Acknowledgement Of Paternity Form In Texas

Description

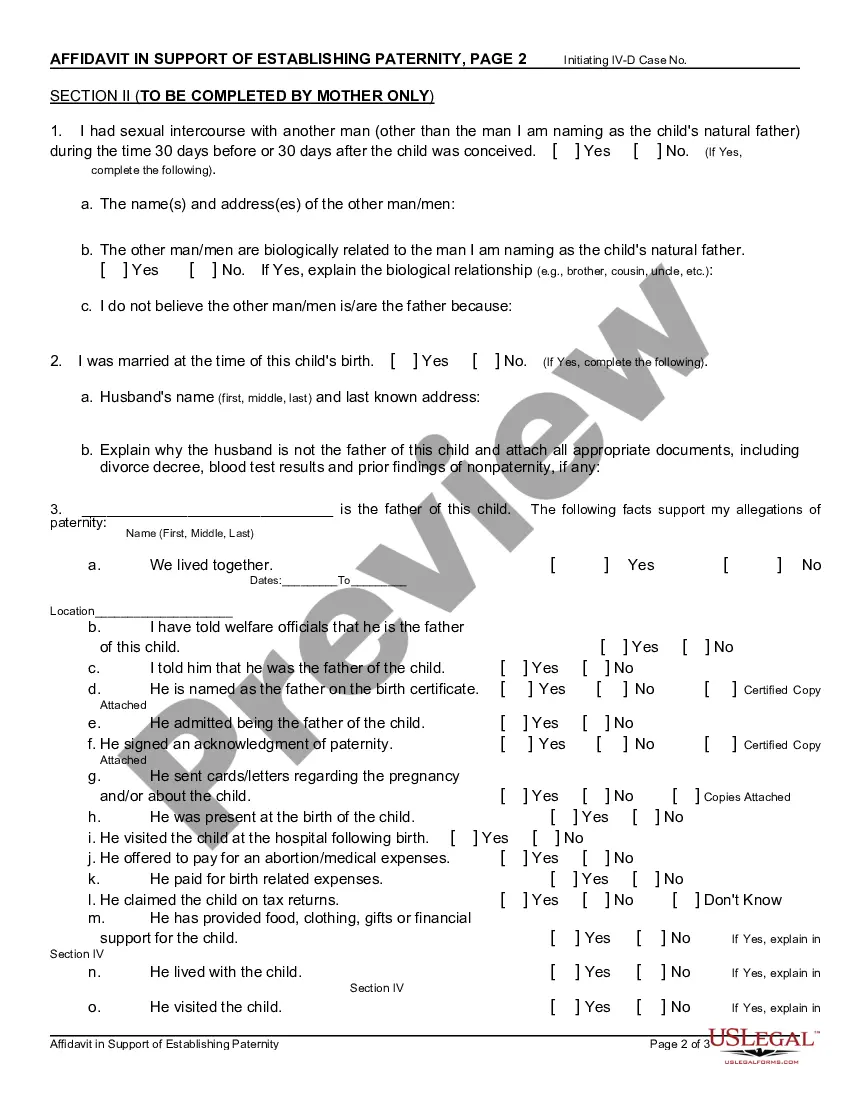

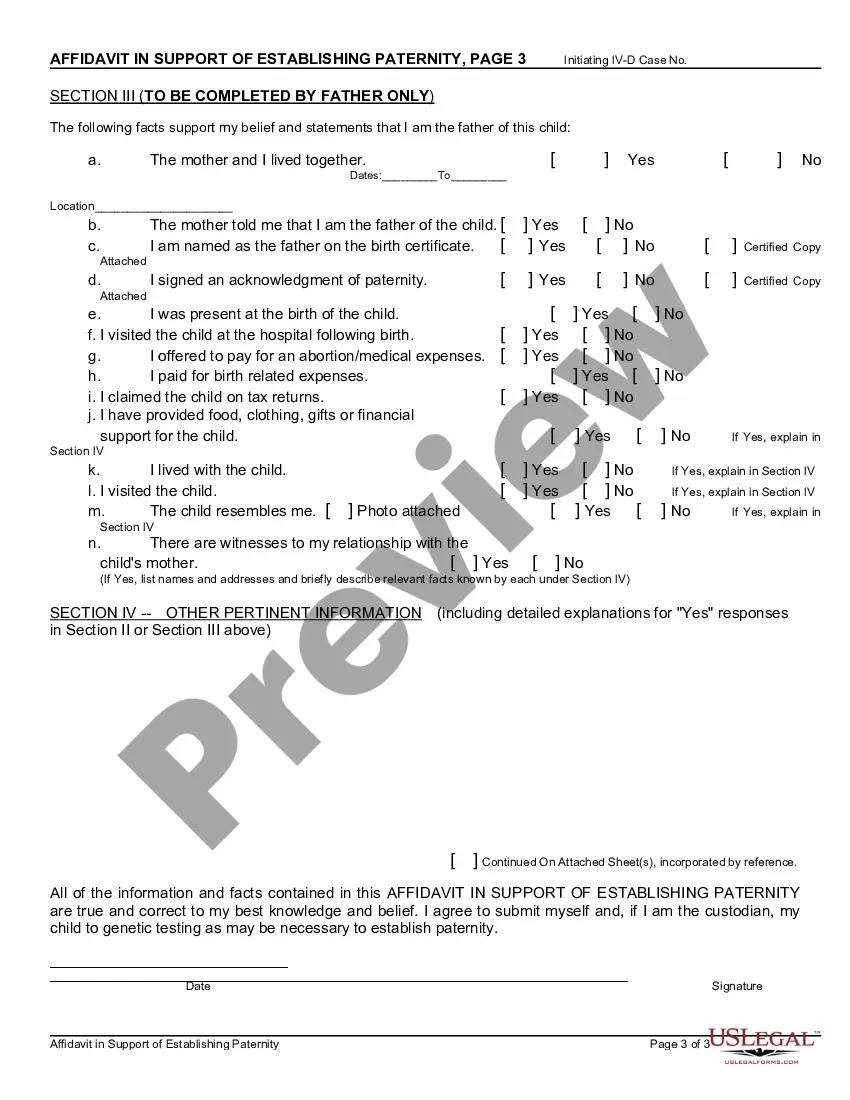

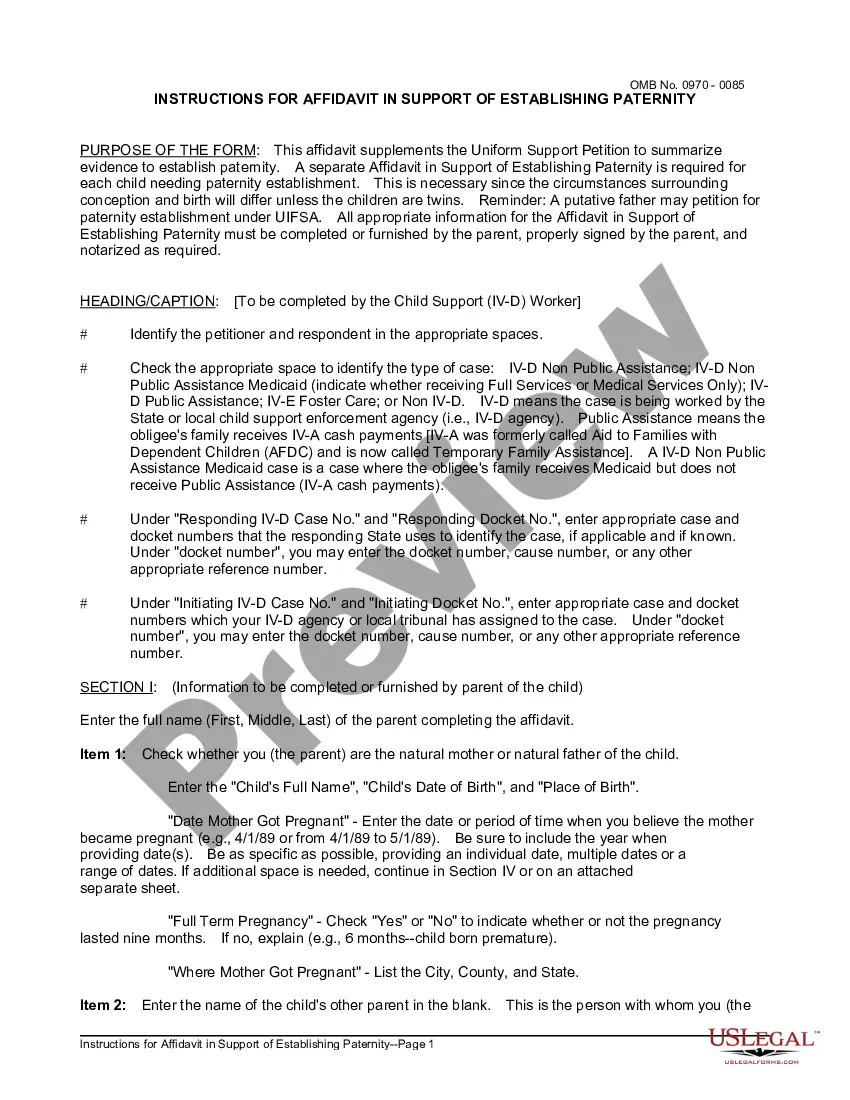

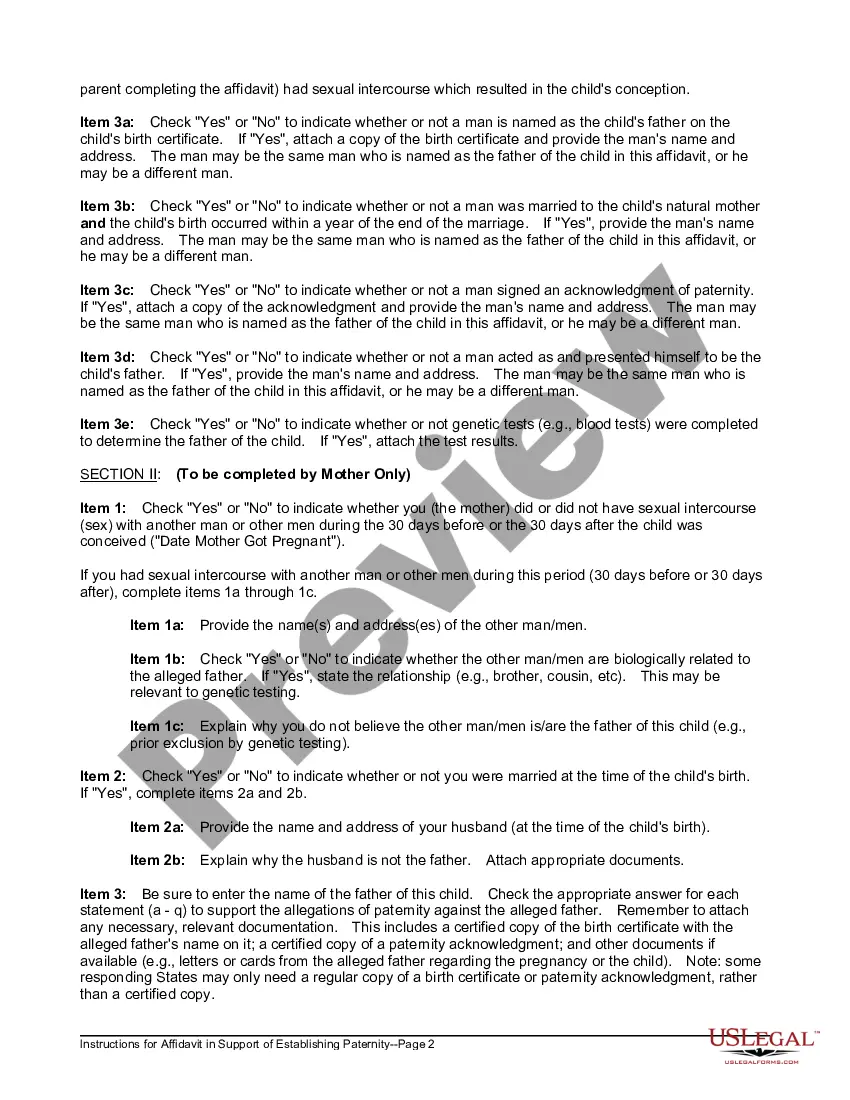

How to fill out Affidavit In Support Of Establishing Paternity?

The Acknowledgment Of Paternity Document In Texas you find on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 validated, state-specific templates for various business and personal situations. It’s the quickest, simplest, and most trustworthy way to acquire the documents you require, as the service ensures bank-level data protection and anti-malware security.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or evaluate the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the correct one. Click Buy Now once you’ve located the template you desire.

- Register and Log In.

- Choose the pricing plan that works for you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Select the format you want for your Acknowledgment Of Paternity Document In Texas (PDF, Word, RTF) and download the sample onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Download your documents again.

- Utilize the same document again whenever needed. Access the My documents tab in your profile to redownload any forms you’ve purchased previously.

