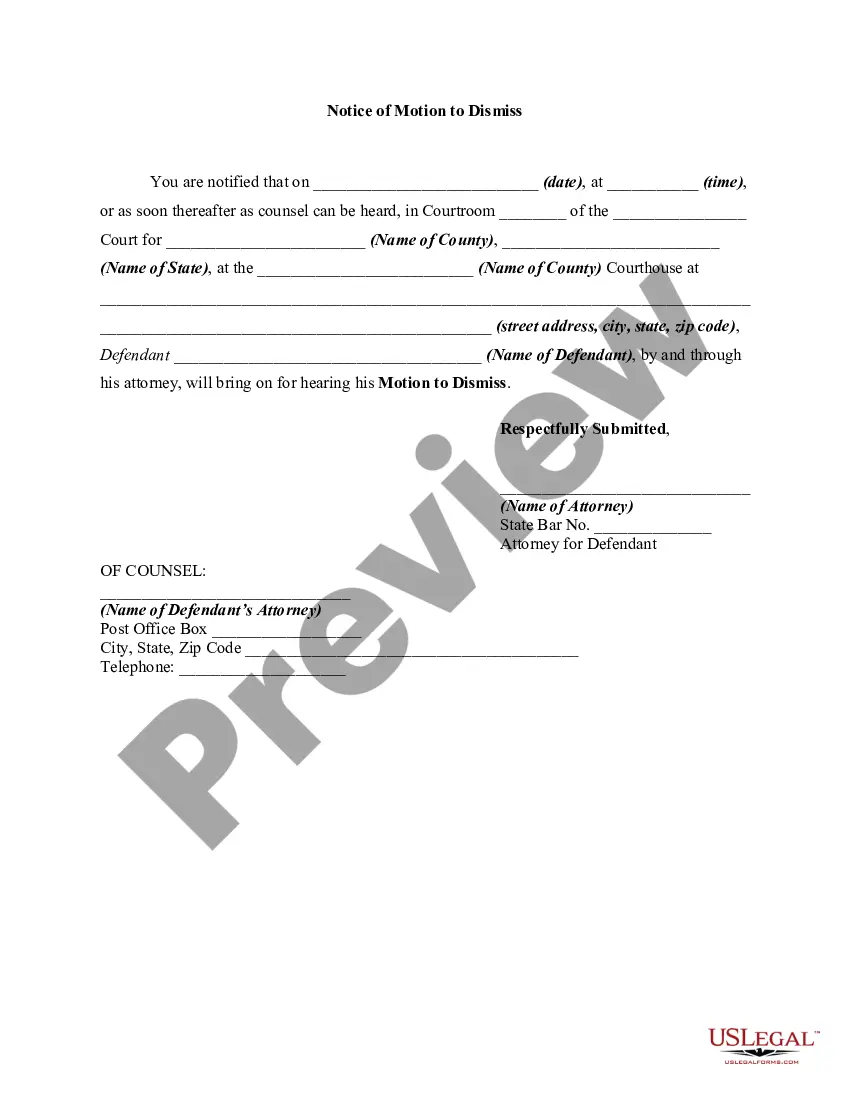

How to fill out Motion To Dismiss Action With Prejudice Of Plaintiff's Cause Of Action Barred By Statute Of Limitations?

Managing legal documents can be daunting, even for the most experienced professionals.

When you are looking for a Statute Barred For Dummies and lack the time to search for the accurate and updated version, the process can be stress-inducing.

Access a wealth of articles, tutorials, handbooks, and resources pertinent to your circumstances and needs.

Save time and effort hunting for the forms you require, and leverage US Legal Forms’ sophisticated search and Review tool to find Statute Barred For Dummies and download it.

Enjoy the benefits of the US Legal Forms web library, supported by 25 years of experience and reliability. Transform your everyday document management into a seamless and user-friendly experience today.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously saved and organize your folders as needed.

- If this is your first time with US Legal Forms, create a free account and get unlimited access to all the platform's features.

- After accessing the form you need, ensure it is the correct one by previewing it and reviewing its description.

- Verify that the sample is recognized in your state or county.

- Click Buy Now once you are ready.

- Select a subscription plan.

- Choose the file format you require, and Download, complete, eSign, print, and send out your document.

- Take advantage of state- or county-specific legal and business forms.

- US Legal Forms meets any requirements you might have, from personal to business documentation, all in one spot.

- Utilize advanced tools to complete and manage your Statute Barred For Dummies.

Form popularity

FAQ

Typically, time-barred debts will still appear on your credit report, but they may not be enforceable. It's possible to dispute the debt with the credit bureaus, especially if it's beyond the time frame set by the statute of limitations. However, having it removed may require more steps, such as proving its status. Familiarizing yourself with 'Statute barred for dummies' can guide you through this process effectively.

When dealing with a debt collector about a time-barred debt, it's crucial to communicate clearly. Start by requesting proof that the debt is valid, while also stating that the debt is beyond the statute of limitations. This approach can often discourage collectors from pursuing payments. Remember, knowing your rights with 'Statute barred for dummies' can enhance your confidence in these discussions.

There are ways to address the statute of limitations, primarily through legal exceptions or defenses. Understanding these nuances can help you effectively manage your legal rights. For clear explanations tailored to your needs, check out US Legal Forms, which breaks down statutes and offers help for those looking into statute barred for dummies.

A debt becomes uncollectible when it exceeds the statute of limitations, indicating that creditors can no longer take legal action to recover it. This timeframe can vary but generally lasts between three to six years based on state law. Understanding when your debt is considered uncollectible allows you to focus on more pressing financial matters. For further clarification on these terms and to gain practical insights, consider using resources available through US Legal Forms.

Creditors typically have a limited timeframe in which they can sue you for unpaid debt, usually ranging from three to six years, depending on your state laws. Once this timeframe expires, the debt becomes statute barred, meaning they cannot legally pursue you for payment. Knowing these timelines helps you protect your rights and manage your debts effectively. Education on such matters can be enriched through useful resources available on platforms like US Legal Forms.

A debt is considered time barred when the creditor has not pursued legal action within the time limits established by law. This time varies by state but generally spans several years, after which the debtor can defend against any future claims. If you wish to grasp these concepts clearly, learning about the statute barred process can empower you to reclaim your financial freedom. Utilizing platforms like US Legal Forms can provide educational materials on these vital topics.

One way to address your debts without paying them directly is by understanding the concept of being statute barred. When a debt is statue barred, it means that creditors can no longer take legal action to collect it due to the time limits set by law. By familiarizing yourself with this concept, you can explore your options for resolving debt effectively. Platforms like US Legal Forms can provide resources that help you navigate these situations.

To prove that a debt is time-barred, you need to establish when the statute of limitations began and the date it expired. This often involves gathering documentation to show the original debt agreements and any payments made. Understanding the law surrounding these time limits is crucial, especially if you face a lawsuit. The term 'statute barred for dummies' serves as a helpful guide to navigate these complex issues.

Being barred by the statute of limitations means that a legal claim cannot be enforced due to the passage of time. Once the statute of limitations expires, creditors lose their right to take legal action concerning the debt. This concept is critical to understand, especially for individuals dealing with old debts. If you're curious about how this works, the phrase 'statute barred for dummies' can help demystify it.

In many states, a debt becomes uncollectible after a specific period, often ranging from three to six years. This period is defined by the statute of limitations, which varies by state and type of debt. Essentially, after this time, creditors can no longer sue to collect the debt. For those looking to understand, 'statute barred for dummies' simplifies this concept, making it easier to grasp.