An Interpleader suit format refers to a legal procedure undertaken when multiple parties claim a right or interest over a particular amount of money or property. This situation may arise when an individual or organization is caught in the middle of conflicting claims and is uncertain about the rightful owner or recipient of the disputed funds or assets. The interpleader suit format allows the stakeholder, known as the "interpleader," to initiate a legal action to resolve the conflicting claims and avoid potential liability. The interpleader suit format typically involves the following crucial steps: 1. Filing of a Petition: The interpleader commences the process by filing a petition in the appropriate court. The petitioner usually requests the court's intervention to determine the rightful recipient of the disputed funds or assets. The interpleader suit is typically governed by specific rules and procedures outlined in the applicable jurisdiction's civil procedure code. 2. Statement of Facts: The petitioner presents a detailed statement of facts outlining the circumstances leading to the dispute. This includes a description of the nature of the funds or assets in question, any relevant agreements or documents, and a clear account of the conflicting claims made by the parties involved. 3. Summoning the Claimants: The court issues summonses to notify all parties to the dispute, also known as the claimants, about the interpleader suit and their inclusion in the proceedings. The claimants are required to respond within a specified time, usually by submitting a written response known as an answer or a formal reply. 4. Preliminary Hearing: After the claimants' responses are received, the court schedules a preliminary hearing. During this hearing, the court verifies the legitimacy of the conflicting claims and may allow each claimant to present their case. This initial hearing aims to determine if the claimants' assertions are genuine, substantial, and warrant proceeding with the interpleader suit. 5. Discovery Process: If the court decides to proceed, the discovery process begins, allowing the claimants to gather evidence, exchange relevant documents, and request testimonies from witnesses. This phase helps to establish a comprehensive understanding of the disputed funds or assets, evaluate the competing claims, and ascertain the merits of each claimant's case. 6. Final Hearing and Judgment: After the discovery process, a final hearing is conducted. During this hearing, the court reviews all evidence, witnesses' testimonies, legal arguments, and relevant laws to make a final determination on the rightful owner or recipient of the disputed funds or assets. The court's judgment usually includes specific directions for distributing the funds or assets and relieves the interpleader from further liability concerning the matter. Various jurisdictions may have specific types or variations of the interpleader suit format depending on their legal systems. Common types of interpleader suits include: 1. Statutory Interpleader: This type of interpleader suit is initiated under specific statutory provisions outlined in the procedural laws of a jurisdiction. It provides a clear framework for interpleader actions, ensuring a smooth and standardized process across similar cases. 2. Federal Interpleader: In certain situations, an interpleader suit may be filed in a federal court instead of a state court. This could occur when the disputed funds or assets involve interstate commerce, federal laws or regulations, or when the parties involved are from different states or countries. 3. Third-Party Interpleader: This type of interpleader suit can be initiated when a party who is not the original stakeholder, but rather a third party, claims an interest in the disputed funds or assets. In such cases, the third party may also request the court's intervention to resolve the conflicting claims and protect their interests. These types of interpleader suit provide flexibility for different scenarios and ensure a fair and orderly process for resolving disputes over the rightful ownership of funds or assets.

Interpleader Suit Format

Description

How to fill out Interpleader Suit Format?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Filling out legal documents requires careful attention, beginning from picking the appropriate form template. For example, if you pick a wrong edition of the Interpleader Suit Format, it will be turned down once you submit it. It is therefore important to get a reliable source of legal papers like US Legal Forms.

If you need to obtain a Interpleader Suit Format template, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Check out the form’s description to make sure it suits your situation, state, and county.