Form popularity

FAQ

The term 'acknowledged father' refers to a man who has legally recognized himself as the father of a child through the Acknowledgement of Paternity form in Texas. This legal acknowledgment is crucial for asserting rights and responsibilities in matters like custody and child support. By signing this document, the father ensures his parental status is recognized in all legal contexts.

To obtain a copy of the Acknowledgement of Paternity in New York City, you should contact the New York City Department of Health and Mental Hygiene. They can provide you with instructions on how to request a copy, including any necessary forms and fees. If you need assistance, consider using platforms like US Legal Forms, which can simplify the process for you.

An Acknowledgement of Paternity (AOP) is a legal document that establishes a father's relationship with his child. By signing this form, both parents affirm that the man is the biological father, which grants him rights and responsibilities under Texas law. It is essential for securing parental rights and can impact child support and custody matters.

You can obtain an Acknowledgement of Paternity form in Texas from multiple sources. Typically, you can get it at hospitals when a child is born, as they provide the form during the admission process. Additionally, you might find it at local vital records offices or download it from the Texas Department of Family and Protective Services website.

Mortgage Promissory Notes: 12-Year Statute of Limitations When you get a mortgage loan to buy a house in Maryland, you give the lender a Deed of Trust, which gives them the right to foreclose if you default. You also give the lender a separate promissory note that obligates you to repay all the money they lent.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A deed of trust is an agreement where the borrower is using the property to secure a loan. A deed of trust is very similar to a mortgage, but there are key differences between a deed of trust and a mortgage. For example, mortgages generally have two parties: the borrower and the lender.

In Maryland a deed must include the name of the grantor and the grantee, the consideration paid for the property. In addition, there must be a preparer's certification and an acknowledgment by a notary public or authorized court officer.

The Maryland deed of trust is broken down into sections A- Q, and then1 -25. The deed of trust is a rather lengthy document usually 15 pages with additional rider pages when applicable. Section A ?G is the basic information of the borrower(s), lender and trustee.