Deed Of Partition In Uk For A Trust Without A Lawyer

Description

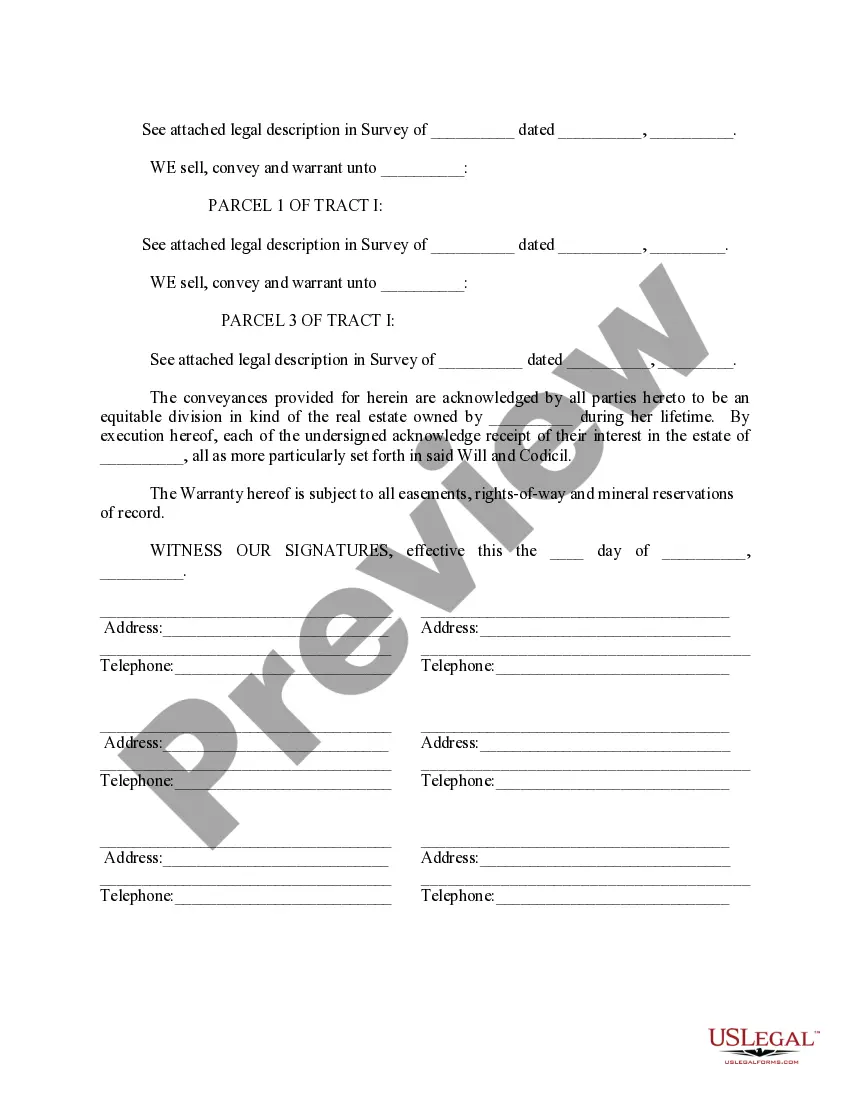

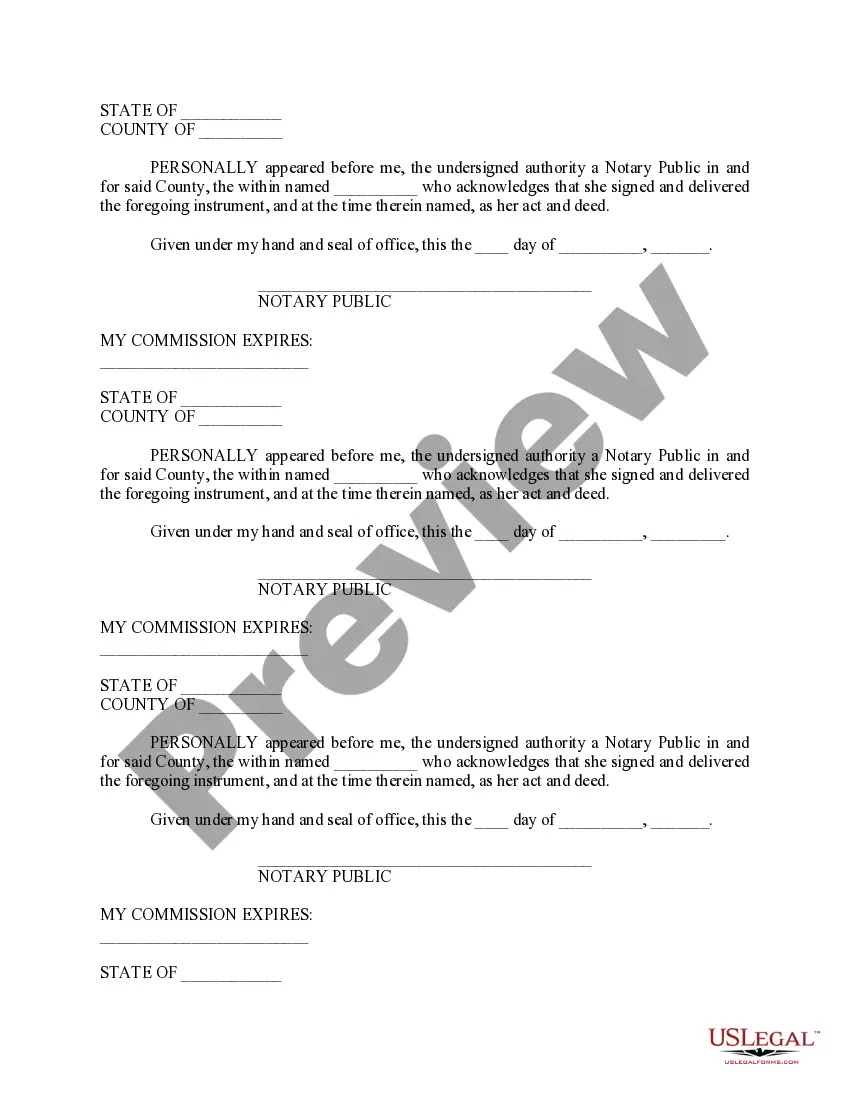

How to fill out Partition Warranty Deed?

Individuals typically link legal documentation with complexity that only an expert can handle.

In some aspect, this is accurate, as creating a Deed Of Partition In Uk For A Trust Without A Lawyer requires significant knowledge of the subject matter, encompassing state and local laws.

However, with US Legal Forms, the process has become simpler: pre-prepared legal documents for any personal or business situation tailored to state statutes are gathered in a single online repository and are now accessible to everyone.

Complete registration for an account or Log In to move forward to the payment section. Process payment for your subscription using PayPal or via your credit card. Choose the file format and click Download. Print your document or upload it to an online editor for a faster completion. All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them whenever required through the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents categorized by state and usage area, making it quick to locate a Deed Of Partition In Uk For A Trust Without A Lawyer or any other specific template.

- Existing users with an active subscription must Log In to their account and select Download to obtain the form.

- New users on the platform will need to first create an account and subscribe before they can retrieve any legal documentation.

- Here is the procedure to obtain the Deed Of Partition In Uk For A Trust Without A Lawyer.

- Carefully examine the content of the page to confirm it meets your requirements.

- Review the form description or inspect it through the Preview option.

- If the previous document isn’t suitable, search for another example using the Search bar at the top.

- Select Buy Now once you identify the proper Deed Of Partition In Uk For A Trust Without A Lawyer.

- Pick a pricing plan that aligns with your necessities and financial considerations.

Form popularity

FAQ

To obtain a deed of trust in the UK, you can follow a straightforward process that does not require a lawyer. First, you should gather all the necessary details about the property and the parties involved. Next, use online resources like USLegalForms, which offer templates for creating a deed of partition in the UK for a trust without a lawyer. Completing the required forms and ensuring they meet legal standards will help you achieve your goal efficiently.

One of the biggest mistakes parents make when establishing a trust fund is not communicating their intentions with involved family members. This lack of communication can create confusion and resentment among heirs. By utilizing a deed of partition in the UK for a trust without a lawyer, you can ensure that your wishes are clearly expressed and understood.