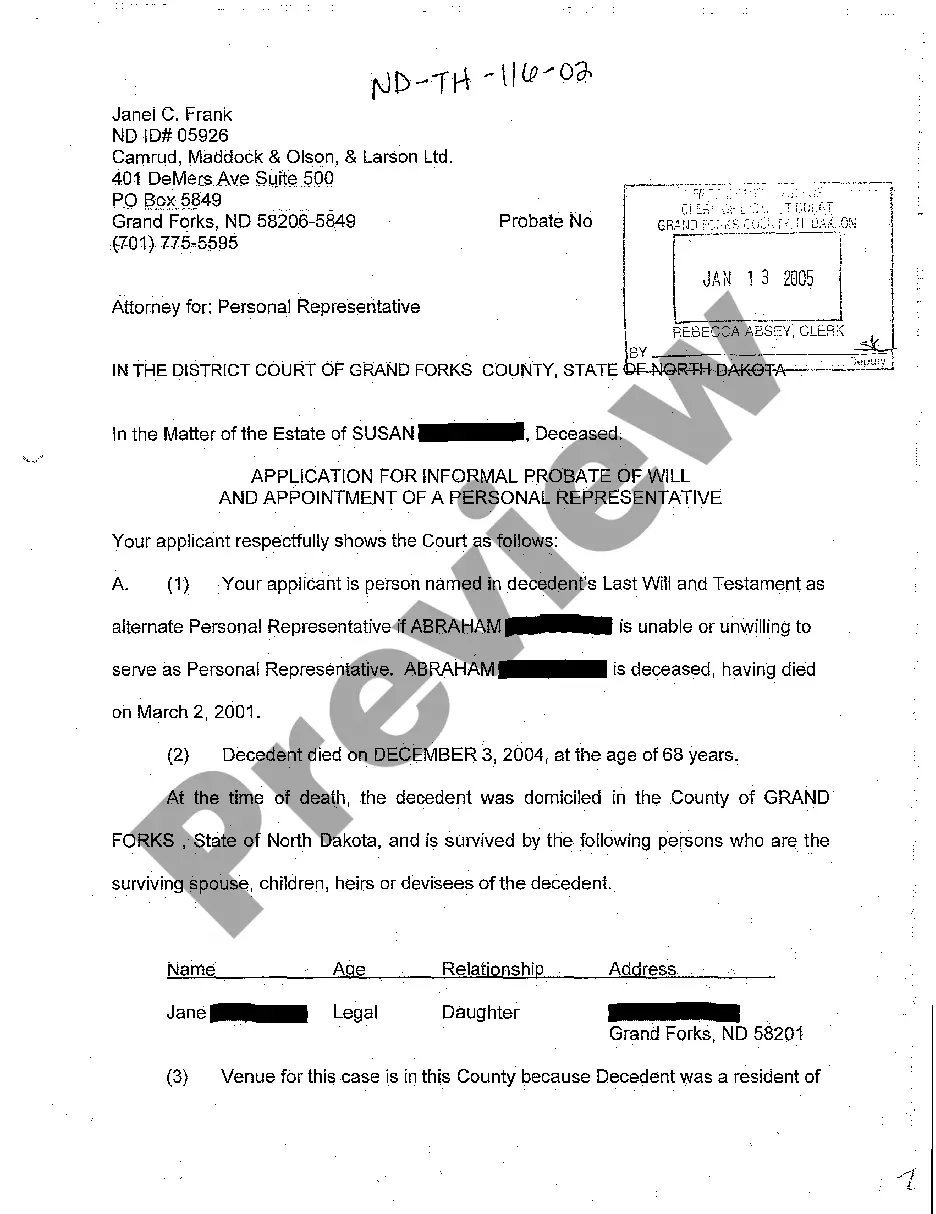

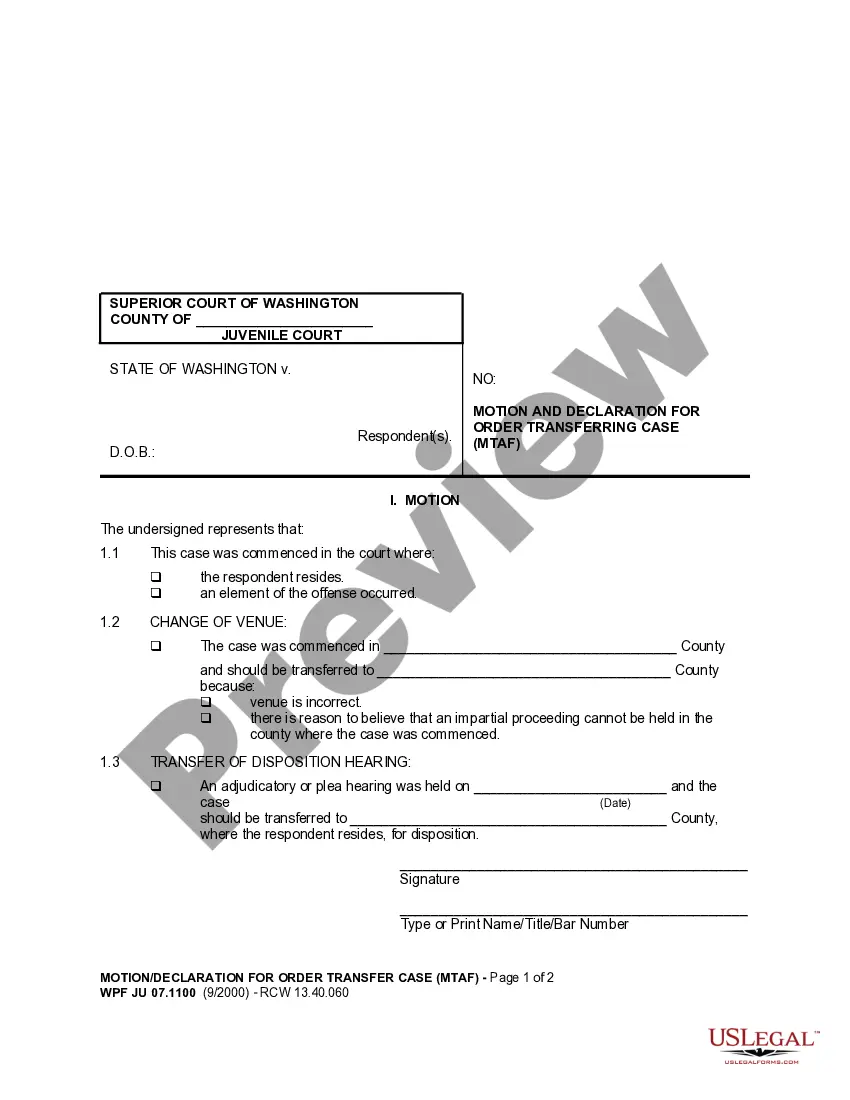

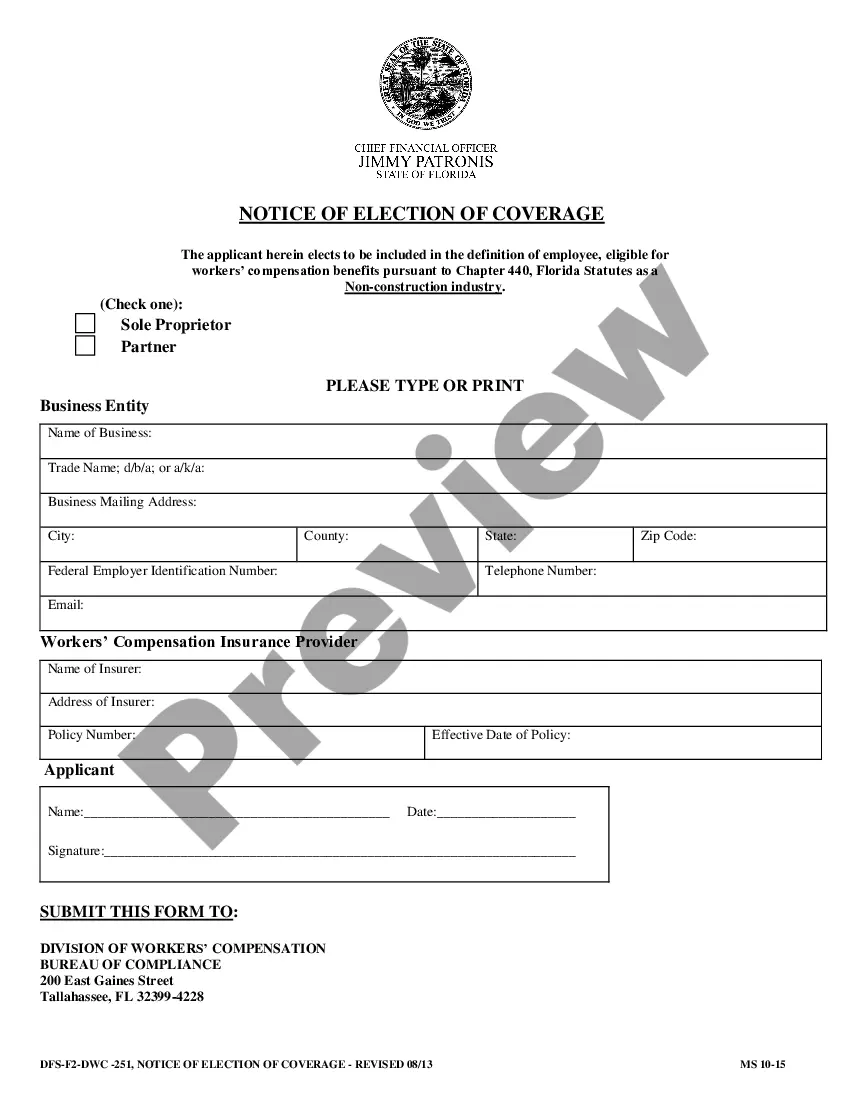

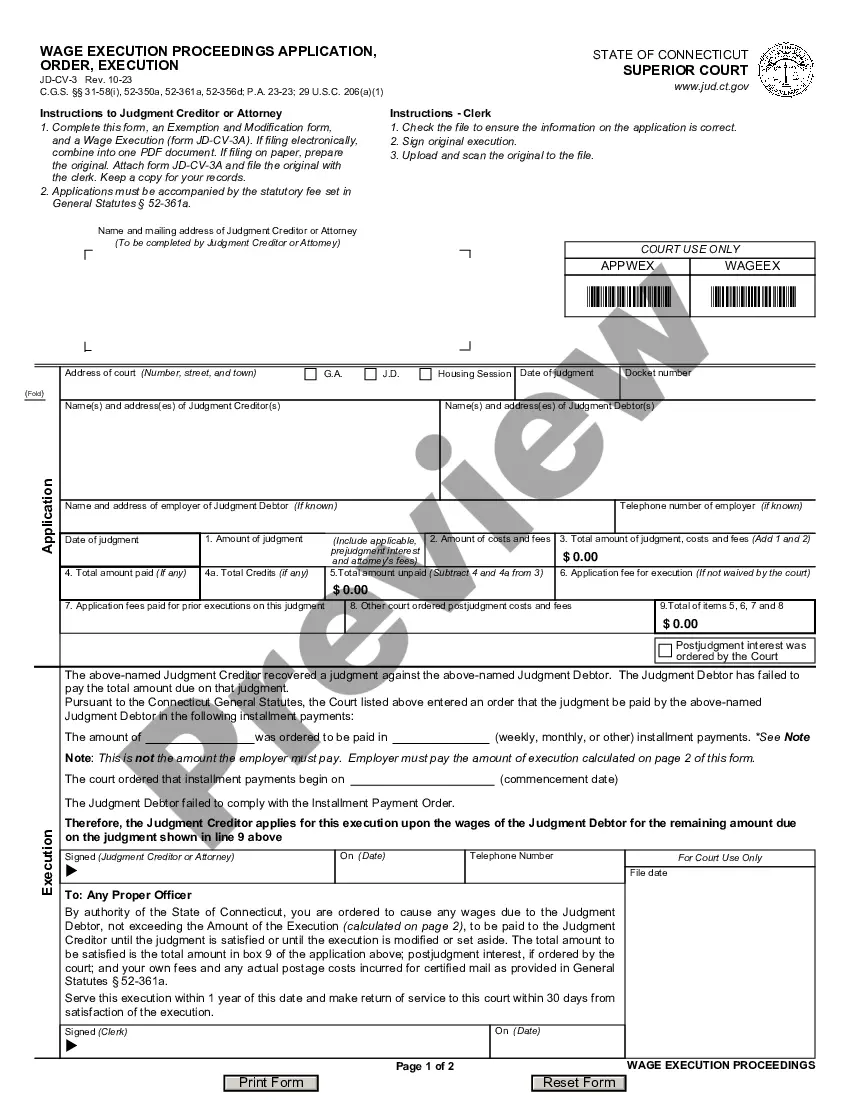

- Click on the form’s preview to see it.

- If it is the wrong document, go back to the search function to locate the Interpleader Suit Format sample you require.

- Download the template if it meets your needs.

- If you have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the document format you want and download the Interpleader Suit Format.

- When it is downloaded, you can complete the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the web. Utilize the library’s easy navigation to get the appropriate form for any occasion.

Form popularity

FAQ

An interpleader is a way for a party who holds property (a stakeholder) to initiate a suit between all claimants, who are parties claiming a right to that property. An interpleader allows the stakeholder to bring all claimants into the same action, instead of litigating against claimants in separate actions.

Another example is that an escrow holder in a real estate transaction holds a deposit and the parties are arguing about whether one or the other should receive the deposit back. In such cases, the escrow holder will often file an interpleader action.

There are two specific types of interpleader actions in the United States federal courts. Statutory Interpleader governed by 28 U.S.C. § 1335, and Rule Interpleader established by Federal Rules of Civil Procedure 22.

Example: X is in possession of the property claimed by Y and Z adversely. X does not claim any interest in the property and is ready to deliver it to the rightful owner he can file an interpleader suit.

INTERPLEADER. Persons having claims against the plaintiff may be joined as defendants and required to interplead when their claims are such that the plaintiff is or may be exposed to double or multiple liability.