A significant mistake parents often make when setting up a trust fund in the UK is failing to clearly define the trust's purpose and terms. This lack of clarity can lead to misunderstandings or disputes among heirs. To avoid complications, consider using a deed of partition in the UK for a trust without a lawyer, ensuring that all details are transparent and documented.

Some downsides of trusts in the UK include potential legal complexities and ongoing administrative costs. Establishing a trust requires careful planning and may involve tax implications that could affect beneficiaries. When creating a deed of partition in the UK for a trust without a lawyer, awareness of these downsides can help you make informed decisions.

The average amount in a trust fund in the UK can vary significantly based on the type of trust and its purpose. However, many trust funds hold between £50,000 and £150,000. When drafting a deed of partition in the UK for a trust without a lawyer, it's essential to consider how much is necessary to meet the needs of your beneficiaries.

Trust funds can present several dangers, including mismanagement by trustees or lack of transparency regarding fund usage. Without proper supervision, trust funds might not be used for their intended purpose, potentially harming beneficiaries. Understanding these risks is crucial when considering a deed of partition in the UK for a trust without a lawyer.

A deed of trust becomes legally binding in the UK when it is executed as a formal document, signed by all parties involved, and witnessed correctly. It must specify the terms of the trust, including the responsibilities of trustees and beneficiaries. When you create a deed of partition in the UK for a trust without a lawyer, ensure the document meets all legal requirements to avoid future disputes.

A deed of trust in the UK does not have a predetermined expiration date, as it generally lasts until the trust assets are distributed or the terms are fulfilled. For a deed of partition in UK for a trust without a lawyer, it is essential to stipulate the duration within the trust document itself. Regularly reviewing the trust's terms ensures it continues to align with your goals and the interests of the beneficiaries.

To obtain a trust deed in the UK, you typically begin by drafting a trust document that outlines the terms and beneficiaries involved. You can create this document independently or utilize a platform like USLegalForms for expert guidance. Once the deed is drafted, consider whether you want it registered, especially if it relates to a deed of partition in UK for a trust without a lawyer. This ensures clarity and protects your interests in the future.

While a trust deed can provide benefits, it also has disadvantages. One significant drawback is that it may limit your control over the assets included in the deed of partition in UK for a trust without a lawyer. Additionally, certain types of trust deeds might have tax implications that could affect your overall financial strategy. It's important to weigh these factors carefully before choosing a trust deed solution.